Wish you bought Netflix in 2007, Amazon in 2002, or Nvidia in 2005? The Motley Fool is once again zeroing in on rapid growth potential in…

2024: The Year of the NEXT “Inflection Point” Stocks

Many transformative stocks can lay dormant for years before an “inflection point” triggers EXPLOSIVE growth – and rewards opportunistic early investors with as much 174X, 199X, and even 303X gains.

Time and time again, The Motley Fool has been able to research and help spot these inflection points, alerting investors to some of the most transformative stocks of the last two decades, including Netflix, Amazon, Nvidia, Salesforce, Tesla, Apple, and many more…

Using the same rigorous process historically used to help identify inflection point opportunities, Motley Fool analysts have now spotted 10 top stocks potentially on the verge of an inflection point in 2024!

Fair Warning: Hurry… Today’s Early Bird offer to gain immediate access and lock in the LOWEST price expires tomorrow at midnight!

Dear fellow investor, If you’re looking to ease into 2024, this opportunity may not be for you. However… If you ever wished you could go back to 2007 when Netflix made its game-changing move into streaming… Completely transforming the entertainment landscape… And delivering a +17,480% return for investors since The Motley Fool’s recommendation that same year…

Chart refers to U.S. market.

Or you wish you could go back to just before Amazon transformed e-commerce with AWS in 2006… Launching a cloud computing revolution that would redefine the internet… And delivering a phenomenal 19,990% return to Amazon shareholders since The Motley Fool’s early recommendation…

Chart refers to U.S. market.

Or you wish you could go back before Nvidia went ALL IN on artificial intelligence almost a decade ago… Enabling the AI revolution… And propelling staggering 30,291% gains since The Motley Fool first recommended the stock in 2005…

Chart refers to U.S. market.

I have good news. Because if you missed out on any of those monster stocks in the past – don’t beat yourself up. Instead, consider this: Many of these transformative stocks lay dormant for years before their EXPLOSIVE growth. Then, suddenly they reach an “inflection point” – and their trajectory completely changes. The most powerful inflection points can even create entirely new markets – or at least monetize an existing market in a way no one else has. These pivotal moments often happen when a company makes a big, bold move that changes its trajectory in a major way. This pattern isn’t uncommon – and if you can find a way to position a portfolio BEFORE a major inflection point, even a single stock can deliver truly transformative gains:A single US$20,000 investment when the Motley Fool recommended Netflix right before its streaming inflection point would be worth US$3.5 million today.

The same US$20k amount invested in Amazon before its AWS inflection point would be worth more than US$4 million dollars today.

And US$20,000 invested in Nvidia around the time they went all-in on AI would be worth an incredible SIX million US dollars today.

But here’s the thing… Just because a company makes a big announcement doesn’t mean it’s automatically an inflection point and their stock is about to rip. There are moments that seemed like they should have been inflection points… but weren’t. Which is why we’ve studied inflection points at the Fool for years. From where I sit, that’s what sets The Motley Fool apart: our ability to help spot these game-changing moments. And while past performance doesn’t guarantee future results… As our co-founder David Gardner says: It’s a pretty strong hint! But let’s also be clear: As powerful as inflection points can be it took a lot of guts and conviction to hold on through all the ups and downs to get to those returns. So, let’s turn to some past inflection points – and what it means for investors like us who are looking to target future inflection points. Put simply…Inflection points are pivotal moments followed by RAPID growth

Here’s one inflection point that’s quite easy to pinpoint: It was triggered by Apple’s most famous invention ever, and certainly its most commercially successful thus far – the iPhone. Now, not long after the iPhone was released in 2007, the Motley Fool recommended Apple to Stock Advisor US members and wrote…“Apple’s presence in the mobile device market is bound to explode, delivering even greater spoils to the bottom line”

Chart refers to U.S. market.

+4,370% returns. For me, a number that huge is difficult to visualize, so let’s make it more concrete. Had you invested US$20,000 in Apple the day they announced the first iPhone, and held all the way through to now, that $20,000 would have grown to about US$890,000. And members who followed The Motley Fool’s Apple recommendation early in 2008 were able to capture almost all of those gains. But let’s not forget – the iPhone had plenty of skeptics when it came to market. One Bloomberg commentator wrote it will only “appeal to a few gadget freaks” and “in terms of its impact on the industry, the iPhone is less relevant.” What this shows to me is… When it comes to inflection points, it takes more than just experience and careful analysis to capitalize on them. It also takes guts. At the Motley Fool we’ve proven more than once we’re willing to go against the grain and trust our analysis. Just like we saw with Apple – likely minting more than a few fortunes for Motley Fool members in the process, I’m sure! Now, Apple and the iPhone is a famous example – but it’s far from the only one The Motley Fool has alerted members to.The same pattern played out with Netflix’s streaming inflection point…

And speaking of guts – what’s interesting is that Netflix also had a lot of skeptics when it was first recommended to members. That was all the way back in October of 2004 – and that initial recommendation has done incredibly well – it’s up a whopping 21,119%.

