For income-seeking investors, finding reliable high-yield investments can be a challenge in today’s volatile market. With its 7.4% distribution yield, SmartCentres Real Estate Investment Trust (TSX:SRU.UN) presents an intriguing opportunity. Could this REIT be the dependable source of monthly passive income you’ve been searching for?

SmartCentres REIT is a Canadian retail property owner making strides in bolstering a diversified portfolio of 195 properties spanning 35.3 million square feet of gross leasable area (GLA). As the REIT transitions from a primarily retail-focused model to a mixed-use development strategy, its attractiveness to income-focused investors seeking reliable monthly distributions grows. Let’s dive into the latest operating numbers and assess whether SmartCentres REIT can deliver on its promise of stable distributions and growth.

Source: Getty Images

SmartCentres’ Q3 performance: A positive trajectory

SmartCentres REIT’s third-quarter (Q3 2024) earnings results reflect strength in operations:

- Same property net operating income (NOI) growth: Year-over-year growth was robust at 8.2% (excluding anchors) and 4.9% (including anchor tenants). This growth, driven by strong leasing activity, underscores SmartCentres’ ability to enhance property income.

- Strong occupancy rates: In-place and committed occupancy reached 98.5% by September, a steady improvement from earlier quarters and much better than the 97.7% printed in March this year. This reflects effective leasing strategies and strong tenant retention.

- Re-leasing spreads: New leases achieved an 8.9% rent premium over expiring agreements, and average portfolio rental rates on non-anchor space has risen to $23.13 per square foot, further enhancing future rental income potential. With 10.2% of its leases expiring in 2025 – at rents at $15.06 per square foot and well below current market rates – SmartCentres has a unique opportunity to secure higher-paying tenants and boost distributable cash flow.

- AFFO per unit growth: Adjusted funds from operations (AFFO) per unit rose to $0.61 from $0.48 a year ago, significantly improving the AFFO payout ratio to 75.2% – a substantial reduction from 96.1% during the same period in 2023.

The above metrics indicate that SmartCentres REIT is successfully navigating current economic challenges while laying a solid foundation for future growth.

A balanced approach to development

The REIT continues to execute its mixed-use strategy, adding four new properties, including two self-storage assets during the first nine months of 2024.

In 2025, three new self-storage facilities, including a 1,540-unit asset in Toronto, will begin generating revenue, further diversifying income streams. The trust’s extensive development pipeline promises steady contributions to distributable cash flow in the coming years.

SmartCentres REIT’s distribution sustainability: A closer look

SmartCentres REIT offers a compelling yield of approximately 7.4%, but sustainability remains a key question.

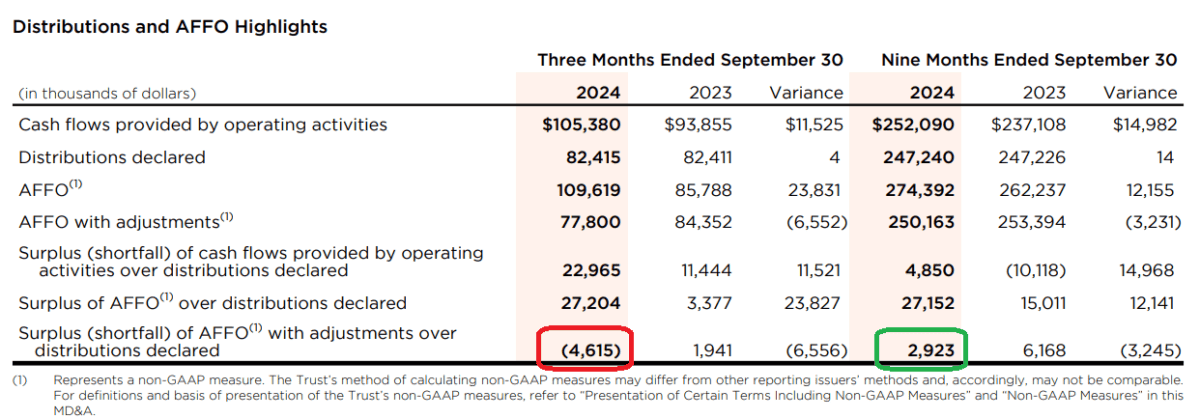

The trust adjusts its AFFO for gains and losses on derivatives, and volatile receipts from condo and townhouse sales. Despite the strong AFFO payout ratio for the first nine months of 2024, the REIT’s third-quarter AFFO (with adjustments) exceeded 105%, and there was a significant cash flow shortfall during the past quarter.

While shortfalls raise investor concerns over distribution sustainability, management attributes the temporary shortfall to increased capital expenditures, which are essential to the trust’s transformative projects.

Recurring cash flow from rental properties continues to fully cover monthly distributions, providing a cushion for volatile income from condo and townhouse developments. A healthier interest rate environment could further stabilize these supplementary cash flows, enhancing the overall safety of distributions.

Future prospects: A passive income play positioned for growth

SmartCentres’ focus on residential and mixed-use developments aligns with demographic shifts favouring urban living. The trust’s manageable debt ratio of 43.6% supports its ability to fund ongoing projects without compromising its financial health. With a strong balance sheet and a strategic vision, SmartCentres is poised to capture long-term growth opportunities while maintaining income stability.

Investor takeaway

For income investors, SmartCentres REIT remains a solid contender. Its 7.4% yield is supported by steady operational improvements, a robust occupancy rate, and growth prospects from mixed-use developments. While the high payout ratio warrants vigilance, management’s proactive measures to diversify revenue and enhance cash flow offer reassurance. Investors comfortable with a moderate risk profile may find SmartCentres REIT a compelling addition to their diversified portfolios.