Shares of Taiwan Semiconductor (NYSE: TSM) were moving lower today after the chip manufacturing giant posted slowing revenue growth in its August update.

Though its growth rate was still strong, it marked a deceleration from July, and that news was enough to push the stock lower.

At 10:45 a.m. ET, the stock was down 2.6%. It recovered some in intraday trading and was down 1.5% for the day as of 1:25 p.m. ET.

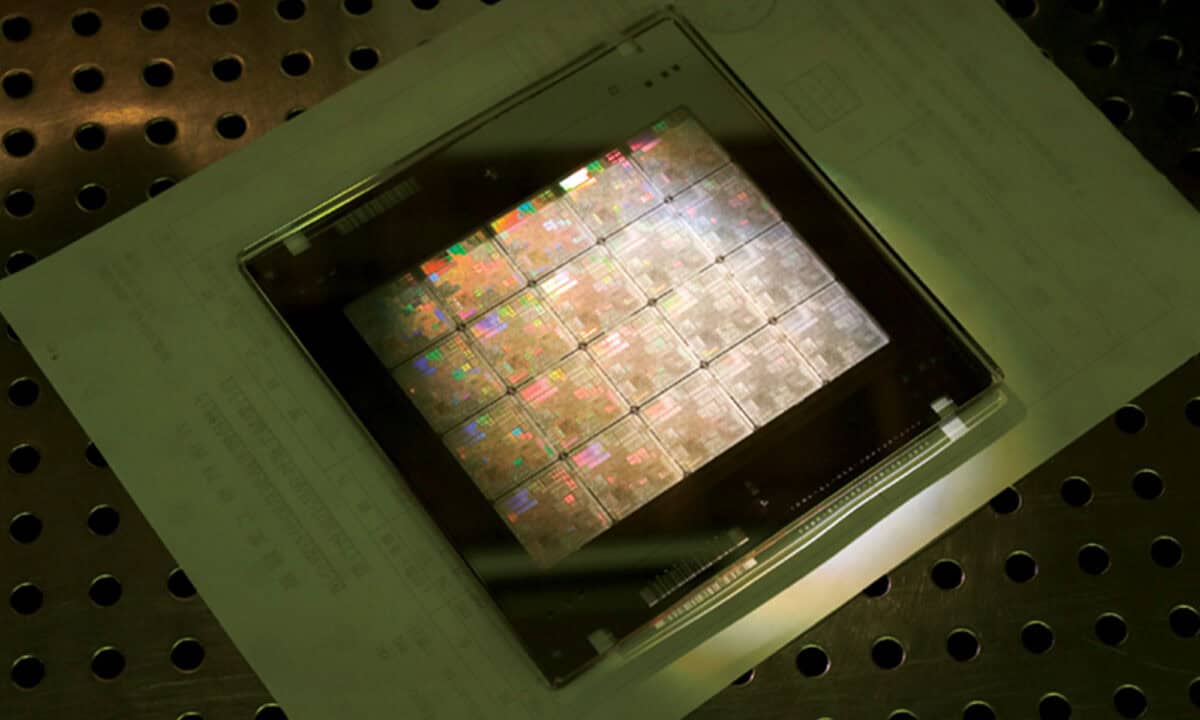

Source: Taiwan Semiconductor

TSMC hits the brakes

Taiwan Semiconductor has been one of the biggest beneficiaries of the artificial intelligence (AI) boom thus far, as the company is the world’s biggest contract chip manufacturer, serving customers like Apple, Nvidia, Broadcom, and AMD. For that reason, its performance is closely watched as a bellwether for AI and the broader semiconductor industry.

For August, the company reported revenue of $7.8 billion, up 33% from a year ago but down 2.4% from July’s total. Year to date through August, revenue is now up 31% to $55.1 billion, meaning August growth was mostly consistent with the rest of the year.

Management does not provide any commentary on the monthly reports, but not only was revenue down sequentially, but the growth rate, while still strong, was a meaningful deceleration from 45% in July.

Should investors be worried?

Most companies don’t report monthly data because the numbers are often volatile and not reflective of underlying business trends. The August slowdown at TSMC could certainly be just a blip rather than a trend.

The update is no reason to be alarmed at this point, but it is worth keeping tabs on the company’s monthly revenue reports, especially as some investors are worried about a bubble in AI.

If TSMC reports another deceleration in September, it could be some cause for concern, but investors should also remember that generative AI will take years to play out.

Therefore, under those circumstances, a modest sell-off in TSMC stock seems fair, but the report is no reason to change your thesis on the stock.