If you’re chasing yields of 8% or higher, you’re likely venturing beyond the usual dividend stocks like pipelines, telecoms, and banks, landing in riskier territory with mortgage investment corporations or split shares.

While these assets can be tempting, they come with considerable risks that aren’t always worth the reward. Instead, consider using exchange-traded funds (ETFs).

Some ETFs are designed to cater to yield-hungry investors by using covered call strategies and leverage to boost income potential. These strategies can help overcome the limitations of individual dividend stocks and deliver consistently high payouts.

Here’s a look at how these strategies work and two from Hamilton ETFs offering double-digit distribution yields with monthly payouts – ideal for generating passive income.

What are covered calls?

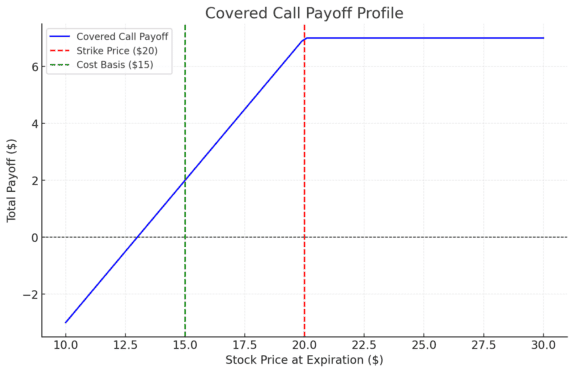

Imagine you own 100 shares of Acme Corp, bought at $15 per share, and the current market price is $20. You believe the stock will stay rangebound and don’t want to sell your shares, but you’re looking to generate extra income.

Here’s what you can do: sell one covered call with a $20 strike price. In doing so, you collect a premium – cash paid to you immediately for entering into the contract. In exchange, you’re obligated to sell your 100 shares at $20 per share if the stock price exceeds that level by the option’s expiration date.

How much premium you collect depends on the strike price (at-the-money and in-the-money options pay more), the option’s expiry date (closer dates pay less), and the stock’s volatility (higher volatility means higher premiums). Now, what happens next depends on how the stock performs:

- In the money: If Acme’s price goes above $20, your shares are “called away,” and you sell them at $20, missing out on further gains.

- Flat: If Acme stays at $20 or below, the option expires worthless, and you keep your premium while holding onto your shares.

- Out of the money with a loss: If Acme drops way below $20, you still keep the premium, but you’re exposed to losses in the stock’s value.

The key takeaway? Covered calls trade upside potential for immediate income. It’s not free money – just a different way to realize gains while holding a stock.

What is leverage?

Leverage is a strategy that allows you to increase your market exposure by using borrowed funds, potentially enhancing returns – but also magnifying risks.

Imagine you own 100 shares of Acme Corp and sell a $20 covered call. Your upside is now capped at $20 per share, plus the premium you received. That’s the tradeoff of a covered call strategy.

Now, let’s say you borrow an additional 25% of your portfolio’s value, or $25, using a margin loan. You use this borrowed money to buy more shares of Acme. As a result, your exposure increases: instead of controlling $100 of Acme stock, you now control $125 worth. Any market movement, whether up or down, is magnified because you’re using borrowed money to hold more than you could otherwise afford.

Leverage isn’t free – you’ll pay interest on the margin loan. And if Acme’s price drops significantly, your broker might issue a margin call – requiring you to deposit additional cash to maintain your position. This added volatility means gains and losses are amplified, making leverage a double-edged sword.

HYLD and HDIV

If managing covered calls and leveraging sounds too complicated, don’t worry – you can invest in the Hamilton Enhanced U.S. Covered Call ETF (TSX:HYLD) and the Hamilton Enhanced Multi-Sector Covered Call ETF (TSX:HDIV).

Both ETFs invest in a portfolio of other Hamilton covered call ETFs spanning most of the 11 market sectors. HYLD is designed to emulate the S&P 500 index, while HDIV mirrors the S&P/TSX 60 index.

Each ETF within their portfolios sells at-the-money (ATM) covered calls on 33–50% of its holdings. This approach strikes a balance: you get higher income from the call premiums while retaining most of the upside potential of the stocks they hold.

To further boost returns, Hamilton employs 25% leverage (1.25x) internally within each ETF. This strategy amplifies both income and growth potential. And yes, both HYLD and HDIV are eligible for registered accounts like the RRSP and TFSA.

As of December 10, HYLD offers a distribution yield of 12%, while HDIV yields 11.3%.