Did you know that the tax-free savings account (TFSA) is one of the few aspects of the Canadian tax system that gives regular Canadians an advantage over the rich? It’s not widely known, but it’s true. With tax-deferred accounts, wealthier Canadians typically get more contribution room than working class Canadians. An effect of this is that the rich are able to put more money in such accounts than regular Canadians are. So, these accounts just end up being another way for the rich to get richer.

It’s not so with the TFSA. The TFSA’s new contribution limit is the same for everyone each year, and relatively small. As a result, the TFSA allows regular Canadians to shelter a larger percentage of their wealth than rich Canadians. So, a working class Canadian who invests in a TFSA can slowly catch up with one of their rich peers over time.

Source: Getty Images

How the TFSA helps regular Canadians

At first glance, you might think that the annual TFSA contribution room is the same for Canadians over the age of 17. It’s the same for everyone, so the end result is the same, right?

No. You see, working class Canadians often have total savings that can fit inside of a maxed out TFSA. Rich Canadians can only put a portion of their savings into a TFSA. So the working class Canadian can have a fully tax-sheltered portfolio. For a rich Canadian, that’s not possible – barring fleeing to a foreign country.

TFSA math

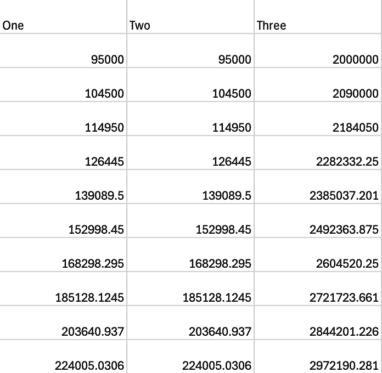

To illustrate how a poorer Canadian gets more of a benefit from the TFSA than a richer Canadian, I built a table with three columns. Column one is a $95,000 TFSA balance that represents an entire working class Canadian’s lifetime savings. Column two is a $95,000 TFSA belonging to the rich person. Column three is $2 million, which represents the rich person’s taxable savings. Each of these columns sees a 10% return each year, but each year the rich person sells enough stock to pay a 5% capital gain tax on the entire portfolio.

As you can see, the working class Canadian ends up with $224,005, while the rich Canadian ends up with $224,005 from the TFSA plus $2.97 million from the taxable account, or $3.19 million in total.

At the start of the 10 years, the working class Canadian has 4.5% of the rich Canadian’s wealth. By the end, he/she has 7% of the rich Canadian’s wealth. That’s the advantage of having a smaller starting amount. You can put more of it in a TFSA!

A suggestion

If you want to build wealth at a rate similar to that of the working class Canadian earned above, you might want to invest in dividend stocks. They offer a lot of compounding power.

Take the Canadian National Railway (TSX:CNR) for example. It’s a Canadian railroad company that has a 2% dividend yield at today’s prices. The dividend might seem small at first glance, but it has grown at 10.5% per year over the last decade. More importantly, CNR has delivered total returns above 10% per year, which makes the math above work.

Can CN Railway keep this going? Potentially, yes. It still has all the advantages it had at the start of its rise. It has only one competitor. It has a 35% profit margin. It has an enviable rail network that touches three coasts. Rail is far cheaper per unit of weight than trucks. So CN Railway may indeed keep the compounding going into future. If it does, then a $95,000 TFSA invested in it could go a long way.