Imagine you want to generate a steady stream of passive income every month, and you have $10,000 to start with. What could that look like?

Here’s the setup: We’ll be using a Tax-Free Savings Account (TFSA) for this exercise, which is perfect for Canadian investors aiming to grow their wealth without the burden of paying taxes on interest, dividends, or capital gains.

Inside this TFSA, we’re not just buying dividend stocks. Instead, we’re looking at a unique monthly-paying closed-end fund (CEF), the Canoe EIT Income Fund (TSX:EIT.UN).

Let’s see how much monthly income you could realistically expect today from a $10,000 investment in EIT.UN within a TFSA.

What is EIT.UN?

EIT.UN is the largest CEF in Canada with a whopping $2.94 billion in assets. It’s traded just like a stock, yet it offers the broad diversification typically found in mutual funds.

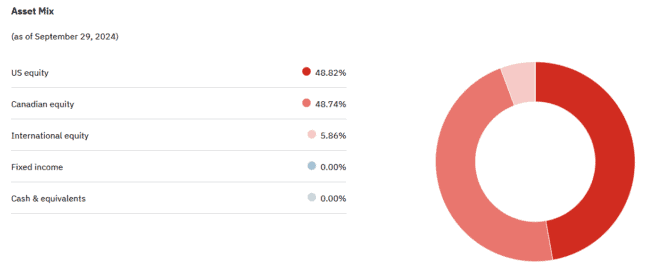

Here’s the scoop: EIT.UN maintains a balanced portfolio, split fairly evenly between Canadian and U.S. stocks. It’s like having a foot in two major markets at once!

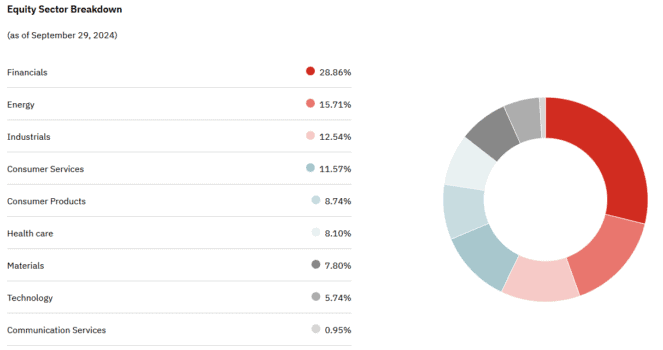

The fund’s composition is quite concentrated, though — the top 25 holdings account for more than 76% of its total assets. These are spread across several sectors, including financials, energy, industrials, and consumer services and products.

One of the fund’s standout features is its consistent monthly distribution of $0.10 per share, which has been going strong for decades. This payout is a mix of dividends, capital gains, and even a return of capital.

But here’s something to keep an eye on: EIT.UN uses leverage to boost its returns, typically about 20%, making it a higher-risk, higher-return option.

Thinking of grabbing some shares for those dividends? You’ll need to buy them before the ex-dividend date to qualify for the next payout — right now, that deadline is set for October 22, with the distribution following on November 15.

Also, the market price of EIT.UN can sometimes differ from its actual net asset value (NAV). As of October 9, it’s trading at a slight discount — $14.85 market price compared to a NAV of $15.02 — making it a potentially attractive buy.

How much passive income will $10,000 in EIT.UN generate?

Assuming EIT.UN’s current share price of $14.85, $10,000 would buy 673 shares of EIT.UN. At $0.10 per share, investors can expect $67.30 in monthly tax-free income within a TFSA.

| TICKER | RECENT PRICE | NUMBER OF SHARES | DISTRIBUTION | TOTAL MONTHLY PAYOUT |

| EIT.UN | $14.85 | 673 | $0.10 | $67.30 |

While $67 a month might not seem like a game-changer, consider what this could cover: a tank of gas, a nice dinner out, or even your phone bill.

The idea here is to invest in productive assets that effectively work for you, turning your capital into a source of regular, passive income. This strategy embodies the essence of smart, long-term investing —letting your money make money.