Ever wondered how much you could make if you optimized your Tax-Free Savings Account (TFSA) solely for passive income generation?

According to Moneysense’s calculator, if you were a Canadian resident before 2010, born in 1991, who has never contributed to a TFSA, you would have $95,000 of TFSA contribution room available in 2024.

Let’s explore how much you could be earning tax-free using one of my favourite monthly income exchange-traded funds (ETFs) from Hamilton ETFs.

The ETF to use

If regular dividend stocks don’t offer high enough yields without entering potentially unstable territory, consider using the Hamilton Enhanced Multi-Sector Covered Call ETF (TSX:HDIV), which employs some financial engineering.

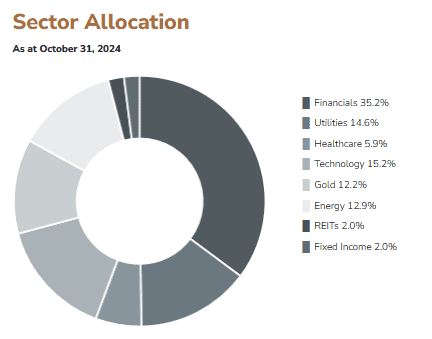

How it works: HDIV holds a selection of 11 Hamilton ETFs designed to mirror the sector composition of the S&P/TSX 60, including areas such as financials, technology, energy, gold, utilities, REITs, and bonds.

Each of these underlying ETFs employs a covered call strategy. This approach involves selling options, which caps the upside price potential in exchange for generating high monthly income.

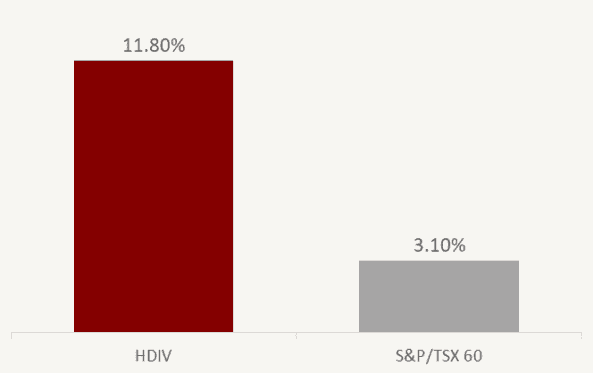

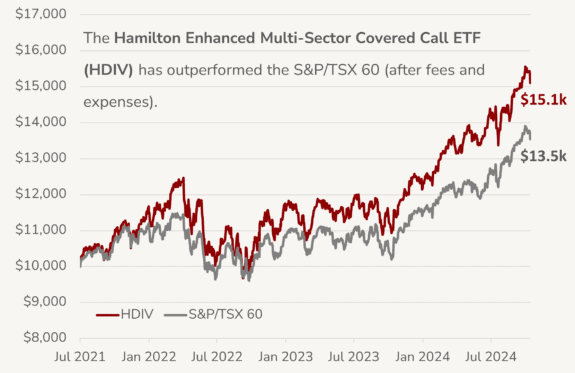

To further enhance returns, HDIV is permitted to borrow up to 25% of its assets – similar to using a margin loan – which increases both potential gains and risks. So far, it has worked, with HDIV beating the market.

As of November 19, HDIV boasts a yield of 11.8%. The most recent monthly distribution of $0.171 per share was paid on November 7, following an October 31 ex-dividend date.

How much you could make

Assuming HDIV’s most recent November 7 monthly distribution of $0.171 and a share price of $17.92 as of November 19 remained consistent moving forward, an investor using a maxed-out $95,000 TFSA could buy 5,301 shares.

| ETF | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| HDIV | $17.92 | 5,301 | $0.171 | $906.47 | Monthly |

This corresponds to $906.47 in tax-free monthly passive income, or $10,877.64 per year. Again, all tax-free within a TFSA!