Your Tax-Free Savings Account (TFSA) is an excellent venue for housing income-generating assets, especially since the dividends you receive are entirely tax-free!

If your account is sufficiently funded and the yields are high enough, you can effectively create a secondary stream of passive income.

Whether you’re in the accumulation phase of your life and reinvesting dividends or in need of income and planning to make withdrawals, these dividends can significantly enhance your financial strategy.

In this guide, I’ll introduce you to two Canadian exchange-traded funds (ETFs) that not only offer higher-than-average yields but have also historically delivered strong total returns. Here’s how these can be valuable long-term holdings in your TFSA.

A Canadian dividend ETF

First up is the Vanguard FTSE Canadian High Dividend Yield Index ETF (TSX:VDY).

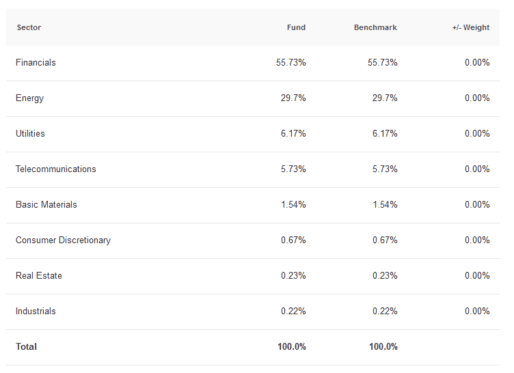

This ETF specifically targets the higher-yielding segments of the Canadian stock market, predominantly focusing on the financial and energy sectors with 56 holdings.

What makes VDY particularly appealing for a TFSA is its distribution structure; it pays out dividends monthly. Currently, it boasts a 12-month trailing yield of 4.6%.

Additionally, it’s cost-effective for investors, with a management expense ratio (MER) of only 0.22% – that’s just $22 annually on a $10,000 investment.

A Canadian REIT ETF

Real Estate Investment Trusts (REITs) are another astute choice for a TFSA. They typically offer higher yields, and since these aren’t taxed as favourably as Canadian dividends, placing them in a TFSA can maximize your returns.

For those interested in REITs, consider the Vanguard FTSE Canadian Capped REIT Index ETF (TSX:VRE).

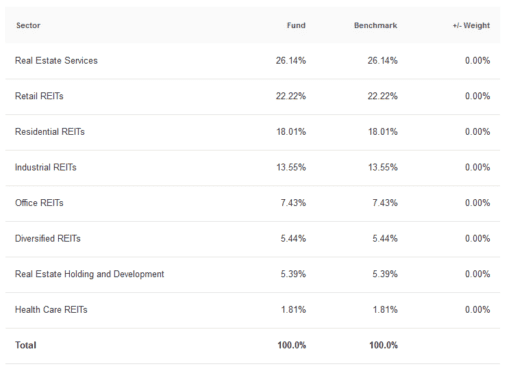

This ETF encompasses a diversified mix of 15 REITs spanning various sub-sectors, including retail, residential, industrial, office, diversified holdings, development, and healthcare.

Like VDY, VRE also distributes dividends monthly. Currently, it provides a yield of 2.8% and carries a management expense ratio (MER) of 0.39%.

The Foolish takeaway

Both VDY and VRE are affordable, pay above-average dividend yields, and have monthly payout schedules. In a TFSA, you can keep 100% of the dividends received from either ETF. You can withdraw this as passive income, or reinvest it in more shares of either ETF to grow your portfolio faster.