THIS ONE-TIME INVITATION EXPIRES IN…

After helping a small group of Motley Fool Canada members achieve +100% annual returns last year…

David Gardner is finally BACK and inviting you to follow along — trade for trade — as he builds a BRAND-NEW portfolio for “maximum upside” in 2021 and beyond

If you are planning to invest in the stock market in 2021, I urge you to scroll below and…

Discover David Gardner’s proprietary “Blast Off Formula” that has 4xed the market across two different portfolios…

Learn how this unique formula drove David to buy Amazon at US$3.19 per share in 1997 and Netflix at US$1.87 per share in 2004…

And see how you can secure access to David’s brand-new portfolio-building service at 50% OFF the annual price!

Just don’t delay… because Blast Off 2021 was designed to serve a tight-knit community of individual investors, and this low price offer is available for a limited time only. In fact, this special invitation expires at midnight tonight. DON’T MISS OUT!

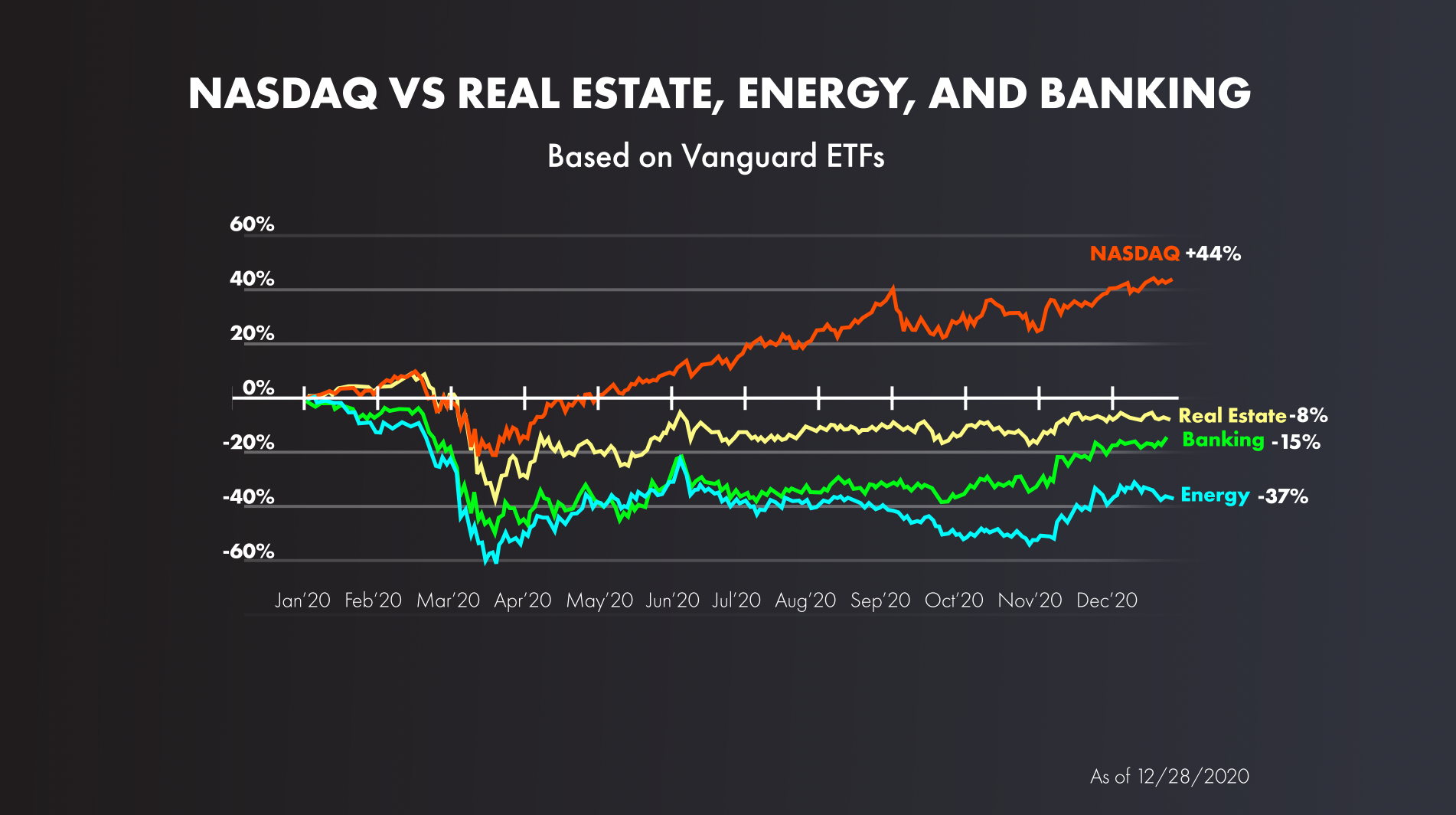

Dear fellow investor, If 2020 taught us anything as investors, it’s the value of having a plan. A plan for the unexpected. A plan for volatility. A plan to harness the opportunity created by massive disruption – and ride that wave of change to titanic profits. Because while there was a clear bifurcation in 2020 between the sectors that were winners and losers, with tech coming in on top while real estate, banks, and energy languished…

Chart refers to U.S. market.

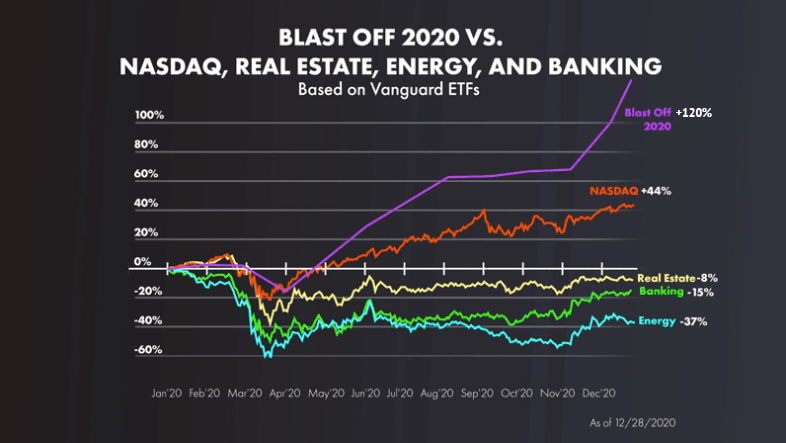

The REAL separation was between those who built and implemented a plan to target “maximum upside” and ride the wave of disruption to incredible profits… and those who didn’t. You see, a select group of Motley Fool members not only outperformed 2020’s losers… but every sector in the stock market. And it wasn’t even close.

Chart refers to U.S. market.

The secret to their success? It wasn’t loading up on risky options trades or using excessive leverage. It wasn’t a hot stock tip from their friend or the internet. (Nor was it riding the bitcoin rollercoaster.) Nope, it was much simpler than that: They followed Motley Fool co-founder David Gardner’s “Blast Off Formula” – the proprietary system that has enabled his team to beat the market by more than 4x…

Chart refers to U.S. market.

Now, our team here at The Motley Fool has spent months poring over the data from the COVID pandemic and its effects on the market and economy both in the U.S. and Canada, and we’ve come to two logical – and I believe, inescapable – conclusions. Conclusion number one: We need to face facts. The world is changing. Rapidly. Formerly “safe” sectors like energy, financials (yes, even the big banks), airlines, and real estate sank as the COVID pandemic swept across the world. While at the same time, tech stocks have been on an absolute tear as companies like Amazon and Shopify have opportunistically seized market share. We don’t believe this is a temporary “market rotation” that will reverse itself in the next year or two. We think we’re seeing the early stages of a permanent shift in consumption patterns. The rules of the game have changed. Old titans of industry are failing, and new winners are rapidly emerging. And we believe individual investors must adapt or risk getting left behind. Investors need a plan and a strategy for not just weathering or surviving this disruption – but harnessing its energy to profit from it. I’m talking about targeting “maximum upside” with some of the most ambitious and aggressive stocks on the market. Which brings me to conclusion number two: I believe that David Gardner’s “Blast Off Formula” is that plan, and I want to take just a few minutes of your time today to show you the evidence and explain why I believe every Motley Fool member who is serious about sustaining success in 2021 and beyond must consider adopting David’s investing approach. But before I explain why David and his team are so confident in their ability to continue beating the market as we enter the new, allow me to briefly explain how and why David Gardner agreed to even make his “Blast Off Formula” public…David Gardner is The Motley Fool’s #1 U.S. stock-picker, and it’s not even close. Just look at the numbers…

By now, you’ve probably heard a lot about David Gardner. His fully-verified two-decade track-record turns Wall Street and Bay Street fund managers green with envy. But don’t take my word for it. A 2016 independent analysis from Manifest Investing compared David’s track record to every single U.S. mutual fund listed by Morningstar with a trackrecord of 15 years. Here’s what they found:Morningstar identifies 1,404 mutual funds with 15-year track records. How many of them performed better than David’s Stock Advisor selections? ZERO. NADA. Goose egg.

118 U.S. stock recommendations that have gone up 5X or more in value.

61 U.S. stock recommendations that have gone up 10x or more in value.

30 U.S. stocks recommendations that have gone up 20x or more in value.

And that’s how David has built his incredible track record—not by being right more often than other investors, but instead by making more money when he is right. Because a single 10x or 20x stock can cover your losers many times over.

And that brings me back to the unusual challenge I issued to David two years ago. As the Vice President of Membership here at The Motley Fool, I have the honor of getting to speak to hundreds of Motley Fool members every year. And here’s something I hear from members all the time:“I know that David is an amazing stock picker—but haven’t I already missed the boat on his best stocks?”

I’m happy to report that Motley Fool U.S. members lucky enough to get in on the ground-floor with David and his team were able to profit from some of the best performing stocks of the past two years:

An emerging e-commerce powerhouse from Ottawa up 904%

A Dallas company transforming the way we meet people up 297%

An under the radar San-Francisco cloud company up 387%

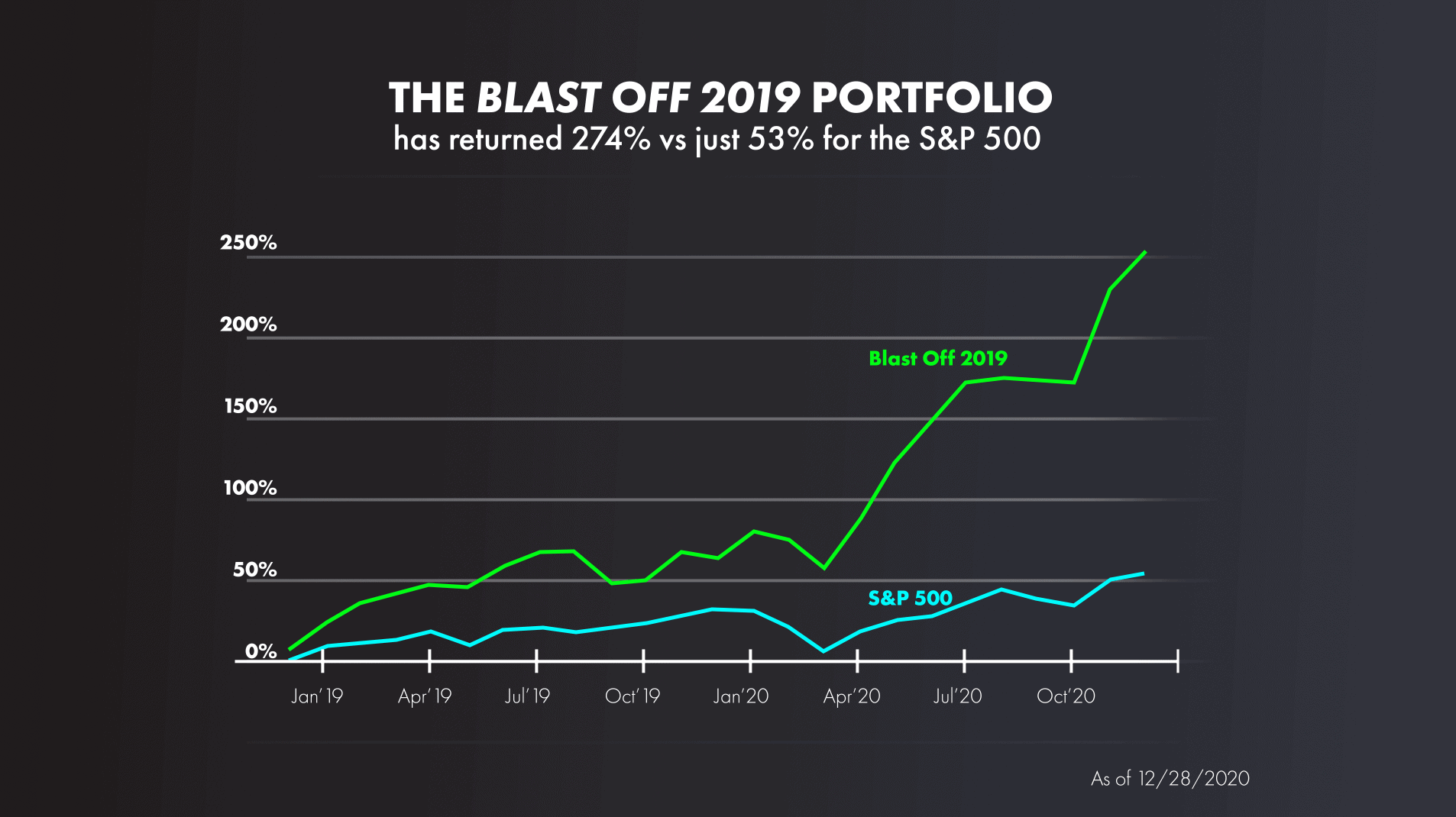

A tiny producer of security gear from Scottsdale up 224%

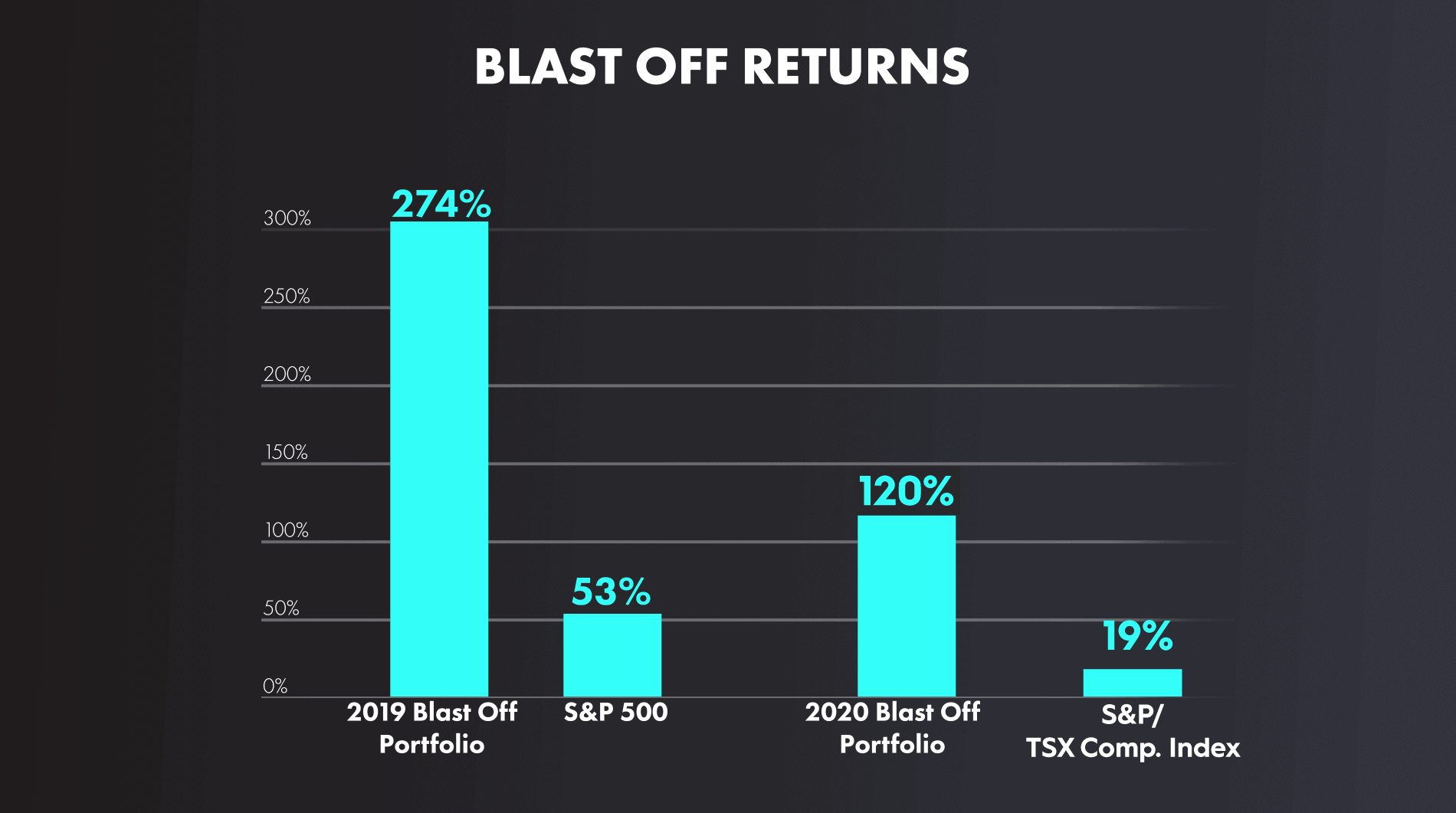

But there’s no need to cherry pick returns, the entire Blast Off 2019 portfolio has returned 274% — vs just 53.5% for the U.S. S&P 500 – in just 24 months!

