Enbridge (TSX:ENB) is one of North America’s top energy infrastructure and gas distribution companies. Given Enbridge stock’s history of strong dividend growth and shareholder value creation, what can investors expect for 2025?

Let’s take a look.

Enbridge: The dividends keep coming

Just this last year, Enbridge posted its 30th year of consecutive dividend increases. This is part of what has made Enbridge stock a go-to stock for income-seeking investors. But what can we expect for 2025? Will this record of dividend increases continue?

Today, Enbridge stock is yielding a very generous 5.88%. I’ve written in the past about how I believe that this yield implies a risk that’s priced into Enbridge stock that’s overstated. In fact, the company is becoming increasingly lower-risk as its regulated utilities business has significantly grown due to recent acquisitions.

This means that Enbridge’s dividend, as well as its cash flows have become more predictable and secure — all good news for dividend investors.

2025 financial outlook

Some very positive trends are driving the outlook for 2025 and beyond. For example, global oil consumption has recovered to all-time highs. Also, natural gas demand is increasing rapidly due to liquified natural gas (LNG) demand, coal switching, and electric power demand.

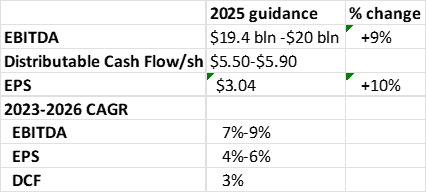

Against this very favourable backdrop, Enbridge will benefit from its own company-specific drivers. These include the first full-year contribution from the company’s U.S. utility acquisitions, as well as the $5 billion of projects that were placed into service at the end of 2024. The table below highlights Enbridge’s solid financial outlook.

Enbridge stock: Still undervalued

As far as Enbridge stock goes, I think its attractive valuation will become increasingly obvious to investors as the year progresses. Trading at 21 times earnings, it’s not necessarily cheap. However, there is a deserved premium that Enbridge should command.

This is due to the changing nature of the business that breeds more security, and this should translate into higher valuation multiples. Upon closing of all three of Enbridge’s U.S. gas utilities acquisitions, the company’s gas distribution business became the largest natural gas utility in North America. This positions Enbridge for strong and even more predictable long-term growth.

Before these acquisitions, a low-risk business model already backed Enbridge stock. For example, 98% of the company’s cash flow generated is from long-term, cost-of-service or take-or-pay contracts. Also, its customer base is 95% investment grade, and 80% of its earnings before interest, taxes, and depreciation is inflation-protected.

Renewables: Another area of growth

Finally, 2025 will also see Enbridge’s renewables projects come into service, adding to the company’s diversity. In fact, the company has two solar projects that will come into service in 2025. The company completed its Fox Squirrel project in late 2024, and it will complete its Sequoia project in two phases, one in 2025 and one in 2026.

These projects are already substantially contracted and will add to Enbridge’s returns. For example, the Fox Squirrel project has a long-term purchase agreement with Amazon for 100% of its production. Also, the Sequoia project is substantially contracted under long-term purchase agreements. It will be one of the largest North American solar facilities by capacity.

Bottom line

In summary, Enbridge has a lot going for it, and 2025 is a year where a lot of its growth opportunities are getting kick-started. I expect Enbridge stock to increasingly reflect this in 2025 and to continue its strong rally that started at the beginning of 2024.

2-for1 Sale

2-for1 Sale