There are hundreds of exchange-traded funds (ETFs) in Canada, and as someone who analyzes them for a living, I’ve come across plenty of interesting ones.

This year, two from Hamilton ETFs caught my eye – mainly because they’re the first lightly leveraged dividend growth ETFs available in Canada.

The idea is simple: dividend growth stocks are already good investments. So why not borrow a little money to invest more in them? These ETFs do just that, using modest leverage to enhance returns while maintaining exposure to high-quality dividend growers. Here’s how they work.

Understanding leveraged ETFs

There are two types of leveraged ETFs, and while both magnify returns, they do so in very different ways.

The ones you’ve probably seen before are daily resetting leveraged ETFs – these aim to deliver 2 or 3 times the daily return of an index like the S&P 500. They achieve this by using complex financial instruments called derivatives.

While they work as intended for short-term trading, holding them long term can produce unexpected results, since the daily compounding doesn’t always line up perfectly with the expected multiple.

The newer leveraged ETFs are built for long-term investing. Instead of derivatives, they use physical leverage, meaning they borrow cash and invest more directly into their portfolio.

Think of it like opening a non-registered brokerage account and using margin. If you deposit $100 and borrow an extra $25 to invest a total of $125, you’re using 1.3 times leverage.

That’s exactly what these lightly leveraged ETFs do – they invest more in high-quality stocks without the complications of daily resets.

The two ETFs I like

The two ETFs that stand out to me are the Hamilton CHAMPIONS™ Enhanced U.S. Dividend ETF (TSX:SWIN) and the Hamilton CHAMPIONS™ Enhanced Canadian Dividend ETF (TSX:CWIN). Both ETFs use 1.3 times leverage to invest in stocks from their respective indices.

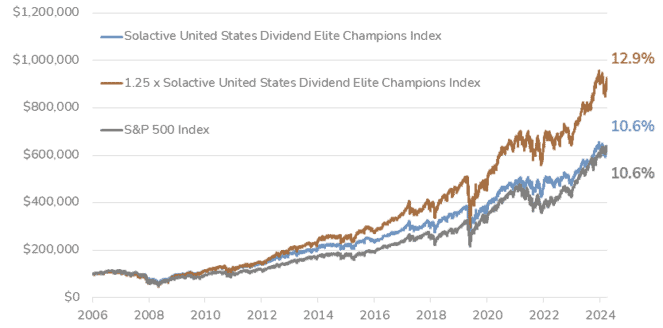

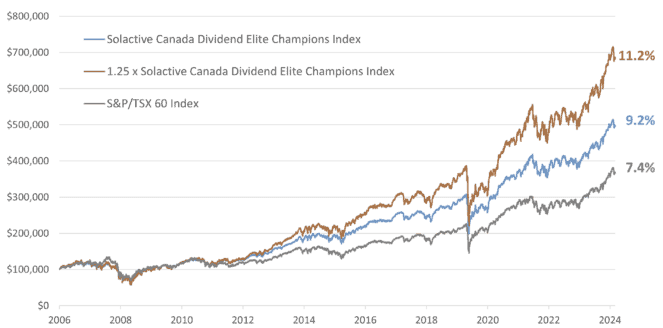

SWIN follows the Solactive United States Dividend Elite Champions Index, which screens for U.S. stocks with 25-plus consecutive years of dividend growth. CWIN follows the Solactive Canada Dividend Elite Champions Index, which requires stocks to have 6-plus years of dividend growth.

In both cases, the ETFs equally weight the selected stocks, ensuring no single company dominates the portfolio. Here’s a look at some of their notable holdings.

Historically, applying leverage to these dividend growth indices has resulted in outperformance. That said, the ETF won’t track the index perfectly – indices are frictionless, while ETFs have trading costs and management fees that eat into returns.

But even with these factors, the strategy looks promising for higher-risk investors looking to enhance their dividend growth exposure. And unlike margin, you can employ both in registered accounts like a Tax-Free Savings Account (TFSA)!

Act Fast: 75 Only!

Act Fast: 75 Only!