Earning $400 a month in passive income—$4,800 annually—might not sound like much at first. But take a moment to really think about it.

If you could generate that completely hands-off (and tax-free in a Tax-Free Savings Account, or TFSA), it could cover your car payment, insurance, phone and internet bill, utilities, or even a few nice nights out. It’s the kind of cushion that can make life a little easier and a lot more enjoyable.

So, how much would you need to invest to make this happen? Thanks to some unique funds from Hamilton ETFs, it might be less than you think.

Let’s crunch the numbers using Hamilton Enhanced Multi-Sector Covered Call ETF (TSX:HDIV) to see how much you need to turn this idea into a reality.

What is HDIV?

HDIV is a fund of funds, meaning it holds other Hamilton-covered call ETFs across multiple sectors. It’s designed to mirror the composition of the S&P/TSX 60, offering broad exposure to Canadian large-cap stocks.

HDIV employs a covered call strategy, where call options are written on part of the portfolio. This approach sacrifices some upside potential in exchange for generating higher income from the premiums collected. It’s not without trade-offs but provides a different way to realize gains.

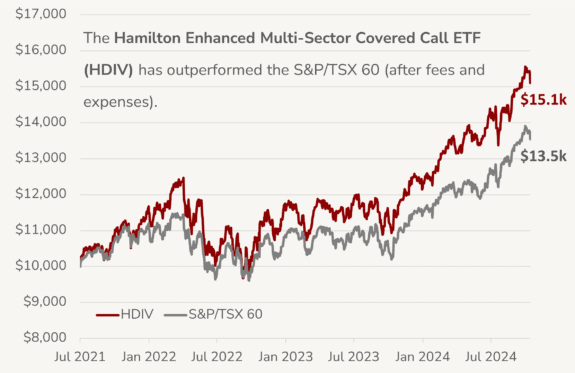

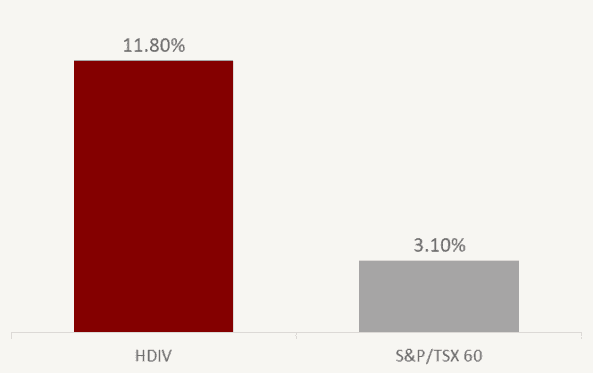

To offset the capped upside, HDIV uses 25% leverage, or 1.25x. This amplifies returns during positive markets but also increases losses during downturns. Historically, this combination has worked well, with HDIV outperforming the broader Canadian market.

Currently, HDIV delivers an 11.8% annualized yield. Its distributions typically go ex-dividend on the last day of the month and are paid out during the first week of the following month. It’s a practical choice for investors seeking reliable income.

How much to invest?

Assuming HDIV’s most recent November 7th monthly distribution of $0.171 and a share price of $17.97 as of writing remained consistent moving forward, an investor using a TFSA would need to buy roughly $42,031.83 worth of HDIV, corresponding to 2,339 shares to receive around $400 monthly tax-free.

| ETF | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| HDIV | $17.97 | 2,339 | $0.171 | $399.97 | Monthly |