Canada’s Bank of Nova Scotia (TSX:BNS), affectionately known as Scotiabank, has long been a staple in Canadian portfolios for its robust dividend and international flair. But with its stock lagging peers year-to-date (-12.3% total return) and a bold new strategy unfolding, investors are asking: Is Scotiabank’s high-yield dividend worth the risk — and where will this bank be in seven to ten years? Let’s unpack the opportunities, challenges, and critical questions shaping Scotiabank stock’s future.

Source: Getty Images

The strategic pivot: From Latin America to North America

In December 2023, Scotiabank unveiled a sweeping strategic overhaul aimed at reshaping its geographic footprint. The bank has just sold its operations in Colombia, Costa Rica, and Panama — taking a $1.4 billion impairment loss during the first quarter (Q1 2025) — to exit volatile Central American markets. In 2024, it disposed of a Peru subsidiary to Banco Santander and made a two-stage investment into U.S.-based KeyCorp, acquiring a 10% stake in the Cleveland-headquartered regional bank.

Scotiabank’s retreat from identified emerging markets marks a seismic shift. For years, Latin America offered higher growth but came with political instability, currency risks, and regulatory headaches. By reallocating capital to North America (Canada, the U.S., and Mexico), Scotiabank is trading growth potential for stability.

KeyCorp’s commercial banking and wealth management prowess gives Scotiabank a foothold in the world’s largest financial market while diversifying beyond Canada’s potentially saturated banking sector. However, the U.S. market is fiercely competitive, dominated by giants like JPMorgan Chase and Bank of America. Scotiabank’s minority stake limits immediate control but offers optionality for future expansion.

Scotiabank stock valuation vs. peers: Cheap for a reason?

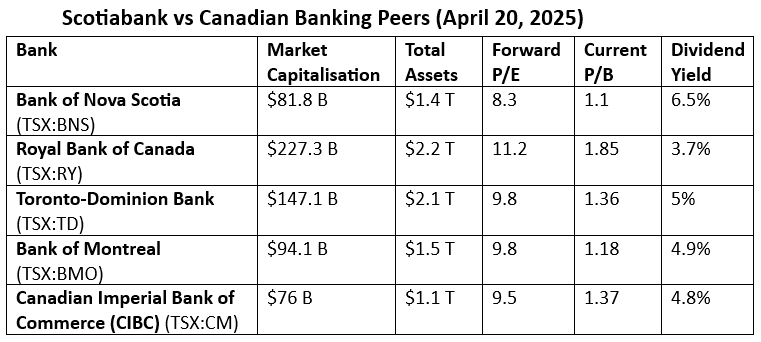

Scotiabank’s valuation metrics tell a story of undervaluation — but also skepticism. Compared to Canada’s Big Five banks, BNS stock trades at a forward P/E of 8.3, well below Royal Bank of Canada stock’s 11.2 and TD Bank’s 9.8. Its price-to-book ratio of 1.1 is the lowest among peers, suggesting the market values it barely above its asset base — a rarity for a major Canadian chartered bank.

The standout feature on Scotiabank stock is its 6.5% dividend yield, the highest in the group, which appeals to income seekers. However, this discount reflects investor concerns about execution risks in its new strategy and past underperformance. If Scotiabank delivers on its North American ambitions, today’s valuation could look like a bargain in hindsight.

Will the four-pillar strategy work?

Scotiabank’s CEO Scott Thomson’s strategic plan hinges on four priorities: growing in Canada, the U.S., and Mexico; simplifying operations to improve client access; deepening client relationships through advice-driven banking; and investing in workplace culture. Since Q1 2024, Scotiabank has closed unprofitable Latin American branches and redirected resources to North America.

While tangible results remain sparse, divestitures are costly. They have been accompanied by impairment charges that eat into the bank’s capitalization. Should a global recession happen within the next seven years, Scotiabank may be forced to delay asset sales.

The U.S. expansion is still in its infancy, and success depends on integrating KeyCorp’s operations without overextending capital. Over the next seven years, the bank must also prove it can compete in mature markets like the U.S., where growth may be slower but steadier than in emerging economies.

Scotiabank stock’s 7-year outlook

The bull case for Scotiabank rests on stability. Exiting emerging markets could reduce earnings volatility, while its 6.5% dividend yield —backed by a manageable payout ratio — offers a cushion if profitability holds. If U.S. growth materializes, BNS stock’s valuation multiple could climb toward peers’ 9–11 P/E range, driving share prices higher.

The bear case warns of pitfalls. North America’s mature markets lack the growth potential of Latin America, and U.S. banking is a tough arena for newcomers. Missteps in integrating KeyCorp or navigating regulatory hurdles in Mexico could erode margins. Investors also face uncertainty around whether Scotiabank’s cultural shift — streamlining operations and investing in talent — will translate into tangible efficiency gains.

Investor takeaway

Scotiabank stock’s seven-year trajectory hinges on U.S. success, dividend durability, and operational efficiency. The 6.5% yield is compelling for income investors, especially in a low-rate environment. However, slower growth in North America and divestitures could pressure earnings, making it critical to monitor payout ratios. For growth-focused investors, the stock’s upside depends on execution. If Scotiabank proves it can carve out a niche in the U.S., shares could potentially rise 30–50% as valuation multiples normalize.