Thanks to exchange-traded funds (ETFs), even as a total beginner to investing, you can easily invest in 500 of the top American companies with a single ticker and beat most professionally managed funds.

Are you interested in getting started with this strategy? Here’s the “why” and “how.” There are no complex concepts or advanced jargon to understand; this strategy is designed to be very straightforward and understandable for beginners.

Why the S&P 500?

Even as a beginner, you’ve likely heard of the S&P 500. This index comprises 500 large U.S. companies selected by a committee based on liquidity, earnings, and size criteria.

It’s designed to represent the broad American economy and holds stocks from all 11 sectors: information technology, health care, financials, consumer discretionary, communication services, industrials, consumer staples, energy, utilities, real estate, and materials.

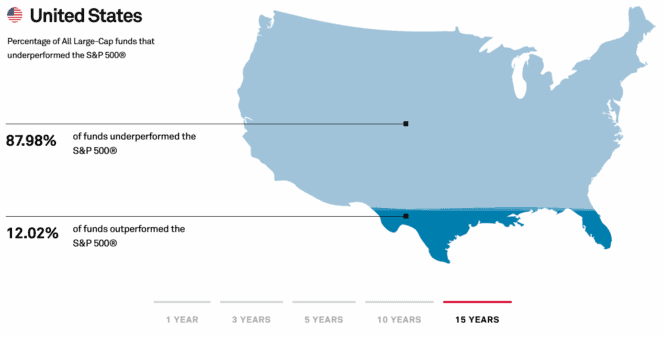

Despite its simplicity, the S&P 500 has been tough to beat. For instance, the Standard & Poor’s Indices Versus Active (SPIVA) report found that over the last 15 years, only 12% of actively managed funds managed to outperform this index.

So, by having your investments track the S&P 500, you have a great chance of beating even professional investors. But there is a catch.

How to invest in the S&P 500

You can’t technically invest directly in the S&P 500 because it’s an index. Instead, you need to buy an ETF that tracks this index.

Here’s how these ETFs work: they purchase all 500 stocks in the S&P 500 in the exact proportions as the index and bundle them into a single investment vehicle. This bundle is then sliced up into shares that you can buy and sell on an exchange, just like any single stock.

For S&P 500 exposure, I like BMO S&P 500 Index ETF (TSX:ZSP).

It’s particularly appealing because it’s very cheap, with a management expense ratio of only 0.09%. If you invested $10,000 in ZSP, that’s just $9 in annual fees.

It’s also one of Canada’s most popular ETFs, with over $15 billion in assets under management and is very liquid, trading over 460,000 shares on an average day.