As we navigate through September 2024, Toronto-Dominion Bank (TSX:TD) presents an intriguing case for Canadian investors. TD Bank stock is at a crossroads: the bank’s revenue is growing, and its adjusted earnings showed improvement in the third quarter. However, a regulatory cloud looms over its valuation, future earnings, and capitalization levels. The bank announced today its chief executive officer (CEO) Bharat Masrani’s retirement effective April 2025, further complicating investment decisions.

The CEO’s departure could raise eyebrows since the bank is embroiled with “angry” regulators in the United States and faces a multi-billion-dollar penalty. However, the board’s chosen successor, Raymond Chun, has been around since 1992 and should know TD’s business well.

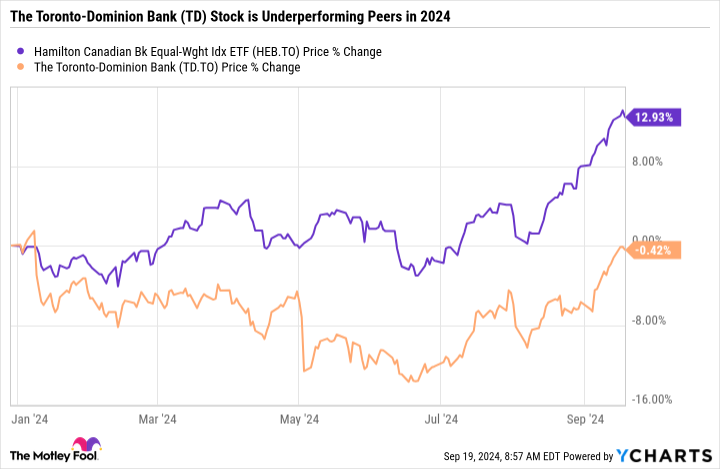

TD Bank stock: An underperformer in a rising tide

TD Bank stock has remained essentially flat this year, showing a minor 0.4% decline. This starkly contrasts the broader Canadian banking sector, as evidenced by Hamilton Canadian Bank Equal Weight Index ETF’s impressive 12.9% year-to-date gain. While TD has outperformed Bank of Montreal (down 9.8%), which is grappling with problematic COVID-era loans, it’s clear that TD Bank stock is lagging behind its peers.

Investors can buy the bank stock at a cheap valuation today and earn a respectable 4.8% dividend yield. The bank stock is a Dividend Aristocrat that has consistently paid a dividends for 166 years and raised payouts during the last 13. It can be a reliable passive-income play.

Further, TD Bank stock currently trades at a forward price-to-earnings (P/E) multiple of 10.5, which is below a peer average of 11.8. Shares present a compelling valuation. However, the decision whether to buy, sell, or hold may depend on one ultimate question that could be worth US$3 billion (CA$4.1 billion) or more.

The $3 billion question: Regulatory woes weighing on the Toronto-Dominion Bank stock

The elephant in the room is the ongoing U.S. regulatory investigation into TD’s potentially lax anti-money laundering (AML) practices. The bank has set aside a whopping US$3 billion in provisions for potential penalties, a significant increase from the US$450 million provision in the second quarter. This dramatic jump suggests the severity of the situation, and management expects a resolution by the end of the year.

This regulatory uncertainty and associated provisions have impacted TD Bank stock. TD’s common equity tier-one (CET1) ratio, a key measure of a bank’s financial strength, has dropped to 12.8%. To maintain a safe buffer above the regulatory minimum of 11.5%, TD had to reduce its stake in Charles Schwab from 13.5% to 10.1%, sacrificing future earnings and growth potential.

The silver lining: Why TD Bank stock might still shine

Despite these challenges, there are compelling reasons to consider TD Bank stock. The bank remains highly profitable, with revenue growing 8% year over year in the third quarter. TD’s dominant position in the Canadian deposit market is a significant advantage, providing a low-cost funding source for its lending operations.

TD’s loan book has shown resilience, with stable provisions for credit losses in the third quarter while many peers saw increased impairments. The bank is also enhancing profitability through a restructuring program expected to yield $800 million in annual benefits starting in 2025. Cost savings, business volume growth, and sustained moats in Canada may help the banking group sustainably generate double-digit return on equity (ROE) and positive returns for investors.

Foolish bottom line: Is TD Bank stock a diamond in the rough?

For long-term-oriented investors, the key question is whether TD’s current challenges are already priced into the stock. Once the regulatory headwinds clear, TD Bank stock may have renewed capacity to grow earnings organically, raise dividends, and repurchase shares, potentially leading to stronger shareholder returns.

TD Bank stock presents a mixed picture for investors in September 2024. The regulatory uncertainty is a significant concern, but the bank’s fundamental strengths and market position remain intact. Risk-tolerant investors might see Toronto-Dominion Bank’s current stock price as an attractive entry point, betting on TD’s ability to weather the storm and emerge stronger. More conservative investors might prefer to wait for clearer skies before committing.

As always, consider your personal financial goals, risk tolerance, and the role this investment would play in your overall portfolio. While TD Bank has faced challenges lately, its long-term track record and leading positions in the Canadian and U.S. banking sectors make TD Bank stock worth watching closely in the coming months.

Act Fast: 75 Only!

Act Fast: 75 Only!