The tax-free savings account, or TFSA, is an opportunity for Canadian investors to earn tax-free income and capital gains. As we know, the cumulative limit for the TFSA currently stands at $102,000. This means that the tax savings from this investment vehicle can be substantial.

Let’s take a look at two high-yield stocks to consider in order to generate $50-plus in monthly, tax-free income.

Freehold Royalties: A juicy tax-free yield of 9.5%

As a royalty company, Freehold Royalties Ltd. (TSX:FRU) offers investors many advantages. These advantages include lower risk, high returns, and predictability. As you can see from Freehold stock’s price graph below, these advantages have translated into a relatively steady performance (excluding the pandemic years, of course).

Today, Freehold Royalties stock is yielding a very generous 9.6%. While this high yield might cause concern over Freehold’s dividend, in my view, we can rest assured. This is because the dividend is backed by a low-risk, diversified revenue base, and a business model that doesn’t include any exploration risk or capital expenses. This is the beauty of Freehold’s royalty business.

But let’s dig deeper into the dividend. At a 9.6% yield, a natural question would be whether this dividend is sustainable. In 2024, Freehold generated $231 million, or $1.53 per share, in funds from operations. This compares to dividends paid of $163 million, or $1.08 per share. With little to no capital requirements of the business, we can see that the dividend is well covered.

Looking ahead, the company’s diversified asset base of 360 companies across the US and Canada will continue to provide it with royalties. Last year, Freehold’s proven, developed reserves increased 107% and its proven and probable reserves increased 109%. While the price of oil has weakened this year, I think we can find comfort in the fact that Freehold continues to benefit from the strong operational performance of its royalty holdings.

Peyto: Yielding 7.3%

Peyto Exploration and Development Corp. (TSX:PEY) is another stock I’d invest in for tax-free dividend income within my TFSA. Like Freehold Royalties, Peyto operates in the oil and gas industry. Peyto is, in fact, one of Canada’s lowest-cost natural gas producers. Given this, along with the positive outlook for natural gas, Peyto is a good place to invest.

With a current dividend yield of 7.3%, Peyto stock is an interesting candidate for our TFSAs. This yield is backed by strong cash flows, as well as a five-year compound annual growth rate (CAGR) of its dividend of more than 60%. Also, natural gas continues to have a strong outlook, as Canada’s liquified natural gas (LNG) industry continues to ramp up.

How to earn $50/month – tax-free

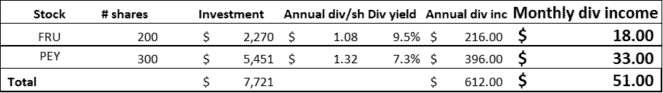

So let’s talk specifics. In order to generate $50 per month by investing in these two stocks, take a look at the following table.

Essentially, buying 300 shares of Peyto and 200 shares of Freehold Royalties will generate $51 of monthly income for your TFSA. This equates to $612 every year of tax-free income.

The bottom line

Investing in high-yield stocks is not without risk, but the two stocks discussed in this article have very attractive risk/reward trade-offs. Simply put, these oil and gas stocks are dependent on commodity prices, of which they have little control.

However, in Peyto’s case, it is a low-cost producer and natural gas has a positive long-term outlook. This mitigates its risks. In Freehold’s case, this company is a royalty trust with highly diversified royalty exposure, and this mitigates its risks.

In summary, investing approximately $7,000 in these two dividend stocks within your tax-free savings account can provide pretty reliable, tax-free monthly income of $50.