You don’t need to chase the next 10-bagger stock, dive into risky options, or stake everything on cryptocurrency to aim for a million-dollar retirement fund.

In reality, those strategies are more likely to erode your wealth than build it. Instead, imagine a simpler, more dependable path to financial security: investing in an S&P 500 index fund.

Starting with just $10,000 and practicing passive investing might just be the key to reaching that seven-figure sum. This approach isn’t about getting rich quickly—it’s about building wealth steadily and surely over time.

A historical example

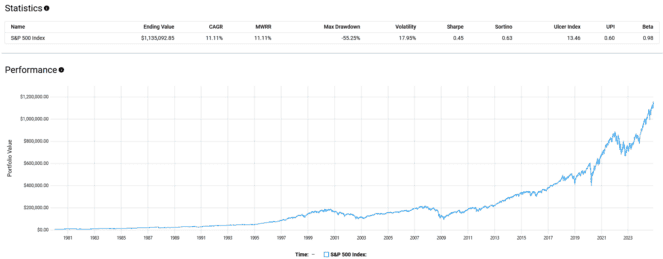

Imagine this: back in 1980, you invested $10,000 in an S&P 500 index fund. Fast forward to today, and that initial investment has grown to $1,135,092.85, achieving a compound annual growth rate (CAGR) of 11.11%.

Your strategy was simple: buy once, set dividends to automatically reinvest, and then just let it sit. Why did this work? Essentially, you placed a long-term bet on the ongoing growth of 500 of the most prominent U.S. companies.

It wasn’t always smooth sailing—the average annual fluctuation was 17.95%, and in 2008, you watched nearly 55.25% of your investment evaporate during the great financial crisis.

However, by steadfastly holding on through ups and downs—literally doing nothing—you reaped substantial rewards, becoming a millionaire in perhaps the most effortless way possible.

Which funds to buy

For exposure to the S&P 500 index, you have two excellent, low-cost ETF options, both from Vanguard, a very reputable asset manager.

First, the Vanguard S&P 500 Index ETF (TSX:VFV) is denominated in Canadian dollars and carries a low expense ratio of 0.09%.

It’s an excellent choice if you’re using a commission-free platform like Wealthsimple for your Tax-Free Savings Account (TFSA).

Alternatively, if you have a Registered Retirement Savings Plan (RRSP) with Interactive Brokers, which offers low currency conversion fees, you might consider investing in Vanguard S&P 500 ETF (NYSEMKT:VOO) in U.S. dollars.

A significant advantage of using VOO within an RRSP is that it doesn’t suffer a 15% foreign withholding tax on dividends.