Chart refers to U.S. market.

But here’s the thing… Almost all of those gains are the result of the RAPID growth following Netflix’s inflection point in January of 2007: As you may have guessed, that’s when Netflix introduced video-on-demand – transitioning from its original DVD rental-by-mail service to an online streaming platform. And in fact, The Motley Fool recommended the stock again right around that time. I’ll just read a short excerpt from that recommendation here, because it’s quite eye-opening:Video-on-demand is fast approaching, and Netflix’s successful direct mail model generates the cash necessary to fund its investment in this area. Because Netflix doesn’t rely on bricks-and-mortar stores to drive its business (…) it can more nimbly adjust to the growing demand for online streaming and downloading.

Chart refers to U.S. market.

But most importantly, Netflix’s streaming inflection point led to that incredible 17,480% gain since our recommendation, shortly before it happened.

Chart refers to U.S. market.

Of course, achieving those gains also meant holding on to the stock for 15+ years, enduring periods of volatility, including large drawdowns at times. (Folks might remember the Quikster debacle in 2011… The company lost nearly 70% of its value over 18 months) And while it required patience, resilience, and a long-term vision… It highlights the immense potential when we identify and act on these pivotal moments – turning insightful analysis into truly extraordinary investment success. Just plug in some real numbers and you’ll realize that a US$20,000 investment in Netflix on The Motley Fool’s 2007 recommendation would have ballooned into a small fortune worth, get this… US $3.5 million. I think you’re starting to see the pattern here:Many of the greatest winners in investing history have seen incredible inflection points – a sudden moment when growth accelerates, the stock skyrockets, and early investors make bank.

Now in the interest of time, I won’t go into as much detail with each one of these next examples – because, frankly, I can’t cover them all but… One stock I want to highlight is Salesforce (NYSE: CRM). Motley Fool Rule Breakers US recommended the stock on January 21st in 2009 – just about ONE MONTH before Salesforce hit its inflection point in late February that same year. You see, that timing perfectly coincides with CEO Marc Benioff announcing a major strategic shift, positioning Salesforce as “the enterprise cloud-computing company.” What that meant is essentially that Salesforce no longer went after small and midsize companies – but decided to challenge legacy enterprise software providers head-on with their cloud-based systems. That bet paid off for Salesforce – and its shareholders. Rule Breakers US members who followed the Fool’s guidance at the time and held on to their shares are looking at a 3,735% return.

Chart refers to U.S. market.

A US$20,00 investment in Salesforce at the time would be worth more than three-quarters of a million US dollars today. Nothing to sneeze at, that’s for sure. Then there’s Amazon. When you look at the stock’s price chart from around 2001 to 2013 you can clearly see its inflection right around 2006.

Chart refers to U.S. market.

What happened? That’s when Amazon officially launched AWS – its cloud infrastructure platform. But the truth is, Amazon had been working on an infrastructure platform long before that. In fact, Amazon CEO Andy Jassy has gone on record and revealed the “Infrastructure as a Service” arm of Amazon was launched with little fanfare around the year 2000. And I gotta say… This is another PRIME example of the kind of inflection point opportunities we live for here at the Motley Fool because… Following these businesses as closely as we do here, Motley Fool analysts wrote as far back as the 2002 Stock Advisor Amazon recommendation that…“The Services division will represent increasing potential as Amazon works with retailers like Target (coming online with Amazon this quarter) and others to run their e-commerce for them.”

And that’s not even the BIGGEST inflection point The Motley Fool has alerted members to!

Because that would be Nvidia. What’s interesting about Nvidia’s journey is the prolonged period of anticipation and patience before the dramatic inflection point. For years, the stock appeared almost dormant, with little to suggest the impending surge. Early investors who recognized Nvidia’s potential had to maintain a steady course, often facing the challenge of staying invested through seemingly uneventful times. Now, The Motley Fool recommended Nvidia in Stock Advisor US as far back as 2005. Then again in 2009. And again in 2017. Here’s what’s amazing. That first recommendation is now up a staggering 30,291%.

Chart refers to U.S. market.

The next recommendation 4 years later naturally had less room to grow. But still, it’s up a massive 12,758%.

