If there’s one investment strategy I’m a big proponent of, it’s low-volatility investing. The idea behind this approach is by minimizing losses during market downturns, you stand a better chance of coming out ahead over the long haul.

Why does this matter? It’s all about the asymmetry of losses. For instance, a 10% loss requires an 11% gain to break even. But, as losses deepen, the required gains to recover increase disproportionately

For example, a 20% loss requires a 25% gain; a 30% loss needs a 43% gain; a 40% loss requires a 67% gain, and a devastating 50% loss requires a full 100% gain just to break even.

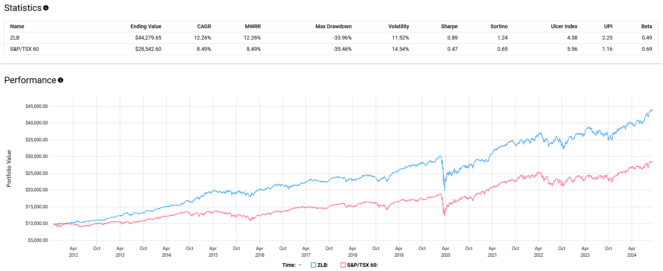

However, embracing low volatility doesn’t mean you have to sacrifice potential gains. Take BMO Low Volatility Canadian Equity ETF (TSX:ZLB), for example, which has historically outperformed the S&P/TSX 60 Index while bearing less risk.

With this in mind, here are two defensive TSX stocks I like, each selected from ZLB’s current top holdings.

Loblaw

A prime example of a defensive TSX stock is Loblaw Companies (TSX:L), which is a big player in the consumer staples sector.

This sector includes essential items like groceries and household goods—stuff you need no matter the economic climate. Because these products are essential, their demand tends to be consistent, making this sector less sensitive to price changes.

Loblaw owns well-known brands like President’s Choice, No-Frills, No Name, and Shoppers Drug Mart. These are the brands that likely populate your shopping list even when times are tight, which is why they’re considered non-discretionary.

From a numbers perspective, Loblaw’s stability is crystal clear through its beta of 0.17. If you’re not familiar, beta is a measure of how much a stock swings compared to the overall market.

A beta less than one means the stock is less volatile than the market, so with a beta of 0.17, Loblaw moves much less dramatically than most stocks during market ups and downs, enhancing its appeal as a defensive stock.

And there’s a cherry on top: Loblaw also pays a modest but very sustainable 1.17% forward annual dividend yield, with a conservative 28% payout ratio. The dividend might not be a big yielding one, but it’s fairly safe.

Hydro One

Hydro One (TSX:H) is another prime example of a defensive stock, perfect if you’re looking for stability.

It’s Ontario’s main electricity transmission and distribution provider, meaning it plays a crucial role in keeping the lights on, no matter the economic weather. This kind of utility is always in demand.

It’s also worth noting that 41% of Hydro One is owned by the province of Ontario, adding an extra layer of stability since it’s under partial government oversight. Hydro One’s beta is 0.34, showing it tends to be less volatile.

Plus, with a dividend yield of 2.68% and interest rates recently dropping three times, Hydro One is positioned well. Lower rates mean cheaper borrowing for expansions or upgrades, potentially leading to even better performance from utilities.