I’m a firm believer in broadly diversified, low-cost index exchange-traded funds (ETFs). In my opinion, those tracking indexes like the S&P 500 or the S&P/TSX 60 should form the core of any investor’s portfolio.

However, it’s also reasonable to set aside a small portion of your investments, say 5-10%, for more speculative themes. Right now, one of the hottest themes in the investment world is artificial intelligence (AI).

But instead of trying to pick the best AI stock – which can be quite risky – consider these two AI-themed ETFs that offer a safer way to participate in the AI boom.

The CI option

First up is the CI Global Artificial Intelligence ETF (TSX:CIAI), one of the more popular AI ETFs in Canada.

It is currently the largest, with $574.5 million in assets under management (AUM). This figure represents the total value of all assets held by the ETF, indicating significant investor confidence and scale.

Currently, it’s also one of the most cost-effective AI investing options. As a new ETF, it doesn’t have a published Management Expense Ratio (MER) yet, but its management fee is 0.2%. I anticipate the MER will be around 0.3-0.4%, which is still reasonable for a specialized fund.

Unlike index-based ETFs, CIAI is actively managed. This means that instead of tracking a predetermined index, the fund’s holdings are selected by Peter Hofstra, SVP, Co-Head of Equities – Research, and Jeremy Rosa, VP, Portfolio Manager & Research Lead – Equities at CI Global Asset Management. They pick AI-themed companies that they believe will outperform.

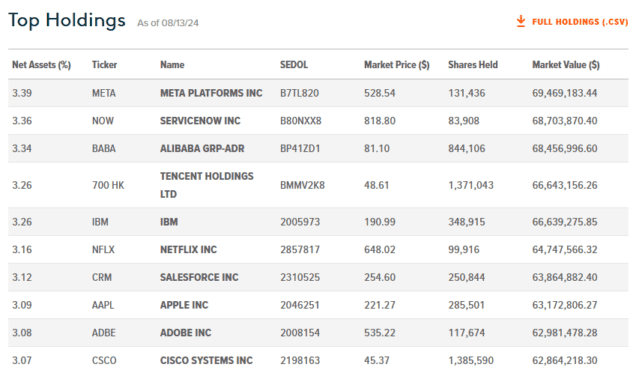

The current top holdings, making up 82.13% of the fund, can be seen below:

The Global X option

Horizons ETFs recently rebranded as Global X ETFs Canada and launched some new funds, including the Global X Artificial Intelligence & Technology Index ETF (TSX:AIGO).

At first glance, AIGO might appear small and unpopular with only $3 million in assets under management (AUM). However, this perception is misleading.

The reason? AIGO is an “ETF of ETFs.” For a 0.49% management fee, AIGO actually invests in a highly popular U.S.-based Global X AI ETF, which itself manages over $2 billion in assets.

This setup means that when you, as a Canadian, invest in AIGO, you are effectively purchasing shares in a well-established U.S. AI ETF.

Global X simply takes your investment, converts the currency, and buys the U.S. ETF on your behalf, saving you the hassle and cost of currency conversion.

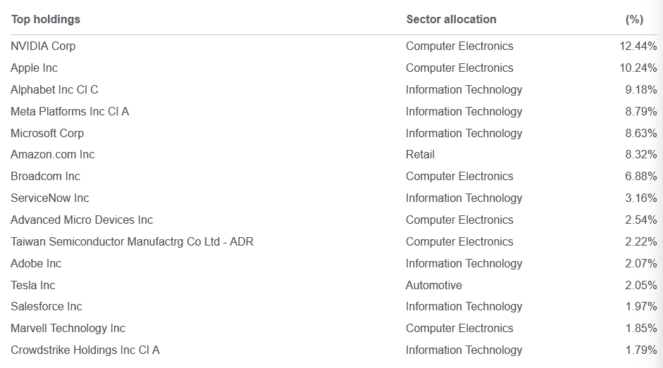

Here’s a glimpse of what AIGO holds, as represented by its benchmark, the Indxx Artificial Intelligence & Big Data Index: