Recent Articles

Dividend Stocks

Why Are You Buying This Specific Dividend Stock?

Dividend Stocks

Can Crescent Point Energy Corp.’s Share Price Double?

Dividend Stocks

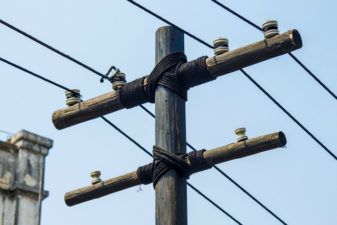

Should You Add Emera Inc. to Your Dividend Portfolio?

Investing

Here Is Another Chance to Buy High-Growth Spin Master Corp.

Dividend Stocks

Should You Buy This High-Growth Utility on the Dip?

Dividend Stocks

Is it Time to Buy Fortis Inc. Stock?

Dividend Stocks

This Dividend-Growth Stock Is a Bargain

Metals and Mining Stocks

Should You Bet Your Money on Tahoe Resources Inc.?

Dividend Stocks

Why Energy Stocks Have Been Weak

Dividend Stocks

2 Stocks to Improve the Safety of Your Energy Portfolio

Investing

What Makes a Good Investment for Your Stock Portfolio?

Dividend Stocks

Build a Diversified Portfolio With These 3 Dividend Stocks

Dividend Stocks

2 Valuable Utility Stocks Trading Near Their Highest Prices

Energy Stocks

Get High Returns From 2 Small Energy Stocks

Dividend Stocks

2 Energy Stocks With Remarkable Returns Potential

Dividend Stocks

How to Access Promising Upside to Higher Energy Prices in a Safe Way

Dividend Stocks

2 Energy Stocks With Remarkable Yields

Dividend Stocks

A Buying Opportunity in a High-Yield Stock Right Now

Dividend Stocks

Why Have Alaris Royalty Corp. Shares Popped 8.5%?

Dividend Stocks

Should You Take Profits in Fortis Inc.?

Dividend Stocks

2 Cash Cows With High Yields and Outstanding Upside

Dividend Stocks

Is it Time to Buy Canadian Imperial Bank of Commerce Shares?

Dividend Stocks

Should You Buy Pembina Pipeline Corp. Today?

Dividend Stocks

Fairfax Financial Holdings Ltd. Shares: Should You Buy the Dip?

Dividend Stocks

Should You Buy This Unloved, High-Yield Stock Right Now?

Dividend Stocks

2 Winners You’ll Want to Keep in Your Stock Portfolio

Dividend Stocks

Cenovus Energy Inc. Shares Down 8%: What Should You Do?

Metals and Mining Stocks

No One Wants to Be in Gold or Silver Right Now: Should You?

Dividend Stocks

Can Hate Turn to Love for These Battered Dividend Stars?

Dividend Stocks

Why You Shouldn’t Care About Altagas Ltd.’s Stagnant Share Price

Investing

Spin Master Corp.: Should You Buy on the Dip?

Dividend Stocks

How Should You Invest in Stocks if You Don’t Have a Lot of Money?

Energy Stocks

Should You Invest in a Lump Sum or in Small Bites?

Dividend Stocks

Now Is Not the Best Time to Buy Fortis Inc.

Dividend Stocks

What Should You Do in a Lofty Market?

Dividend Stocks

How Cheap Should a Stock Be Before You Buy it?

Dividend Stocks

New to Investing? What Should You Invest in 1st?