Pause and consider this: Are you buying into the hype? Artificial intelligence (AI) is the current hot topic, but remember the lessons from the dot-com bubble – stock valuations can quickly outpace company fundamentals.

When a trend dominates the news, you might unknowingly be providing an exit for earlier investors and be left holding the bag.

If you’re ready to proceed with caution and want to integrate AI investments into your portfolio as a Canadian, this quick primer and a specific exchange-traded fund (ETF) pick will help you get started.

What are AI stocks?

When discussing AI stocks, it’s important to recognize that there’s no official stock market sector solely dedicated to “AI,” unlike defined sectors such as technology, consumer discretionary, or communications.

AI spans a diverse array of industries and company types, each playing a different role in the broader AI ecosystem:

- Develop AI: These companies focus on creating and advancing artificial intelligence technologies. They work on the algorithms and software that enable machines to perform tasks which typically require human intelligence.

- Commercialize AI: These entities take AI technologies and bring them to market, integrating them into products and services that improve efficiency or create new user experiences.

- Utilize AI: A wide range of companies fall into this category as they incorporate AI to enhance their operations, from automating processes to enhancing decision-making and customer interactions.

- Support AI: These companies provide the necessary tools and platforms that facilitate AI development and deployment, such as cloud computing services that host AI applications.

- AI infrastructure: Essential to the backbone of AI are semiconductor companies and data centres. Semiconductors are crucial for processing AI algorithms, while data centers provide the necessary computing power to run these complex tasks.

Most companies actively engaged in AI are large-cap entities, as significant investment is required to develop and scale AI technologies.

What are AI ETFs?

ETF providers have developed a variety of AI ETFs, each constructed based on criteria designed to tap into the broad theme of artificial intelligence.

The major advantage of investing through these ETFs includes greater diversification, avoiding the hassle of currency conversion, and liquidity – allowing investors to buy and sell shares of multiple companies in a single transaction.

One standout option is the CI Global Artificial Intelligence ETF (TSX:CIAI), which has a management fee of just 0.20%.

Since its debut in May 2024, this ETF has rapidly grown to $589 million in assets under management, demonstrating strong investor interest.

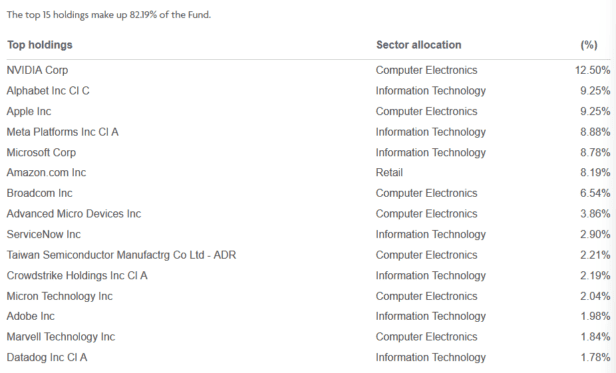

For those curious about its holdings, I recommend checking the latest portfolio snapshot below to see which AI companies are currently included: