Artificial intelligence (AI) stocks have been a prime investment since ChatGPT’s launch in November 2022 — until a recent volatility spike sparked concerns. Nvidia stock, a major beneficiary of the global AI development rush, soared from a US$350 billion valuation in late 2022 to a staggering US$3.3 trillion market capitalization by mid-year. Early investors reaped substantial rewards, but is it too late for newcomers to join the AI investment game?

A sudden drop in technology stocks during the past week coincided with Tesla’s underwhelming quarterly earnings and Alphabet’s (NASDAQ:GOOGL)(NASDAQ:GOOG) lukewarm second-quarter earnings. Nvidia stock, the undisputed face of the AI trade, plummeted 9% during the past week, and the NASDAQ-100, an index heavily weighted with AI-focused tech companies, declined 8%, flirting with technical correction territory.

Understandably, this sharp downturn in primarily AI stocks in July has investors re-evaluating the AI craze. Valuations might be stretched for some companies, and investor anxiety is growing. This jittery sentiment is evident in Nvidia’s 15% drawdown over the past month.

Are these declines a healthy correction or a warning sign for AI stocks?

Nvidia stock has technically corrected, potentially prompting early investors to take profits and reallocate capital to undervalued sectors of the North American stock market. This should be a healthy capital cycle. Successful companies do experience valuation adjustments, too.

AI stocks have rallied significantly over the past year, and bullish markets often overshoot intrinsic valuations, which is natural given human market psychology. Prices tend to surge during periods of euphoria before retreating during fearful market conditions. However, markets may still maintain an upward trend over several years despite short-lived corrections.

Corrections offer long-term-oriented investors new opportunities to enter positions at lower prices. Investors who missed prior rallies find lower (better) entry points. The key issue is assessing an AI investment’s long-term revenue growth and earnings potential. Are the current price declines a temporary setback or a sign of the fundamental problems?

Time to buy the dip in AI stocks?

The recent drop in AI stocks might be insignificant from a long-term perspective. The NASDAQ-100 is still up a healthy 13% year to date, and companies like Alphabet could be entering a new revenue growth phase driven by broader AI adoption.

Alphabet is a global leader in bringing AI to a global user base. Google Search has been enhanced with AI Overviews, and the company recently reported increased user engagement and better user satisfaction. The company has added AI capabilities to all its client offerings to defend its market share and enhance organic growth prospects.

Alphabet’s Cloud division revenue, which is increasingly influenced by direct AI capacity and product sales, crossed the US$10 billion mark for the first time in June 2024 as AI capacity uptake expands. The company’s AI infrastructure supports various AI models and custom builds, customers are reveling, and the platform’s quarterly operating earnings surpassed US$1 billion last month.

Google’s generative AI platforms, which continue to receive massive investment budget allocations, attracted more than two million developers during the second quarter. Alphabet is well-positioned for a profitable AI-driven future, with double-digit revenue growth and a commitment to making AI accessible worldwide. The company is deploying new in-house designed AI chips to reduce over-reliance on more expensive Nvidia equipment. The business could enjoy long-term success and offer attractive returns for new investors at current levels.

Alphabet stock is fairly valued

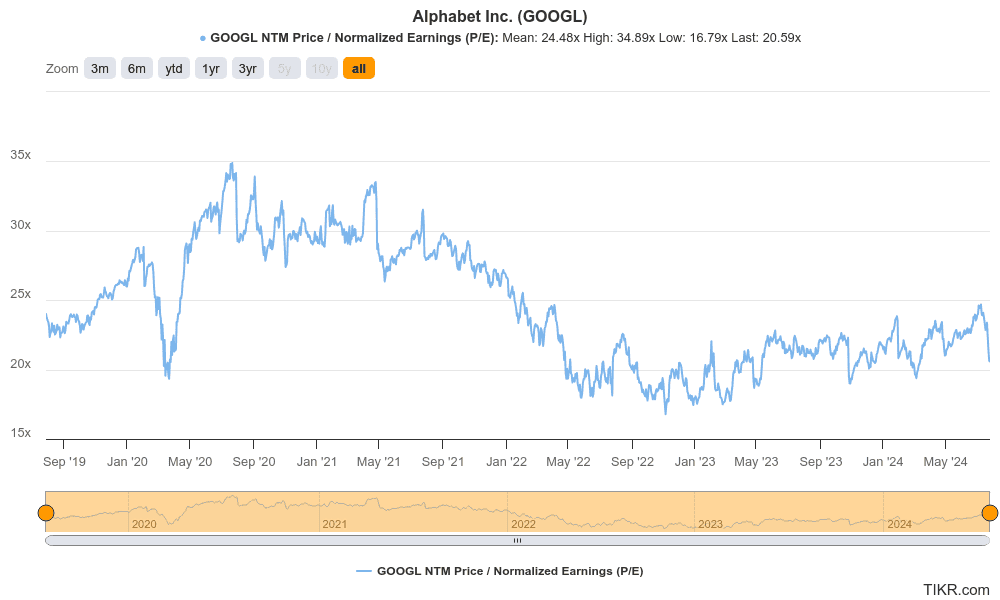

Despite a 22% rally in Alphabet stock so far this year, GOOGL stock appears fairly valued with a forward price-to-normalized earnings per share of 20.9, below the five-year average of 24.5.

It’s not too late to ride a long-drawn, AI-powered growth phase on Alphabet stock.