I’ve said it before, and I’ll say it again: any exchange-traded fund (ETF) that keeps fees low and owns quality companies is already on the right track. It’s not rocket science.

So, I was pleasantly surprised when Hamilton ETFs launched a few that fit this bill exactly. I even bought one of them on launch day. Here’s all you need to know about my favourite ETFs for 2025.

U.S. dividend champions

The ETF I personally own and love is Hamilton CHAMPIONS™ U.S. Dividend Index ETF (TSX:SMVP).

This fund tracks the Solactive United States Dividend Elite Champions Index, which focuses on U.S. companies that have raised their dividends for at least 25 consecutive years.

These aren’t just dividend payers—they’re dividend growers, meaning investors get a rising income stream over time. On average, companies in this index have an annualized 10% dividend-growth rate.

What makes SMVP unique is its equal-weighted approach. Instead of letting the biggest companies dominate the portfolio, each stock gets an equal share, providing better diversification and reducing risk.

The result is a collection of household-name U.S. brands that most investors already recognize, with less exposure to high-growth tech stocks and more focus on defensive sectors like healthcare, consumer staples, and industrials.

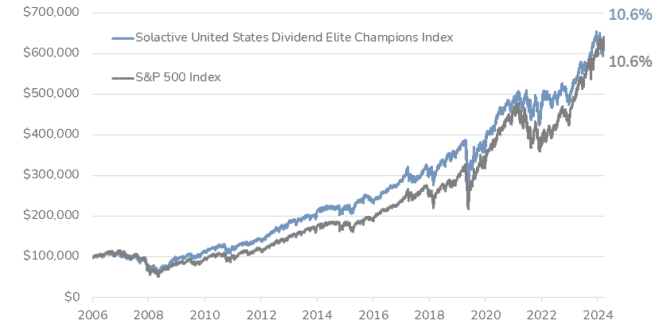

Historically, the Solactive United States Dividend Elite Champions Index has matched the S&P 500 in total returns but with lower volatility and a higher yield.

That’s a rare combination—steady long-term growth without the wild swings of the broader market. Investors can expect a dividend yield of around 3.2% with monthly payouts. SMVP is also waiving management fees to 0% for a year, making it incredibly affordable, too.

Leveraged U.S. dividend champions

If you like SMVP but want a higher risk, higher reward option, the ETF to buy is Hamilton CHAMPIONS™ Enhanced U.S. Dividend ETF (TSX:SWIN).

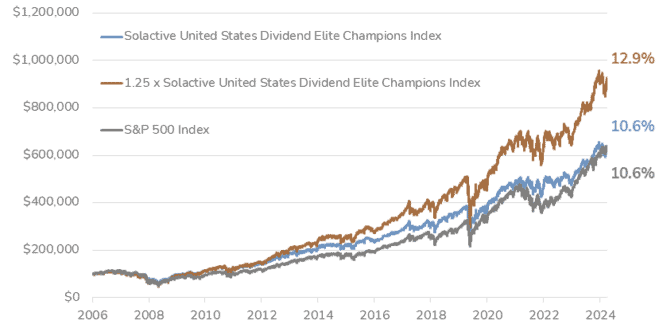

What sets SWIN apart is its light 1.25 times leverage. All this ETF does is invest more in the same companies that SMVP owns, using borrowed capital at institutional rates to provide 25% more exposure to these dividend-growth stocks.

Historically, leveraging the Solactive United States Dividend Elite Champions Index has provided outperformance over both its unleveraged counterpart and the S&P 500 while still maintaining a focus on dividend safety and quality.

SWIN also pays monthly distributions, making it a strong choice for income-focused investors who still want growth potential. Currently, it pays a 4.2% yield.

Act Fast: 75 Only!

Act Fast: 75 Only!