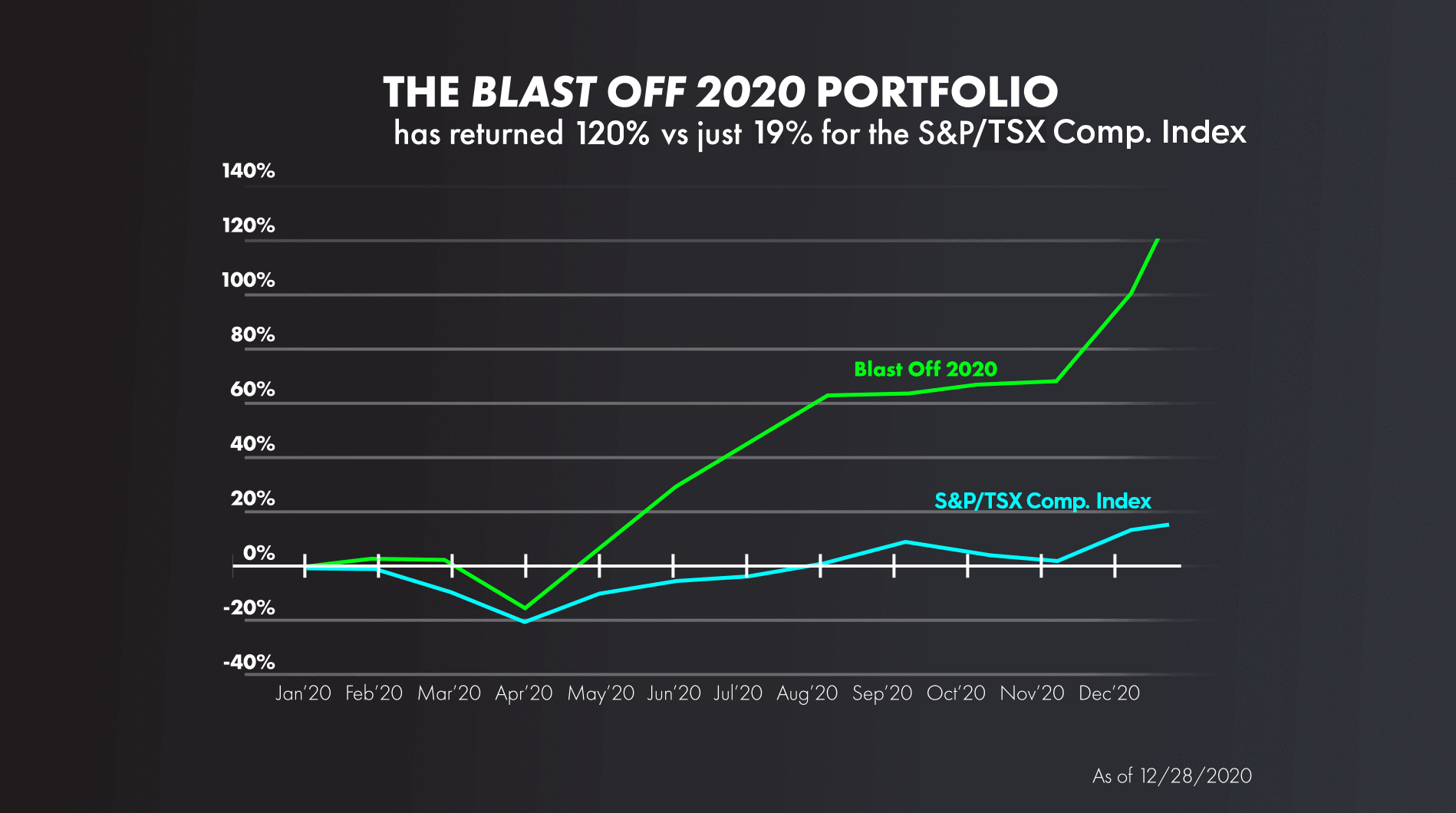

Chart refers to U.S. market.

And while the absolute performance of the Blast Off 2019 portfolio is astounding, perhaps more impressive is that ALL 24 U.S. stocks in the portfolio have made money. That’s right… Not a single stock in the portfolio has generated a negative return for investors! With returns like that, I would understand if some people reading this might think David and team just got “lucky” in 2019 and surely, they could not replicate that performance… Well, this is the part of the story where I tell you: In January 2020, David and his team took the exact same process and applied it to the timeliest opportunities they could identify in a new Blast Off 2020 portfolio… This time, offering membership to Canadian investors just like you. And just like the Blast Off 2019 portfolio, it handily beat the market last year: 120% to 19%.

Chart refers to U.S. market.

And again… With 100% accuracy.That’s right – literally every stock that David’s team recommended in Blast Off 2020 is up.

Same approach.

Same formula.

Two different portfolios.

Incredible results in 2020.

Now, if you are a long-time Motley Fool Canada member, you might recall receiving an invitation like this one to join and follow along with David’s Blast Off 2020 portfolio about this time last year. And frankly, if you opted to decline that invitation, I understand and don’t hold it against you!

I entirely understand waiting for David to prove out the “Blast Off Formula.” But what I don’t want to happen is for you to miss out on David’s team’s top “maximum upside” picks THIS year.Because after living through one of the wildest stock market years of our lifetimes, David and his team are now ready to do it all again…

The SAME “Blast Off Formula” for targeting “maximum upside”

The SAME extraordinary stock selection and vetting process

The SAME rigorous portfolio sizing and allocation approach

And they’ll focus all of their considerable firepower on TODAY’s newest and timeliest “maximum upside” opportunities – EXCLUSIVELY in the new Blast Off 2021 portfolio.

Now, I can’t predict whether David and his team will achieve 100%+ gains in 2021 as they did in 2020… And whether they’ll match the astonishing 100% accuracy they’ve managed to date… But if there’s one thing I’ve learned here at The Motley Fool, it’s that betting against David Gardner is a mistake.Blast Off 2021 is your rare “second chance” at discovering the portfolio formula that has delivered +100%+ returns just in the last year alone…

Just recently, our team here at Motley Fool Canada is happy to open the doors of this brand-new portfolio service created David Gardner and his analyst team to loyal Motley Fool Canada members like you. By launching a new portfolio, we cannot promise the same type of performance as these portfolios have had in the past, but we can ensure that our charter members are able to get in on the ground-floor with David and his team. And as you’ve seen, getting in on the ground floor with David and his team has been quite lucrative. As I just mentioned, the name of this new portfolio is Blast Off 2021. And just like Blast Off 2019 and Blast Off 2020 were designed to find the highest upside U.S. stocks of 2019 and 2020, respectively—Blast Off 2021 is designed to pinpoint the highest upside U.S. stocks of 2021 and beyond. I’ll tell you how you can unlock access to this new portfolio and see every stock they’ve selected in just a minute—but first I want to take a step back and explain the formula David and his team use to find stocks with 5x, 10x, and even 20x potential. This is the same formula David used to build his incredible track record. It’s the same formula he and his team used to build Blast Off 2019 and Blast Off 2020 —and it’s the same formula he and his team are using to build Blast Off 2021.The simple math that explains David’s “unfair” advantage

I promise I will share the exact method David uses to find his giant winners in just a minute, but first I want to show you the math that explains WHY David’s approach is so powerful. If you’re a math person, here’s the simple reason you shouldn’t be afraid to hunt massive upside stocks:Stocks you invest in have finite downside… because you can’t lose more than you invest.

Stocks have potentially unlimited upside… because you can potentially increase your initial investment by 10x, 100x, or even 500x (and I don’t mean to brag, but we have the track record to prove it).

And this simple idea is at the core of David’s insane record of success…The size of your HOME RUN investing winners will have a much bigger impact on your overall returns than will your stock-picking “batting average.”

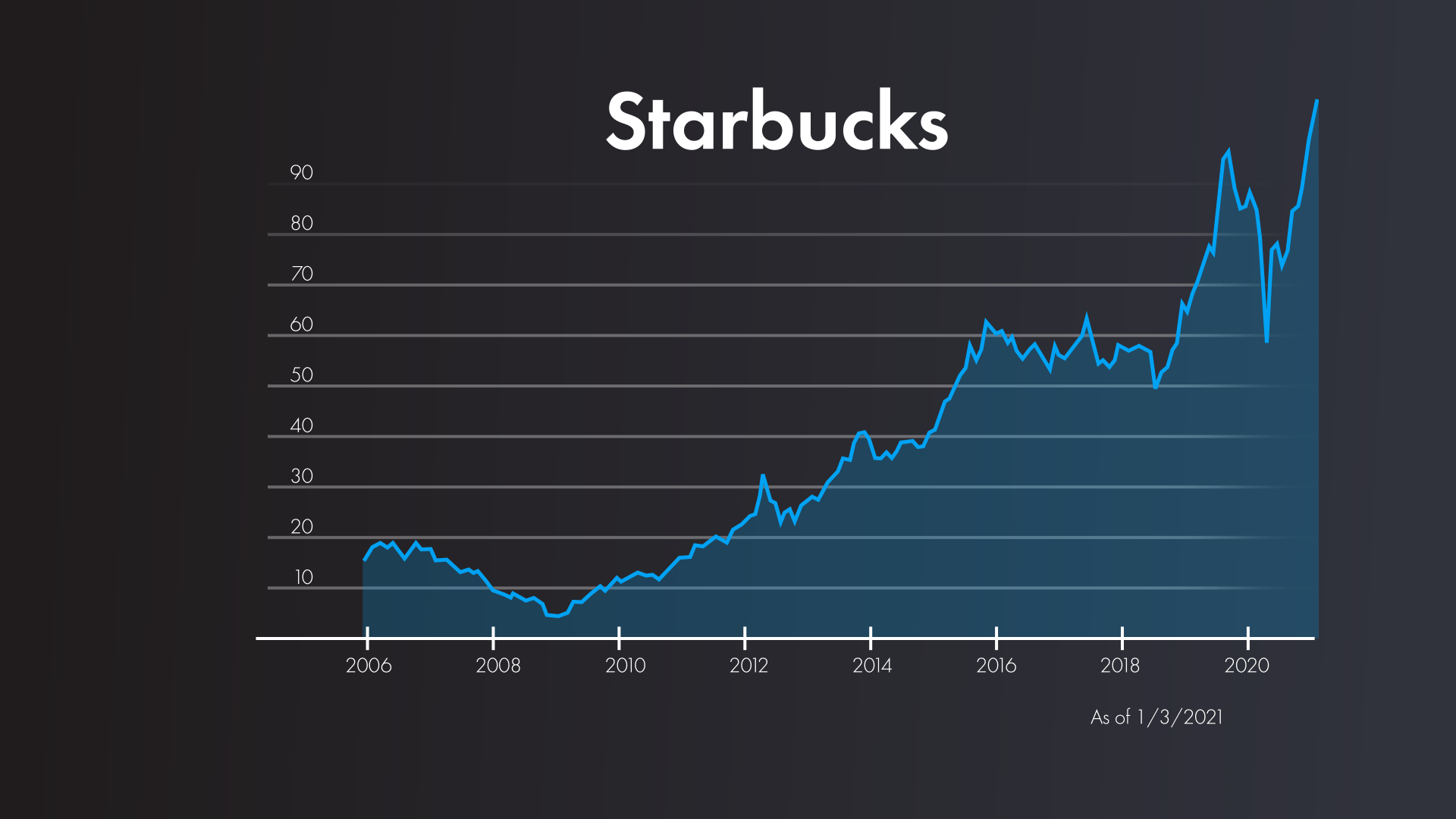

And that’s why David thinks you should spend less time worrying about whether you’re right all the time with your stock picks… and spend more time looking for stocks that can rocket to the moon. David’s contrarian investing approach has been baffling the naysayers for more than 25 years. When David founded The Motley Fool with his brother Tom back in 1993… the “smartest” investors in the ivory tower swore up and down that it was “impossible” for an individual investor to beat the market. David built the original U.S. Rule Breakers real-money portfolio back then to prove them wrong. Investors with enough foresight to listen to David’s unconventional approach then were rewarded with massive winners, like… A small coffee company from Seattle called Starbucks…

Chart refers to U.S. market.

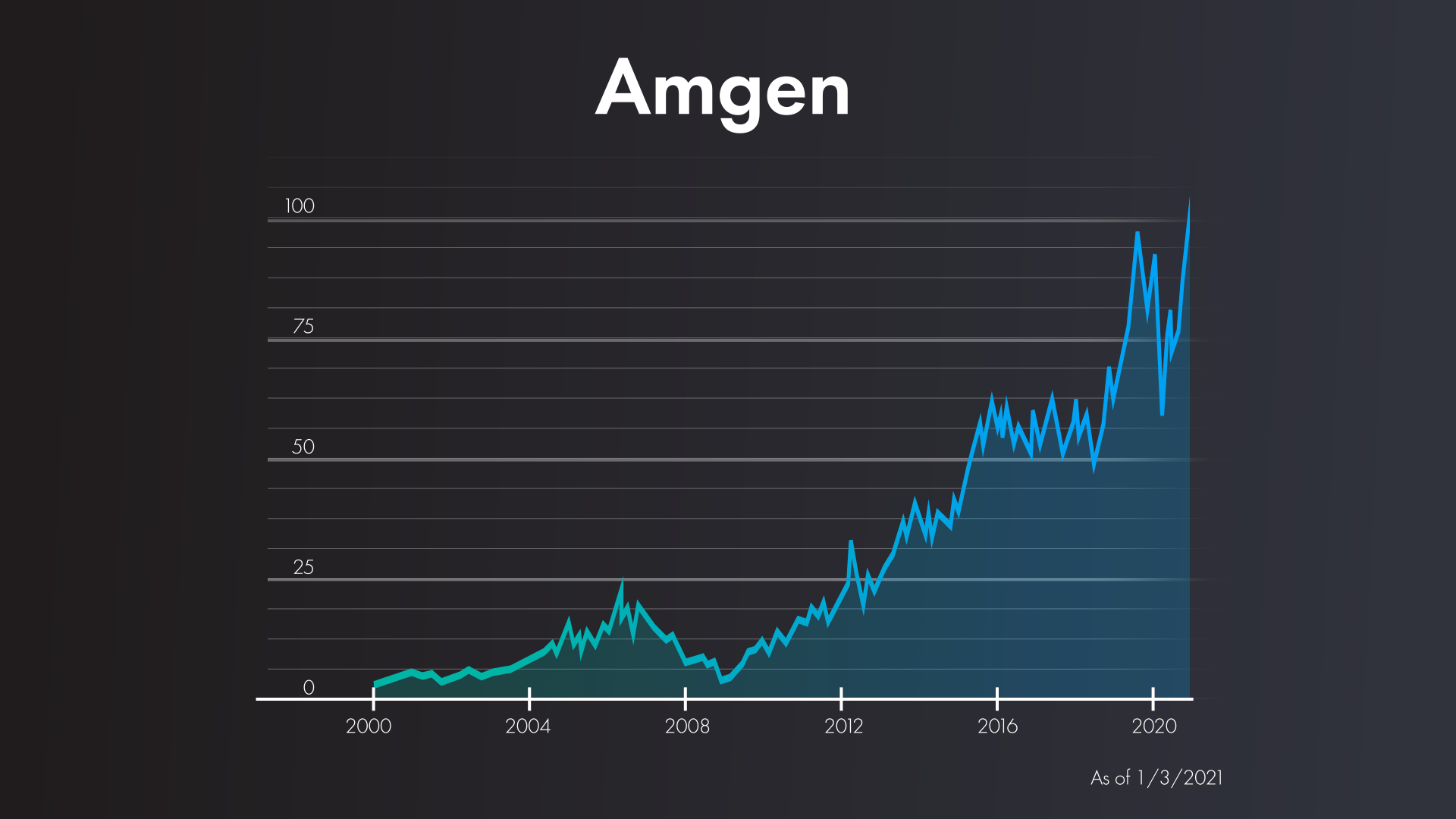

And Amgen, a biotech company that was changing the future of medicine…

Chart refers to U.S. market.

