Pop quiz: Which stocks perform better – value or growth? If your instinct was to say growth, you’re not alone. That answer likely comes from recency bias. Growth stocks, especially U.S. large-cap tech names, have dominated over the last decade. But decades of research suggest the opposite should be true.

Contrarians still have plenty of reasons to be bullish on value, and I’m with them. It’s a view grounded in simple logic: paying less for each dollar a company earns sets you up for better returns over time.

Here’s a bird’s-eye view of the “why and how” behind the value investing case – and one Canadian exchange-traded fund (ETF) I like for putting that strategy into action.

Understanding the value factor

Time for a bit of financial history. I’m going to nerd out for a moment, but stick with me – this part matters.

There are a bunch of models that try to explain where a stock’s returns come from. One of the earliest and simplest is the Capital Asset Pricing Model, or CAPM. It says the more risk you take on, the more return you should expect. But CAPM didn’t quite capture everything happening in real-world markets.

A few decades ago, two academics – Eugene Fama and Kenneth French – proposed a better way to explain stock performance. Their solution was the Three-Factor Model, which added two more “factors” to the equation.

The first was size: small-cap stocks tend to outperform large-caps over time because they carry more risk. The second was value: stocks trading at lower prices relative to their fundamentals, like book value, have historically delivered excess returns compared to expensive growth stocks.

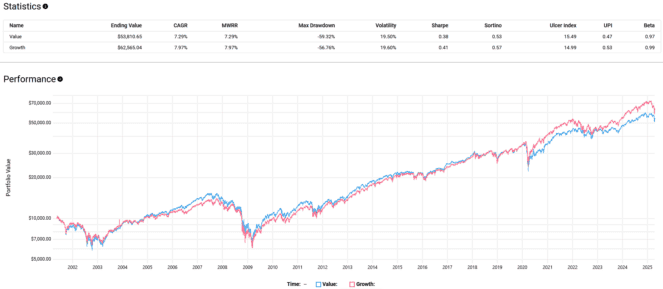

Now look at the chart below, which compares U.S. value and growth index funds starting from the dot-com bubble to today. The trends are cyclical. Value outperformed in the early 2000s, growth dominated in the 2010s, and the gap has widened even more in recent years.

If you’re someone who believes in buying low and selling high, this is the part of the cycle where value stocks are cheap. That’s why now may be the right time to load up.

Why I like this value ETF

One important takeaway from the Fama-French research that often gets missed is that implementation matters. It’s not enough to just believe in value as a concept – you need a clear, rules-based way to define it and actually build a portfolio around it.

That means using specific screeners to sift through the market and isolate a basket of qualifying stocks. The easiest way to do that today is through an ETF like the iShares Canadian Value Index ETF (TSX:XCV).

XCV tracks the Dow Jones Canada Select Value Index, giving you exposure to a concentrated portfolio of 36 Canadian stocks. The fund leans heavily on financials, energy, and materials, which are sectors that often screen as value due to their cyclical earnings and low price-to-book ratios.

It also comes with a 12-month trailing dividend yield of 3.9%, offering a decent income stream on top of the value exposure. The management expense ratio (MER) is 0.55%, which is a bit high for a passive ETF, but reasonable given the focused strategy and the cost of rebalancing a concentrated portfolio.