Chart refers to U.S. market.

And even the 2017 recommendation is up an incredible 1,835% – that’s still 19X your money.

Chart refers to U.S. market.

Needless to say, each of those recommendations made investors who followed our recs a small fortune – or actually a pretty sizable fortune! And while those Nvidia recommendations were based on various strengths, not solely AI, the company’s AI inflection point significantly amplified its growth potential. Just take a guess which of those recommendations came AFTER Nvidia’s inflection point… Because that happened in April of 2016 when Nvidia officially went ALL-IN on artificial intelligence. We’ll put it on the screen again and you’ll see it clearly:

Chart refers to U.S. market.

That’s precisely when Nvidia delivered a new chip that provided a massive performance leap, specifically for AI applications. Here’s that announcement:“NVIDIA Delivers Massive Performance Leap for Deep Learning, HPC Applications With NVIDIA Tesla P100 Accelerators”

— (Nvidia, April 2016)

By analyzing the key elements that have historically marked these transformative moments, we can better identify potential FUTURE inflection points.

Or as Motley Fool co-founder David Gardner so eloquently put it:“In looking back over the tapestry of our investment lives, we should examine the most beautiful threads—our best successes—and look for recurring traits.”

— Motley Fool co-founder, David Gardner

Chart refers to U.S. market.

And the stock is up a mere 10%. From where I sit, Meta’s “should have been” inflection point was missing one of the three key components of our “Inflection Point Formula” – a specific set of traits virtually all inflection points share in common… And over the years we’ve gotten pretty darn good at pinning those traits down! I don’t say this to brag, either. It’s simply based on The Motley Fool’s combined investing experience and track record over the past 30 years. And you’ve seen it with your own eyes today. Of course, sometimes we swing and we miss, too. But when it comes to identifying huge inflection point businesses, I’d frankly put the Fool’s record up against anyone’s. Tesla is another one we haven’t even mentioned yet. Frankly, I can’t mention them all – simply out of respect for your time. But The Motley Fool did also accurately predict that Tesla’s launch of the Model S would be transformative: Just six months before that specific event, Fool analysts wrote in an initial November 2011 recommendation that…“The 2012 launch of the Model S, a premium sedan, will transform the company and move it toward profitability”

Chart refers to U.S. market.

Since then, Tesla’s Model S inflection point has resulted in another 120-bagger for members who followed along. Turning every US$20,000 invested into almost US$2.5 million in extra wealth. Again, we simply don’t have time to mention every single inflection point we’ve been able to pinpoint here, but… After extensive research and analyzing the most impactful inflection points of the past, we’ve been able to boil our approach down to a precise formula. We’ve distilled it down to THREE key components. Each one is critical in pinpointing those rare stocks poised for explosive growth. But more than just theory, in a moment we’re also going to show you how this formula translates into real action – and how we’re targeting the top stocks poised to reach their inflection point in 2024. Now, the first component is…Inflection Point Factor #1 –

Market Readiness

Inflection Point Factor #2 –

Breakthrough Potential

Inflection Point Factor #3 –

Generational Growth

Chart refers to U.S. market.

You can see it clearly… Another inflection point! This time when Netflix introduced its original programming in June of 2013. And once again The Motley Fool was able to alert members right on time. Another BUY alert came out on June 21st, writing that when you… “Add to the mix its original programming — something no competitor can precisely duplicate (…) Netflix has a wider moat than many believe it does.” Granted, Netflix’s original programming inflection point wasn’t as impactful as the first – but still good for an impressive +1,479% return. Especially considering Netflix had grown significantly since back in 2007 when it introduced streaming. Or look at Apple. After the iPhone, they didn’t stop. They kept innovating with the iPad, then wearables. Each one, an inflection point in its own right. Same deal with Nvidia. First they dominate gaming… then AI. You get the point. Stocks that capitalize on inflection points don’t just do it once – they KEEP WINNING. It’s this kind of sustained growth that can turn an ordinary investment into a legacy-building, generational wealth creator. We didn’t just make that up out of thin air, either. It’s based on the EXTENSIVE research into some of the most transformative inflection point opportunities over the past three decades.So how can investors target the NEXT potential inflection point opportunities in 2024 and beyond?

