You don’t need to land a moonshot with penny stocks, meme stocks, or crypto in your Tax-Free Savings Account (TFSA) to earn a million dollars.

A much safer and sensible way is to invest in low-cost index funds, reinvest dividends, contribute consistently, and stay the course.

It might sound like advice your boomer parents might give, but there’s ample historical evidence that it works.

Here’s how you can put this into play today with a low-cost Vanguard S&P 500 index exchange-traded fund (ETF).

Source: Getty Images

The historical evidence

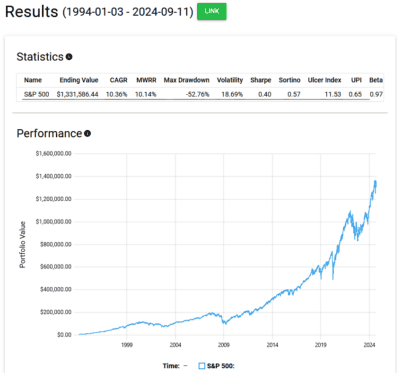

Suppose you went back in time to January 1994, 30 years ago, and started investing in a low-cost S&P 500 index fund.

You began with $10,000 and decided to add $500 every month, reinvesting all dividends and holding steady through any market dips.

Over these three decades, your approach would have netted a compound annual growth rate (CAGR) of 10.36%, and by September 2024, your balance would have swelled to $1,331,586.44. That’s the magic of consistent investing and the power of compounding returns over time.

But it wasn’t all smooth sailing. You would have faced a maximum drawdown of -52.76%, which means at one point, your portfolio could have halved in value. And with a volatility of 18.69%, there were likely plenty of nerve-wracking ups and downs along the way.

This level of risk and the emotional rollercoaster it brings are crucial to consider for anyone thinking about following a similar path. Remember, achieving significant returns often means enduring substantial risks.

The ETF to buy

To put this straightforward buy-and-hold strategy into action within your TFSA, consider purchasing Vanguard S&P 500 Index ETF (TSX:VFV).

This ETF offers the same exposure to the S&P 500 as the older index funds from the 90s featured in the backtest, but it’s traded in Canadian dollars, making it accessible for Canadian investors.

Currently, each share costs about $135. The ETF comes with a low expense ratio of 0.09%, which means if you invest $10,000, your annual fees would be just $9.

This makes VFV an economical choice for those looking to mimic the historical performance of the S&P 500 in a tax-efficient account like a TFSA.