Did Monday, August 5th’s brief market downturn rattle you? It’s perfectly normal to experience corrections, even in a bull market.

However, if this recent dip has made you realize that your risk tolerance isn’t as high as you thought, that’s okay.

There’s a strategy to stay invested while reducing your exposure to volatility—defensive stocks. Here are three excellent examples trading on the TSX today.

Loblaw

A prime example of a defensive TSX stock is Loblaw Companies (TSX:L), notable for its robust presence in the consumer staples sector, which inherently provides stability.

Consumer staples are products like groceries and household goods that people need regardless of economic conditions, making this sector non-elastic—demand does not fluctuate significantly with changes in price.

Brands under Loblaw, such as President’s Choice, No Name, and Shoppers Drug Mart, offer essentials that remain on shopping lists even during economic downturns, showcasing their non-discretionary nature.

Quantitatively, Loblaw’s stability is reflected in its very low beta of 0.17. Beta measures a stock’s volatility relative to the overall market. A beta less than one means the stock is less volatile than the market.

In Loblaw’s case, a beta of 0.17 suggests that it is significantly less affected by market swings, underscoring its role as a defensive stock.

Fortis

Fortis (TSX:FTS), Canada’s largest publicly traded utility company, is another exemplary defensive stock.

Much like the consumer staples sector, utilities are crucial; regardless of economic conditions, people continue to pay for essential services such as electricity, heating, and water.

This consistency in demand ensures stable earnings for Fortis, further bolstered by the regulated nature of its business, which helps smooth out earnings volatility, even in economic downturns.

Reflective of its defensive posture, Fortis has a low beta of 0.22, indicating minimal volatility compared to the broader market.

Additionally, Fortis is recognized as a Dividend King, having increased its dividend annually for over 50 years, with a current yield of 3.96%.

Low volatility ETF

I’m bending the rules a bit with my third pick, but it’s for a good reason. BMO Low Volatility Canadian Equity ETF (TSX:ZLB) is not a single defensive stock but a collection of them.

This exchange-traded fund (ETF) is designed specifically for defensive investing with a focus on low volatility. For a management expense ratio of 0.39%, ZLB uses a rules-based approach to select approximately 50 low-beta stocks from the TSX.

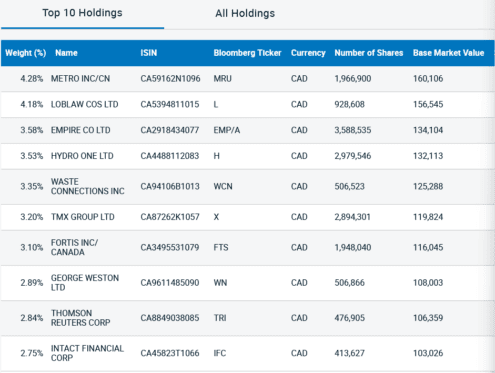

Notably, it includes both Fortis and Loblaw among its top holdings, alongside many of their peers in various sectors: