If you’re looking for a stock that has momentum on its side, look no further. In the last year, Chartwell Retirement Residences (TSX:CSH.UN) has seen its stock rise 38% as occupancy levels continued to rise and financial results strengthened.

In this article, I’d like to highlight some of the reasons I’m positive on Chartwell Retirement Residences and why I’d buy this soaring stock today.

Positive long-term trends driving this stock

Chartwell is Canada’s largest provider and owner of seniors housing communities, from independent living to long-term care. As such, the company is benefitting from one of the strongest secular trends today, the aging population.

According to Statistics Canada, 18.9% of Canada’s population was aged 65 or older in 2023. By 2030, this is expected to increase to 22% to 23%. Also, the population of Canadians aged 75 or older is expected to double in the next 20 years.

The simple fact is that many of Canada’s seniors will either want or need to move into one of Chartwell’s Residences one day. And with their numbers rapidly rising, this means a bigger target market for Chartwell.

Occupancy levels rising

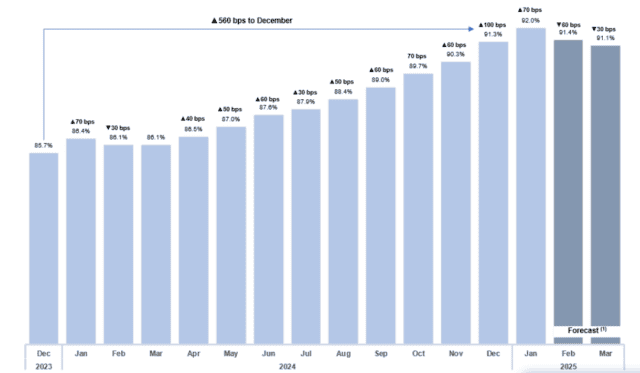

We are already seeing some of the positive trends reflected in Chartwell’s results. For example, occupancy rates have been steadily rising. As you can see from the company’s chart below, they have risen from 85.7% in December 2023 to 92% in January 2025.

Clearly, this increase is reflected in Chartwell’s financial results. In the first nine months of 2024, Chartwell’s revenue increased 15% to $581 million and its cash flow from operations increased 69% to $140 million. Finally, the company’s margins are increasing rapidly. In fact, its operating margin increased 8% to 37.3% as expenses fell during the first nine months.

Chartwell’s steady dividend income

The dividend that Chartwell pays out can be considered reliable and predictable. In fact, the company has paid out a dividend that has proven to be steady and secure. The current dividend yield on the stock is 3.6%. This is a far cry from the days of when it was yielding close to 8%, but it has gotten here due to the stock price appreciation, which is a good thing.

Also, the company is generating an increasing amount of cash flow. This means that its payout ratio is totally reasonable. In the first nine months of 2024, Chartwell paid out 40% of its operating cash flow and 74% of its free cash flow in dividends.

Looking ahead, growth for Chartwell will continue to come from the aging population, but also from acquisitions. Earlier this year, the company acquired Rosemont Les Quartiers, a retirement residence in Quebec for $136 million. The residence offers 632 rental suites catering to a range of preferences and needs. It adds to Chartwell’s portfolio of residences and increases its scale.

The bottom line

Chartwell Retirement Residences is well-positioned to continue to benefit from both the industry trends, as well as its own stellar operational performance. I would buy this soaring stock today for its dependable dividend and long-term growth prospects.