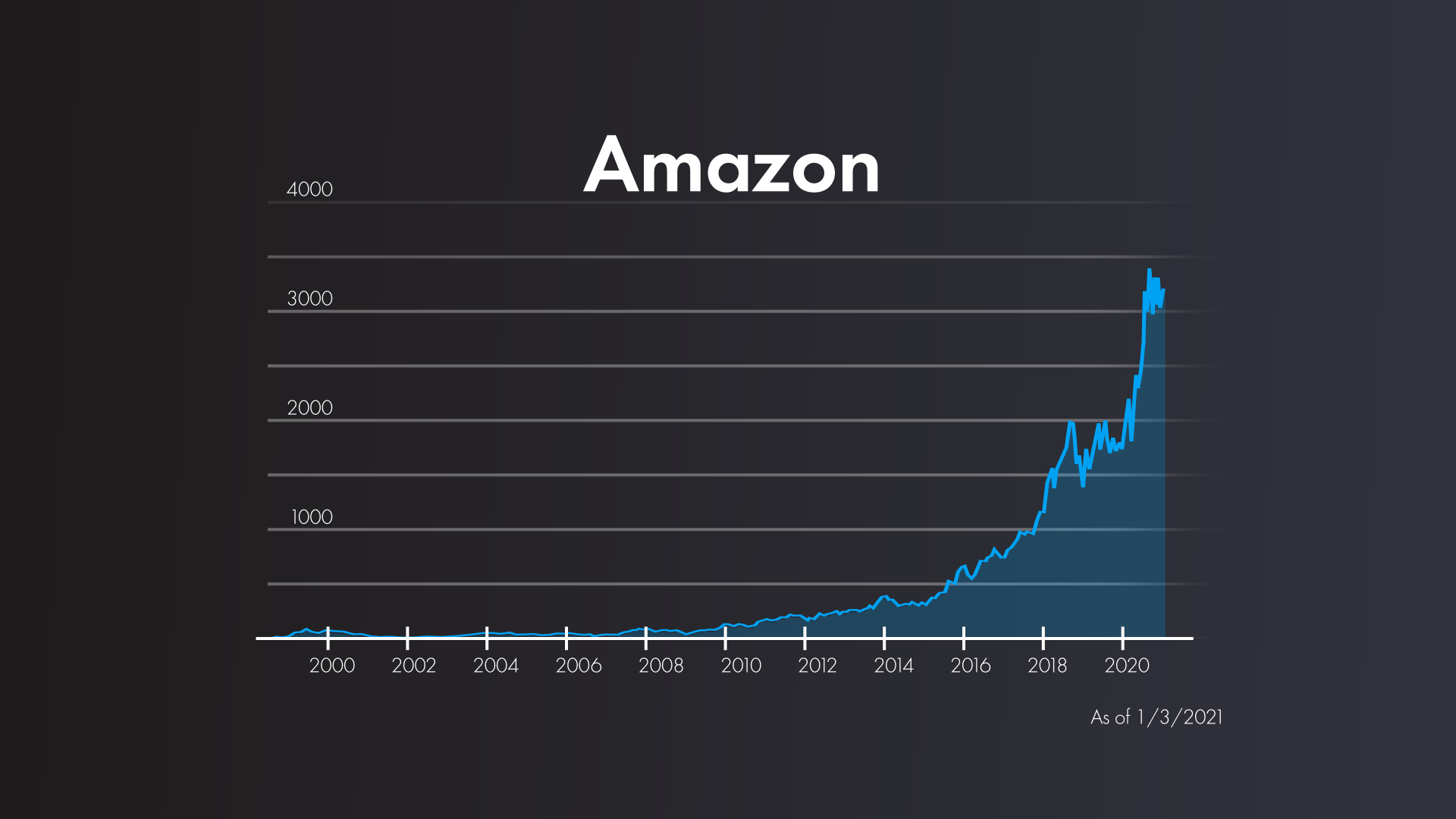

Now, David is always insistent that I bring up his losers as well as his winners, so I want to share a couple of examples that didn’t go well… And I think that is important for a couple of reasons. First, that’s just the kind of guy David is… he tells it like it is and lets the chips fall where they may. Second, taking big swings and missing is part of the point… If you are never missing with your stock picks, I bet you aren’t being aggressive enough to hit massive home runs either… after all, Babe Ruth led the American League in strikeouts five times! So here is one of the worst stocks David bought in the original Rule Breakers real-money portfolio. In June 1997, David recommended a small U.S. tech company called Innovex that eventually was de-listed… Now, most of David’s misses haven’t done as poorly as this stock… but I bring up this extreme example to illustrate the simple point that big winners more than make up for even huge misses. The best example of this fact comes from another company David bought just a few months after Innovex… I’m talking about Amazon, an online bookseller that eventually sold everything.

Chart refers to U.S. market.

Imagine for a second that you were one of the Motley Fool U.S. members who were following along with David in 1997 and 1998 in the original Rule Breakers real-money portfolio… If you had made 600x your money on Amazon, do you really think you’d be worried about losing a few thousand dollars because Innovex didn’t work out? I sure wouldn’t. Now, the naysayers said David just got lucky. “Anyone who bought Amazon back in the late 1990s would have monster returns,” they said… But David’s a pretty competitive guy… So in 2002, David agreed to start over from scratch… and David’s been picking one stock every single month for the past 18 years in our U.S. newsletter, Motley Fool Stock Advisor. The numbers don’t lie… David has proved again and again that his system finds massive winners… David’s Stock Advisor US picks have returned a mind-boggling 827%, versus just 113% for the S&P 500 over that same period. How did he do it?You guessed it… the same strategy… and it’s led to monster winners… companies like:

Apple, up 2554% since 2008

Activision Blizzard, up 5582% since 2003

Match Group, up 1,498% since 2016

Adobe, up 1,422% since 2009

Have there been misses along the way? Absolutely!

Again, that’s the point… if you are out there swinging for singles, you’ll never discover the next Amazon or Netflix.By consistently using the “Blast Off Formula” that he has developed over the past three decades, David has consistently found stocks that shoot up 5x, 10x, 20x or even more

When David and his team utilize this formula to build a brand-new portfolio from the scratch, there are four factors they look for. Now, not every giant winner includes all four of these factors —but if David and his team see a company that shares a couple of these factors, you might be looking at a stock with massive upside.

Chart refers to U.S. market.

