So, you’re ready to start investing – congratulations! Overcoming the inertia and deciding to invest is a crucial step, as it helps you avoid one of the biggest risks out there: the risk of not investing at all.

Now, you face a new decision: where to put your money. There are plenty of options, from safe Guaranteed Investment Certificates (GICs) and Canadian dividend stocks, to the volatile world of cryptocurrencies.

But if you’re a beginner, none of these might be the best fit. Instead, I recommend starting with a globally diversified, low-cost index exchange-traded fund (ETF). Here’s why.

Why an index ETF?

To put it simply, an index ETF is the only investment vehicle that allows you, especially as a beginner, to own a fully diversified portfolio without needing to spend time managing it or acquiring extensive investment knowledge.

How does it achieve this? By purchasing thousands of different stocks from across the globe, covering all market sectors and spanning large, mid, and small-cap sizes, an index ETF offers both growth and dividend returns.

Moreover, these ETFs also invest in bonds issued by governments and corporations worldwide, which vary in maturity. This adds a layer of stability and provides income, enhancing the overall safety of your investments.

Essentially, when you buy shares of an index ETF, you’re acquiring a slice of a vast array of underlying assets. It’s like having a diversified portfolio wrapped up in one single ticker that trades just like a stock – a true portfolio-in-a-box.

Which ETF to buy?

For beginners, I like the BMO Growth ETF (TSX:ZGRO), particularly if you’re comfortable with a higher level of risk and are investing with a long-term horizon, like retirement planning in mind.

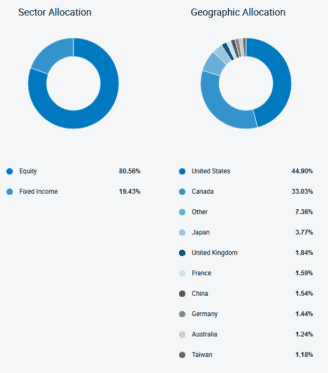

This ETF strategically allocates its portfolio with 80% in stocks and 20% in bonds. It spans a broad range of markets, including Canada, the US, other developed nations, and emerging markets, ensuring thorough diversification.

What’s great is that it’s managed for you; the ETF is rebalanced automatically, so all you need to do is reinvest any dividends, hold your shares, and consider buying more over time to build your investment.

While it isn’t free, it’s certainly cost-effective — its Management Expense Ratio (MER) of 0.20% means you’d pay just $20 annually on a $10,000 investment, which is a small price for the convenience and diversification it offers.