Your goal when investing should always be total returns—the overall gains you make from a stock or exchange-traded fund (ETF).

Total returns come from two sources: dividends and share price appreciation. Some investors prefer one over the other, but I stay agnostic—both matter.

That said, you can strike a balance. If you’re focused on passive income, choosing the right ETF can still deliver solid share price growth alongside steady dividends. Here’s one that does just that.

Why I prefer dividend growth

A high dividend yield can be a red herring. Dividends come directly from a company’s earnings, and when a stock pays one, its share price drops by the dividend amount on the ex-dividend date.

This is the cutoff day for being eligible to receive the payout. If a stock trades at $50 and pays a $1 dividend, it will typically open at $49 the next day.

The smarter approach to passive income is dividend growth. In the long run, you want to own companies that consistently increase their dividends year after year.

Beyond the compounding effect of reinvesting those dividends into more shares that generate even higher payouts, dividend growth is also a sign of financial health.

Companies that can afford to raise their dividends consistently tend to have strong earnings, sustainable cash flow, and disciplined management.

Finally, with inflation historically averaging around 2% per year, there’s no reason why your income stream shouldn’t grow along with it.

A company that raises its dividend over time helps protect your purchasing power, ensuring your passive income keeps up with rising costs.

My favourite dividend-growth ETF

I like the newly launched HAMILTON CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP).

This ETF tracks the Solactive Canada Dividend Elite Champions Index, which holds an equal-weighted portfolio of blue-chip Canadian stocks that have grown their dividends for at least six years. On average, the portfolio’s dividend-growth rate sits at 10%.

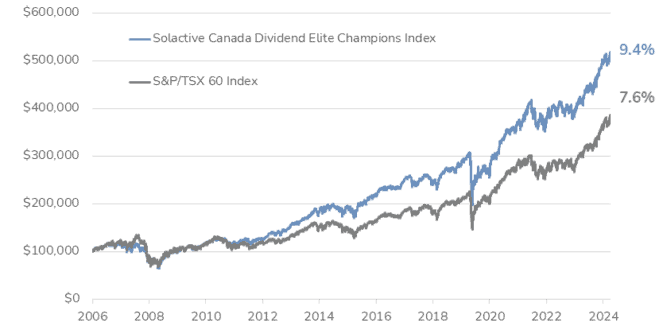

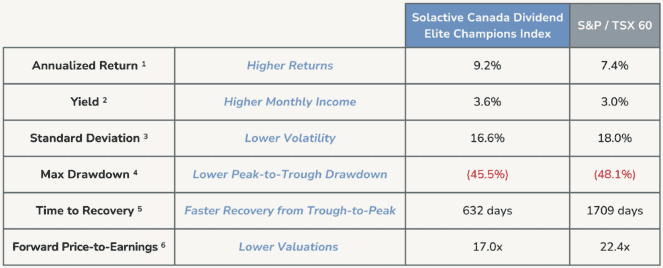

Historically, this index has outperformed the S&P/TSX 60 while taking on less risk. It fluctuates less year to year, and in bear markets, it fell less and recovered faster than broader Canadian benchmarks.

The ETF itself is new, but as a bonus for investors, there’s no management fee for the first year, making it effectively free to buy and hold.

Right now, the estimated monthly distribution is $0.04533 per share. At a price of $15.88 as of February 5, that translates to an annualized distribution yield of 3.42%.