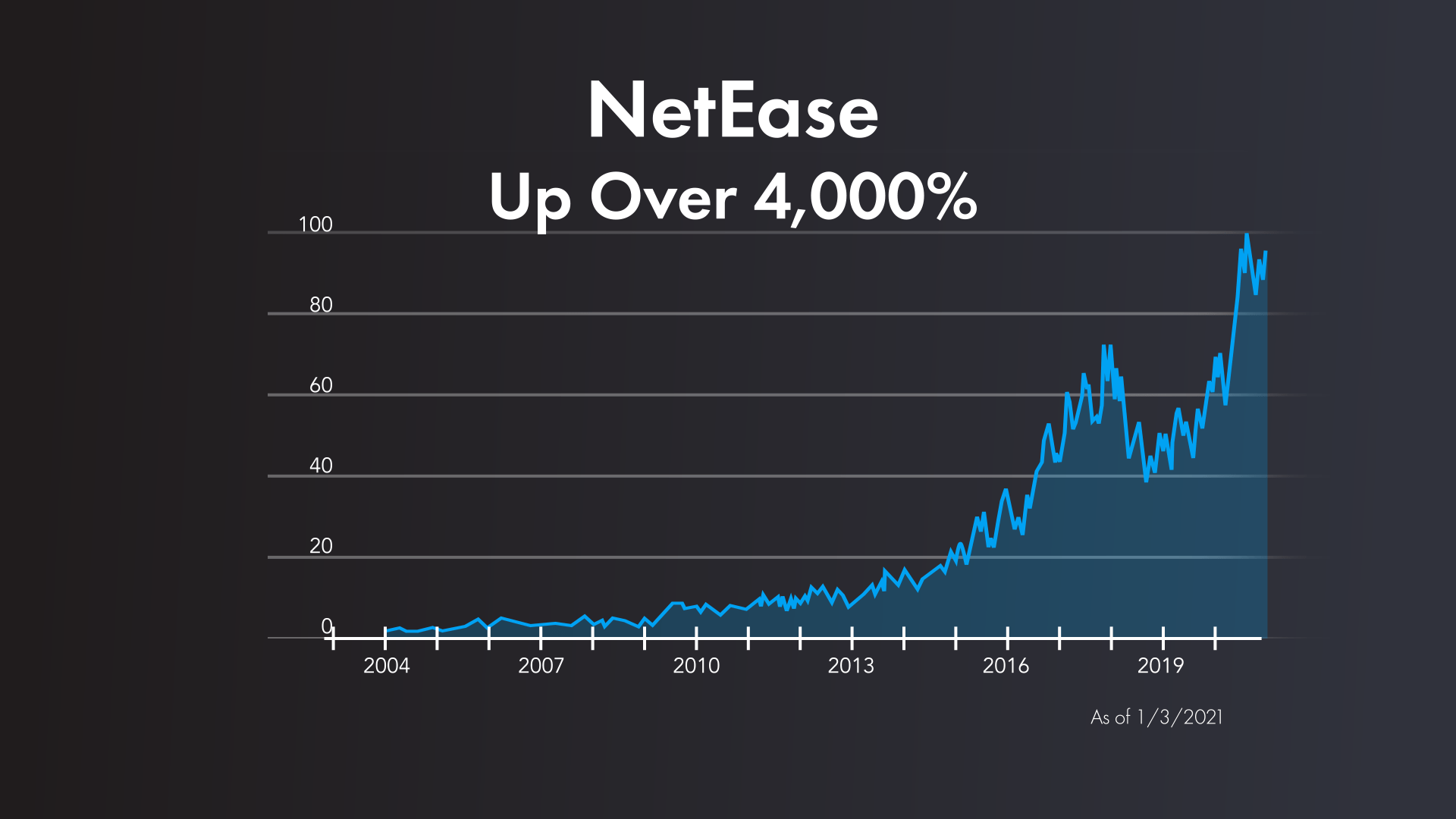

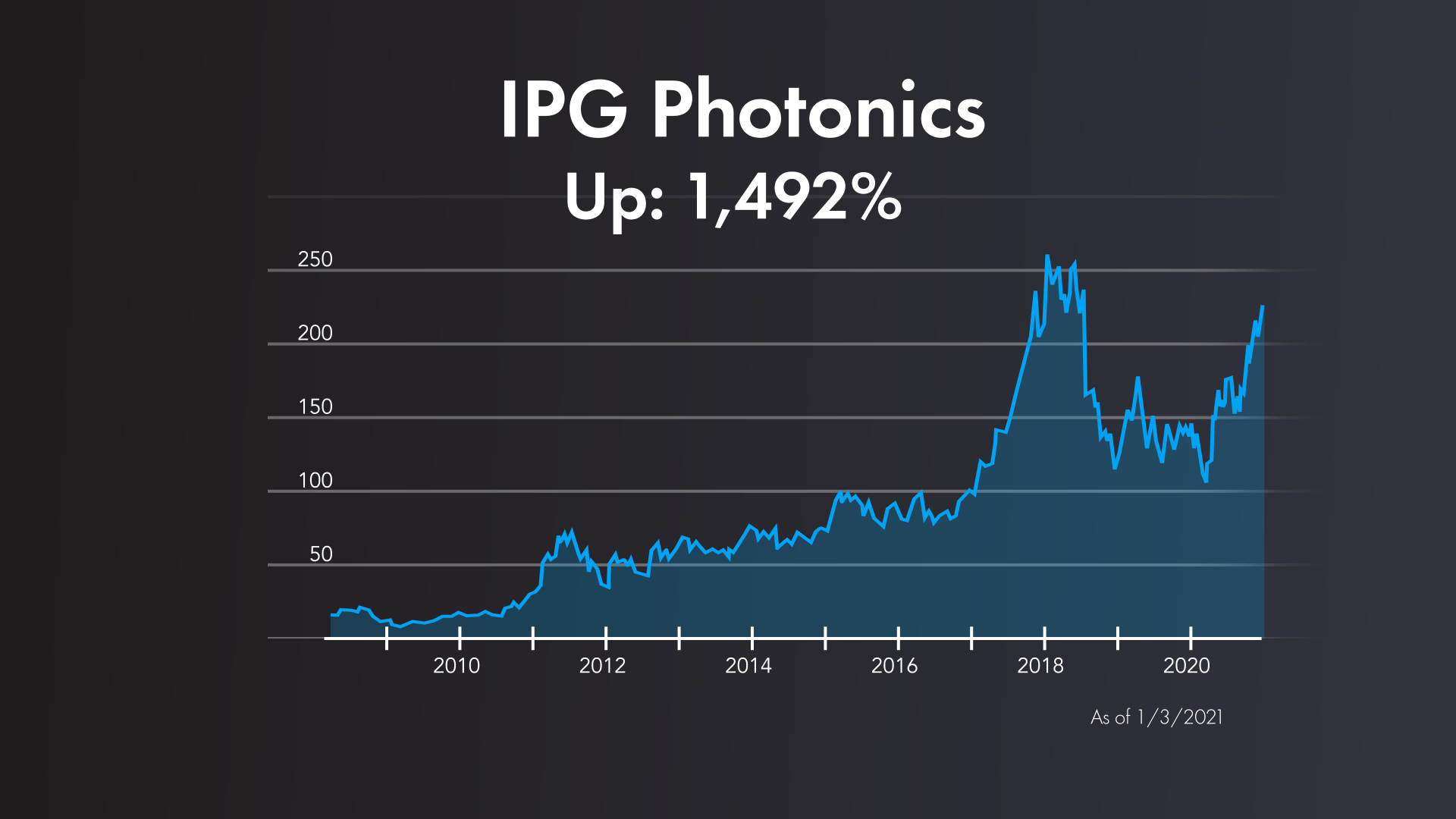

Or IPG Photonics… a company that had a market cap of only US$656 million when David first picked it in 2008… it has returned 1,492%.

Chart refers to U.S. market.

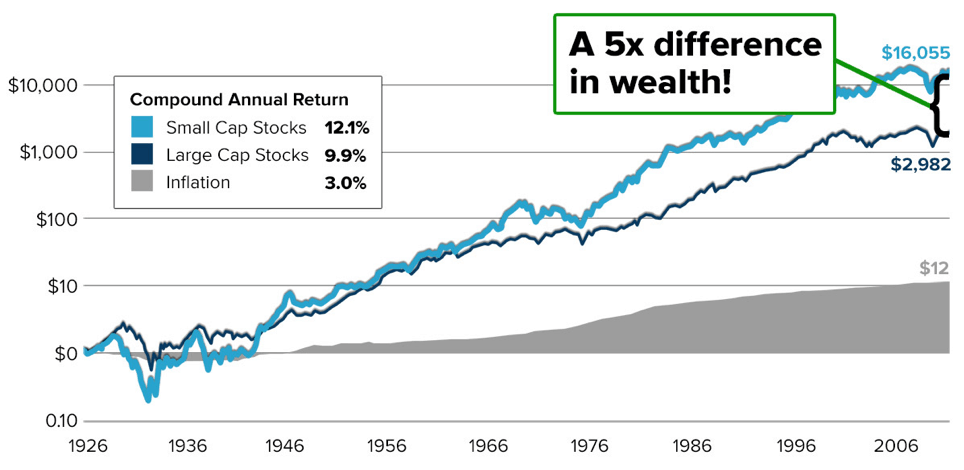

These are just a few quick examples, but here’s the bottom line: It is easier for smaller companies to generate the growth rates necessary send a stock soaring 5x, 10x, or even more. And industry analysis has confirmed this idea over and over again. The following chart shows the difference in performance between small caps and large caps over an 80-year period beginning in 1926.

Chart refers to U.S. market.

Many investors see this data and assume that when it comes to company size, smaller is always better. But it’s not really just the size of the company that matters. Some small companies do not have the potential to grow rapidly—and some mid-cap companies have a unique advantage that allows them to continue to grow rapidly and send their stock price soaring. And that’s a really key point for hunting stocks with huge potential. The company doesn’t necessarily need to be tiny—but the company needs to tiny relative to its market opportunity.. And that brings me to the second trait David and the Blast Off team look for in stocks for their portfolios.

Chart refers to U.S. market.

