If you’re a Canadian looking to invest in artificial intelligence (AI), I highly recommend considering a thematic exchange-traded fund (ETF). Why?

The answer is straightforward: simplicity and diversification. You get a bigger basket of AI-themed companies, and you can do so via just one ticker.

There are quite a few AI-focused ETFs available to Canadian investors, each offering a unique approach to capturing the potential of this dynamic sector. Here are my top three picks and what makes each one stand out.

Passive indexing

If you prefer a hands-off approach where your AI stocks are selected according to a clear, rules-based methodology, consider an index ETF.

One standout option is the Global X Artificial Intelligence & Technology Index ETF (TSX:AIGO).

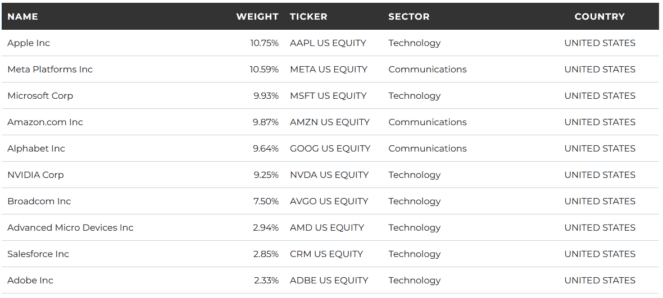

This ETF passively tracks the Indxx Artificial Intelligence & Big Data Index for a 0.49% management fee. The top holdings of the ETF, reflecting a diverse array of AI innovators, are detailed below:

Active management

If you prefer to have a team of experts vetting and selecting your AI stocks, a passive index ETF won’t suffice. For this level of oversight, an actively managed ETF is the way to go.

A prime choice in this category is the CI Global Artificial Intelligence ETF (TSX:CIAI).

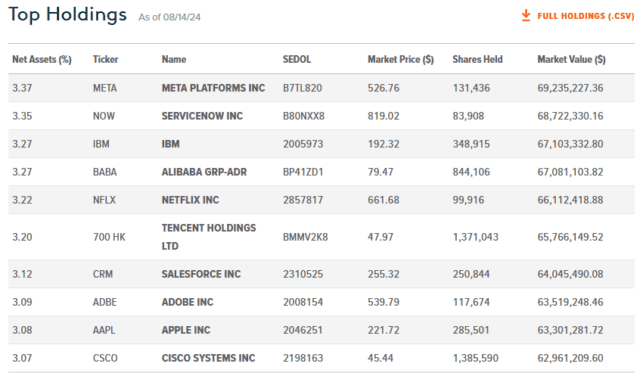

Contrary to what you might expect, active management doesn’t always have to come with a high price tag. CIAI is surprisingly affordable with a management fee of just 0.2%, which is even lower than that of some passive ETFs like AIGO. Here’s a look at its top holdings:

AI picking stocks

A truly unique Canadian AI ETF that stands out to me is the Evolve Artificial Intelligence Fund (TSX:ARTI).

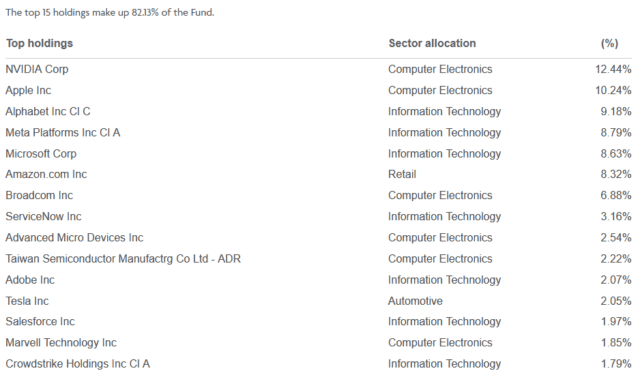

What sets it apart? It utilizes a large language model known as Boosted.ai to assist in its portfolio selection. This approach is both innovative and quite meta, considering it’s AI helping to pick AI-focused investments.

However, this cutting-edge technology does come at a cost. ARTI charges a management fee of 0.60%, which is a bit steeper compared to other options. Here’s a look at its current holdings: