Semiconductor stocks have been the hottest items in the markets in recent years. Ever since NVIDIA (NASDAQ:NVDA) — the chip supplier that made ChatGPT possible — started ripping in the markets, everybody has been pouring money into everything chip-related.

So far, the bet has been the smart one. While artificial intelligence (AI) software developers like OpenAI don’t see themselves being profitable until 2029, NVIDIA and its ilk are already making money hand over fist. In the span of just three short years, NVIDIA has grown its earnings several hundred percent while earning high margins. It’s been a real success story.

Are AI chip stocks still buys? Quite possibly, yes. Although these stocks have run up quite a bit, they have given up some of their gains this year, making them cheaper than they were at the 2024 highs. In this article, I will explore two semiconductor adjacent stocks to buy and hold for the chip revolution.

TSMC

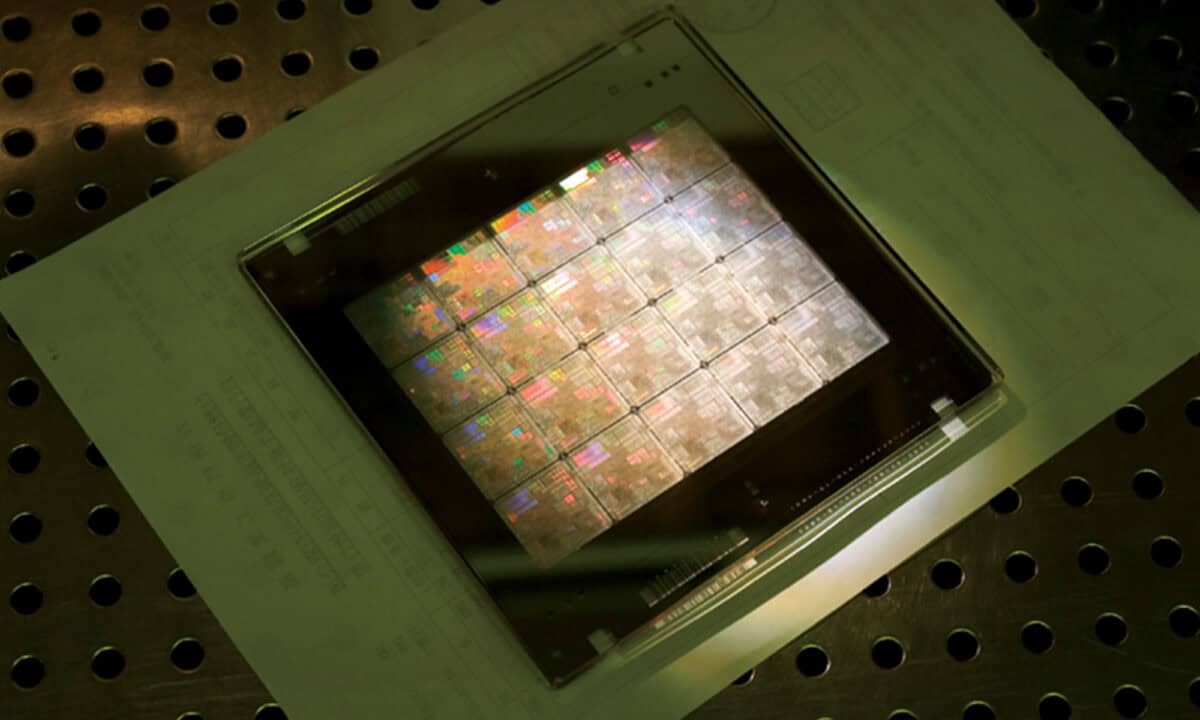

Taiwan Semiconductor Manufacturing (NYSE:TSM), or TSMC for short, is a Taiwanese semiconductor fabrication company. It is the contract manufacturer for NVIDIA and most of America’s other big tech companies. Its main claim to fame is its high market share. TSMC manufactures 60% of the world’s computer chips and 90% of the most high-end chips, such as NVIDIA’s AI accelerator chips. This high market share — near-monopoly share at the high end of the market — is very impressive. And as you might imagine, it has come with a lot of growth and high margins.

TSMC’s stock is actually down quite a bit this year as Donald Trump bullied the company into making a $100 billion American fab investment that may not have been in its best interests. That deal could pull some manufacturing out of Taiwan and into America, lessening Taiwan’s economic defences against a potential Chinese invasion. That’s not a positive, but TSMC will thrive if China doesn’t invade and probably won’t collapse altogether if it does. I’d say this stock is worth a look. I owned it in the past and doubled my money on it.

NVIDIA

NVIDIA Corporation is a U.S. manufacturer of graphics processing units (GPUs). Its basic virtues — being the chip supplier to the AI sector and so on — have already been described. What’s interesting about NVIDIA right now is that its stock has been beaten down this year. At $108, it is down 26% from all-time highs. As a result, it now trades at 37 times earnings, its cheapest valuation in many years. That’s not cheap by the standards of all stocks, but NVIDIA has above-average growth. I’d personally want a price a bit below $100 before buying NVDA, but I don’t think buying it now is crazy.

A Canadian semiconductor-adjacent company

If you’re looking for Canadian companies related to or tangentially involved in the semiconductor industry, one intriguing name to consider is OpenText Corp (TSX:OTEX). It’s dirt-cheap by tech stock standards, trading at 6.8 times earnings. Despite the low multiple, it has grown its earnings at 15% CAGR over the last five years.

The chip angle with Open Text Corp is that the company was tapped by Germany’s TDK-Micronas — a manufacturer of integrated circuits — to provide its employees with remote work software. This doesn’t make OTEX quite a chip stock, but it does align the company with a chip company, which could lead to procurement deals and other such benefits. It might be worth a look.