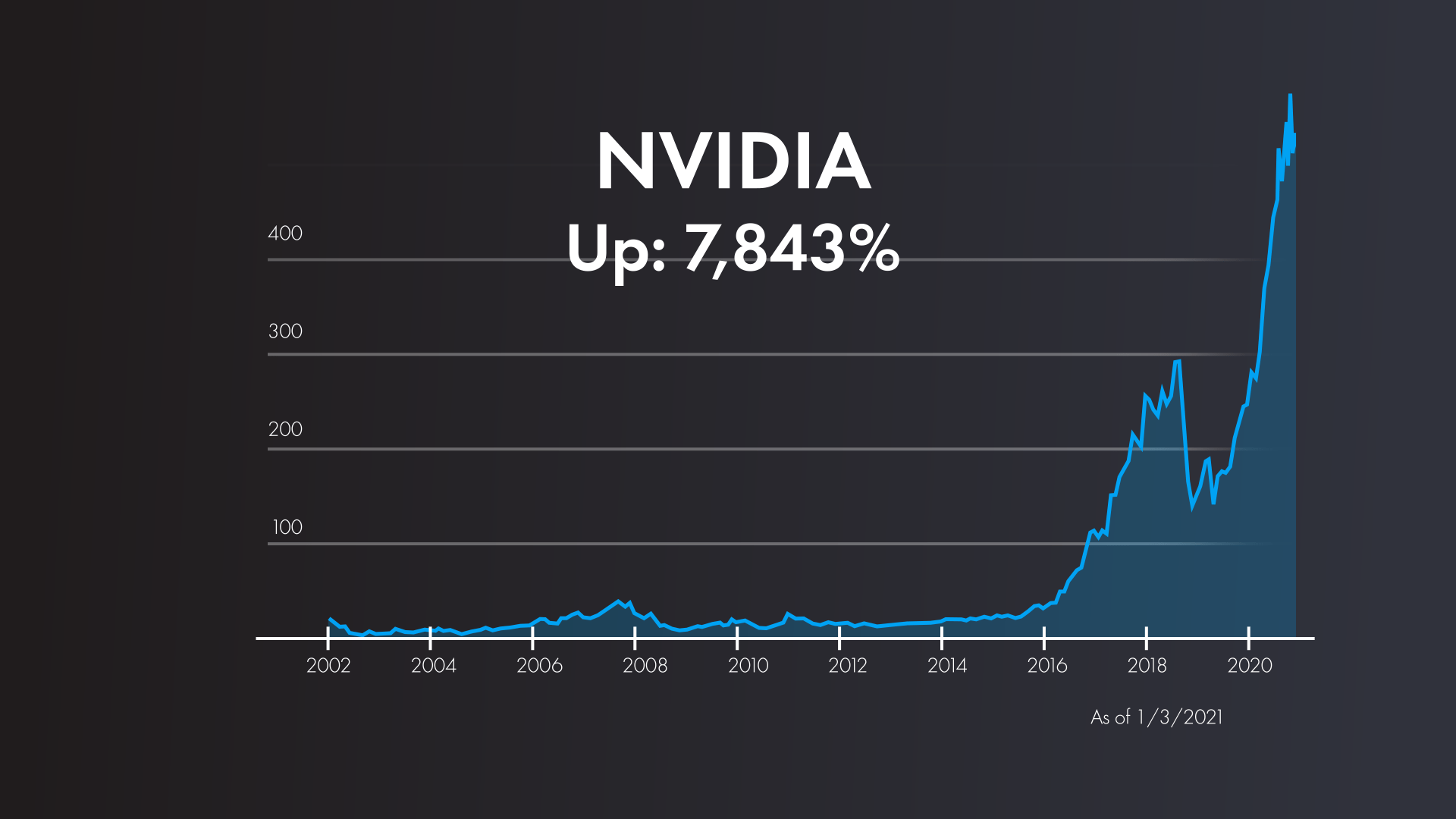

Nvidia has been one of the U.S. market’s top-performing stocks over the past 36 months. And one important reason is that Nvidia is at the forefront of the artificial intelligence boom. Allied Market Research projects that the artificial intelligence market will grow an average of 55% per year over the next seven years. And when you see those kind of industry growth rate numbers, you can expect that the companies that win are going to see massive stock returns. And that is exactly what you are seeing with Nvidia. How does a company take advantage of a massive market opportunity? It all starts with the person leading the company.

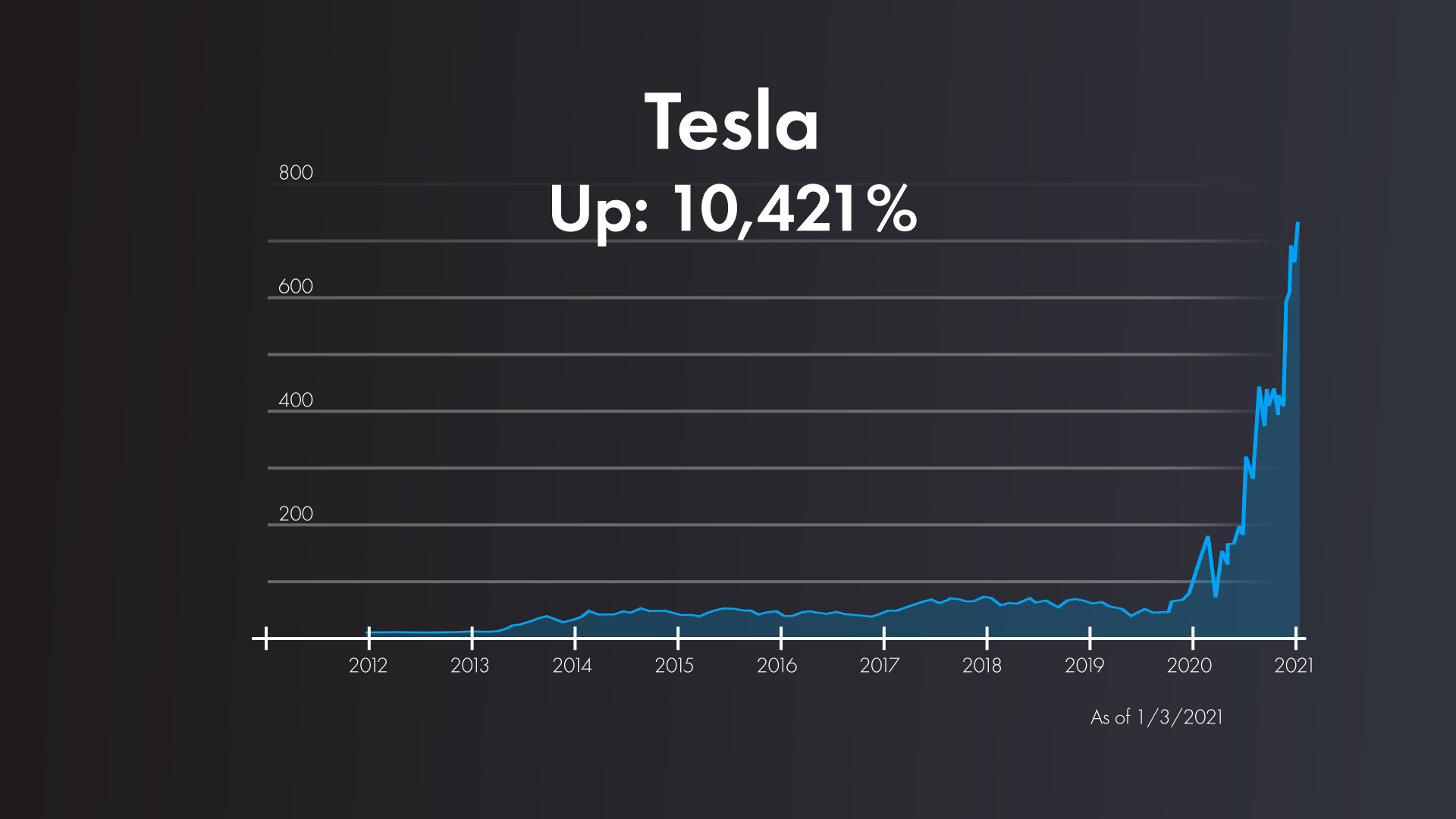

Here’s Bill interviewing Tesla CEO Elon Musk shortly after the company’s IPO.

Chart refers to U.S. market.

And then there’s Salesforce.com‘s outspoken founder, Marc Benioff. Back in 2009, when many critics saw a cocky rebel, David saw a dynamic CEO who was building a cloud computing powerhouse positioned to host every bit of corporate data that connects to the Web — and to disrupt Microsoft, SAP, and Oracle on its way to 3,128.6% returns. And who could forget two visionary founders behind The Motley Fool’s most rewarding U.S. investments of all time?… Of course, I’m talking about Jeff Bezos of Amazon and Reed Hastings of Netflix. Even though these two trailblazers are household names today, that was not the case 20 years ago, when David first personally met Jeff and Reed! Many investors wrongly believed Walmart would crush Amazon and that Blockbuster would surely squash Netflix. Luckily for investors who listened to our guidance, David understood why having the chance to invest in these up-and-coming entrepreneurs represented a life-changing buying opportunity. And get this — just like the small-cap research I shared above, independent researchers at Bain & Company confirmed investing solely in founder-led stocks within the U.S. S&P 500 would have grown your wealth 3x more than investing in non-founder-led stocks from 1990 to 2014. The data is clear. Time and time again, investors like David who can consistently identify the market’s most visionary leaders stand to be rewarded with market-crushing returns. And that’s why David and the Blast Off team always analyze a company’s leadership when searching for potential portfolio holdings within Blast Off 2021. And that brings us to the final (and perhaps most controversial) factor of David’s “Blast Off Formula.”

This might be the single greatest time ever to begin following David’s “maximum upside” investing approach

After missing the chance to follow the incredible gains from the previous Blast Off portfolios, today is your chance to start the new year with a powerful plan and get in on the ground-floor with a portfolio of “maximum upside” U.S. stocks chosen by our #1-ranked U.S. stock picker, David Gardner—and his hand-picked analyst team. That’s right! Because David is dead-set on helping dedicated Motley Fool Canada members like you achieve the highest possible gains in 2021 and beyond, he has personally signed off on an easy-to-follow portfolio-building solution entirely designed to help you position yourself to profit from his absolute-highest-conviction stock recommendations. And as you’ve seen—getting in on the ground-floor of a portfolio built by David and his team has been incredibly lucrative. If you had been one of the lucky ones to get in on David’s original U.S. Rule Breakers portfolio… David would have led you to massive winners like AOL (up over 100x), Starbucks (up over 25X), and Amazon (up over 600x). Now, you can’t go back in time and join David in his original U.S. Rule Breakers real-money portfolio — or even Blast Off 2019 or Blast Off 2020 for that matter — but I believe this opportunity could be even better. And the reason is simple — I believe David is a much better investor today than he was back in the late 1990s. And as proof, I’d just ask you to consider your own career. Were you better at your job after doing it for nearly 30 years than you were when you started? I’d be willing to bet you improved as you learned more, and the same is certainly true of David. He has been constantly perfecting his stock-picking method over the past 30 years… and that’s why I’m convinced that today is an amazing opportunity to get in on the ground floor of an incredible investing journey. Needless to say, this kind of opportunity is rare… Blast Off 2021 is just the second “maximum upside” portfolio we’ve made available in the entire history of Motley Fool Canada, and you’ve already seen how the earlier portfolios performed. When I was interviewing David about this latest portfolio solution, he explained that there is a difference between building a portfolio with the goal of “beating the market” and building a portfolio with the goal of generating “maximum upside.” If David’s goal is to beat the market, he will mix in a number of the “usual names” that may be somewhat larger companies with lower upside, but that are likely less volatile. If the goal is “maximum upside,” then David passes on the household names and looks for stocks that fit more of the factors in his “Blast Off Formula.” David built Blast Off 2021 with the goal of maximizing upside… and that brings up an important point. Blast Off 2021 is intended to help investors choose the stocks for the most aggressive 20%-50% of their portfolio. Blast Off 2021 does not have to replace an existing portfolio nor is it only meant to be a full portfolio solution that an investor would invest ALL of their money in. For this reason, Blast Off 2021 is not for everyone. If you get squeamish at the sight of a little volatility… this may not be the perfect solution for you. Similarly, we recommend members have at least $50,000 in their portfolios to get the most out of Blast Off 2021. That being said, if you are someone who enjoys devoting a portion of your portfolio to truly swinging for the fences… then we think you are going to love Blast Off 2021. Because with Blast Off 2021, you get The Motley Fool’s #1-ranked U.S. stock picker and his hand-picked team building their “maximum upside” portfolio. David is putting everything he’s learned over the past 30 years of investing… everything he’s discovered when finding the biggest winners in Motley Fool U.S. history… into building Blast Off 2021… so let me tell you a little more about this new portfolio.The moment you join Blast Off 2021…

You will instantly learn the names and ticker symbols of the team’s 10 favorite U.S. “Blast Off” stocks—you’ll also receive full in-depth research on each of these companies.

You’ll unlock access to 5-10 additional buy-alerts for each the next 3 quarters—so you’ll be among the first investors to learn the names of our newest stocks as soon as they are available.

You’ll have exclusive access to the team’s “stocks we’re thinking about” list—so you’ll have a sneak peek into stocks that may enter in the portfolio next.

You’ll receive quarterly live video chats updates from the team—so you’ll always know exactly how the team feels about each of these opportunities.

In just a moment, I’ll show you exactly how to claim one of the limited-time membership spots inside Blast Off 2021… And you can be sure that David has complete conviction in Blast Off 2021… because he is putting The Motley Fool LLC’s own investment capital behind each and every company in this portfolio.

The Motley Fool LLC decided to invest in each of these companies because we want to make sure we have “skin in the game” so you can feel confident that we are standing right beside you with these investments… but I have to come clean… there was also a selfish reason we decided to invest in each of these companies… Like I said, the first time David built a portfolio, he bought some of the biggest winners of the past 20 years… including AOL (up over 100x) and Amazon (up over 600x)… And if he has found another stock that turns every $5,000 invested into more than $3 million… there’s no way we are going to sit on the sidelines and miss out.Becoming a member of Blast Off 2021 costs a mere fraction of what you’d pay a professional portfolio manager

Given everything you’ve heard today, I’m sure you’ll appreciate the amount of time and research that goes into creating this type of portfolio-building service. After all, in addition to devoting his time to managing this real-money portfolio, David works with an all-star team of investors from across The Motley Fool to help members like you build the type of portfolio you deserve. Think about that for a second… If you want this level of expertise and research and most importantly, track record … practically the only other likely way you’d be able to get it is to turn over $1 million+ to a hedge fund to manage. And then you’d pay 2% of your total assets and 20% of your gains every year. Of course, while I’m convinced today’s invitation is a tremendous value, I’m sure you’ll understand why membership in Blast Off 2021 isn’t exactly cheap. But when you consider the performance generated from Blast Off 2019 and Blast Off 2020… and that you are getting access to a portfolio built by David Gardner and his team… and that this is only the second time we’ve ever offered membership to our Canadian Fools, I think you’ll agree that Blast Off 2021 is an incredible value. When we launched the Blast Off 2019 portfolio two years ago, U.S. Fools paid as much as US$3,999 for one year of unlimited access. And when you consider that the portfolio is already up 274%… you can see that Blast Off 2019 has already paid for itself many times over. For example, if a member paid $3,999 for access and invested $500,000 just as David and team instructed, they’d be sitting on a $1,320,000 profit – paying for their membership fee 341X over to be exact! While I doubt you’d argue with that math, David and the Blast Off team wanted to make sure as many members as possible had an opportunity to join them on this unique investing journey in 2021. For this reason, we offered annual charter memberships to Blast Off 2021 for up to $2,000 less than we did to U.S. Fools back in 2019! But today, I’d like to extend an even LOWER PRICE OFFER. Join now on a 6-month membership, and you’ll pay just $999! That’s up to 50% less than the annual price, and represents the sheer lowest price we can offer at this time. And when you consider the incredible historical returns we are talking about… I think you can see why this may be the best deal we have ever offered. And today is the perfect day to become a Blast Off 2021 member. Because the second you claim access to Blast Off 2021, you’ll be among the FIRST GROUP of investors who gain immediate access and learn the names of the first 10 buy alerts that David and his team have selected as their picks to maximize returns over the next 5 years. And even better, Blast Off 2021 will continue to build out over the rest of the year—you’ll get 5 new picks each quarter—so you’ll be able to put any new money to work for you right away. I’m extremely proud of the work that’s been done to make Blast Off 2021 the ultimate solution for investors to unearth what we believe could be the next round of skyrocketing stocks… And I hope you’ll join this incredible community we’ve created.But please do not delay your decision…for all the reasons I’ve just shared with you, this opportunity is strictly time-limited.

This special invitation expires at midnight tonight.

Here’s to growing wealthy… together,

David Hanson

Vice President of Membership

The Motley Fool

David Hanson

Vice President of Membership

The Motley Fool

Returns as of 12/28/2020 unless otherwise stated. S&P500/TSX Composite returns as of 12/28/2020 unless otherwise stated. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. Fool contributor David Hanson owns shares of Activision Blizzard, Amazon, Apple, Match Group, McDonald’s, NVIDIA, Shopify, and Walt Disney. David Gardner owns shares of Activision Blizzard, Alphabet (A shares), Alphabet (C shares), Amazon, Apple, IPG Photonics, Match Group, NetEase, Netflix, Starbucks, Tesla, and Walt Disney. Tom Gardner owns shares of Alphabet (A shares), Alphabet (C shares), Netflix, Salesforce.com, Shopify, Starbucks, and Tesla. The Motley Fool owns shares of Activision Blizzard, Adobe Systems, Alphabet (A shares), Alphabet (C shares), Amazon, Apple, IPG Photonics, Match Group, Microsoft, Netflix, NVIDIA, Salesforce.com, Shopify, Starbucks, Tesla, and Walt Disney. Motley Fool Canada owns shares of Shopify.

Blast Off 2021 includes all U.S. stocks. All billing is in CAD. You will be billed according to your choice below and then $999 for six months thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to membersupport@fool.ca, and we’ll get back to you ASAP!

By submitting your order, you are agreeing to our Subscription Terms of Service and Privacy Policy.