We’ve seen how powerful inflection points are – and how they’re single-handedly responsible for minting countless millionaires over the years… Now, of course, we’ve had our fair share of misses as well. For example, we thought 3D printing would have led to an inflection point by now. But so far that hasn’t played out. That’s okay, though. When you swing for the fences with these inflection point opportunities, you’re bound to strike out sometimes, but it’s those big hits that make the risks worthwhile. And you’ve seen the Motley Fool’s track record when it comes to identifying inflection points firsthand… So how can members put this into ACTION in 2024? Well, one way, of course, would be to go out on your own and look for stocks with a potential inflection point on the horizon. Considering there’s something like 3,700 publicly traded stocks in the U.S. alone… You’d have to spend weeks, if not months combing through the 10-Ks of all those companies. Even if you somehow had the time, would you have the confidence that you’d isolate the exact right companies that have the makings of an inflection point opportunity? It’s a daunting task, requiring not just time and dedication but also an enormous amount of EXPERIENCE to accurately analyze the market readiness and breakthrough potential of dozens of businesses. The good news is… Our top analysts have done all that heavy lifting for you!Introducing…

“Inflection Point Opportunities 2024: Ten Top Stocks to Buy Now”

We pulled together our top analysts across the entirety of The Motley Fool and asked them to pinpoint the biggest inflection point opportunities in the market right now. And now, I’m excited to introduce the result of that EXTENSIVE research in a brand new investor report today called, “Inflection Point Opportunities 2024: Ten Top Stocks to Buy Now”.

“Past performance may not guarantee future results – but it’s a pretty strong hint.”

Let me give you a little preview…

We searched far and wide across industries like finance, tech, media, sports, consumer electronics, real estate, and more to identify some of the BIGGEST potential inflection point opportunities on the horizon, including:An Ultra-Sticky Brand Ready to Expand:

Specifically, by tapping into a MASSIVE new category projected to be worth US$126 billion by 2032. That would be more than doubling their current addressable market – which sits at US$90 billion. And with only 2-4% of its current market potential currently realized, the stage is set for an explosive growth period. What’s more, this renowned electronics brand boasts incredible customer loyalty. That stickiness, combined with a full product upgrade cycle in 2024 in addition to that expected expansion into an entirely NEW category is why we expect 2024 to be a major inflection point.

A Pioneer in Next-Gen Therapeutics:

Remember how Apple virtually launched the “smartphone era” overnight with the release of the iPhone? Well, this trailblazer just took a significant leap for the future of medicine – thanks to a recent US FDA approval just last December (so, less than 1 month ago!) signaling a new era in health care. For investors it represents an EXTRAORDINARY opportunity at a critical inflection point. With US$170 million in revenue over the past 12 months, the business has tapped less than half of one percent of the market’s growth potential by 2032! In other words, independent experts project the total addressable market to be more than 483 times BIGGER than the company’s current revenue. With just a US$4.9 billion market cap, that’s a lot of room to grow.

The Rising Star in the Trillion-Dollar Space Frontier

Because while it may sound like science fiction… Here are the facts: The space economy is growing at an EXPONENTIAL rate and is projected to reach US$1 trillion by the year 2040. It’s already worth half a trillion dollars TODAY – and has seen a 91% surge over the past decade. Some experts believe it could even reach a staggering TEN trillion dollars by 2050 – bigger than the economies of Canada, Germany, and the United Kingdom… combined. Of course, that’s still a long way out – so why do we think this stock will reach its inflection point as early as 2024? Simple… The market is ready, signaling strong demand for a new launch program that’s scheduled to blast off this year, according to the CEO. And the company just signed a huge deal, confirming the market seems READY. This rising star sits at a mere US$2.3 billion market cap.

And that’s just a small preview! Most importantly… Remember that, based on our research, we think almost ALL 10 of the stocks in this exclusive new report have a potential inflection point we believe is just around the corner.Want to secure YOU copy of “Inflection Point Opportunities: 10 Top Stocks to Buy Now” today? Here’s How…

In fact, you’ll be able to secure a complimentary copy with today’s very special Early Bird invitation. First… Remember how I said the MOST powerful inflection points change not only that company’s trajectory – but they can launch whole new markets and kickstart new trends in technology altogether? Well, if you’ve ever missed out on investing on the ground floor of technologies like the Internet, smartphones, or e-commerce… There is one MASSIVE technology CNBC calls “the backbone of any digital economy” that’s projected to generate a staggering US$17 trillion dollars by 2035. What’s more, independent experts are pinpointing 2024 as the year it could reach “a significant inflection point”. It’s a technology The Financial Times calls…“A game changer for humanity.”

“…revolutionize America.”

Artificial intelligence

Self-driving cars

Augmented reality

Remote medical care

The Internet of Things

…and more. Think of it like this: If artificial intelligence is the “brain” revolutionizing technology and business going forward…Then 5G is the “nervous system” that makes it all possible!

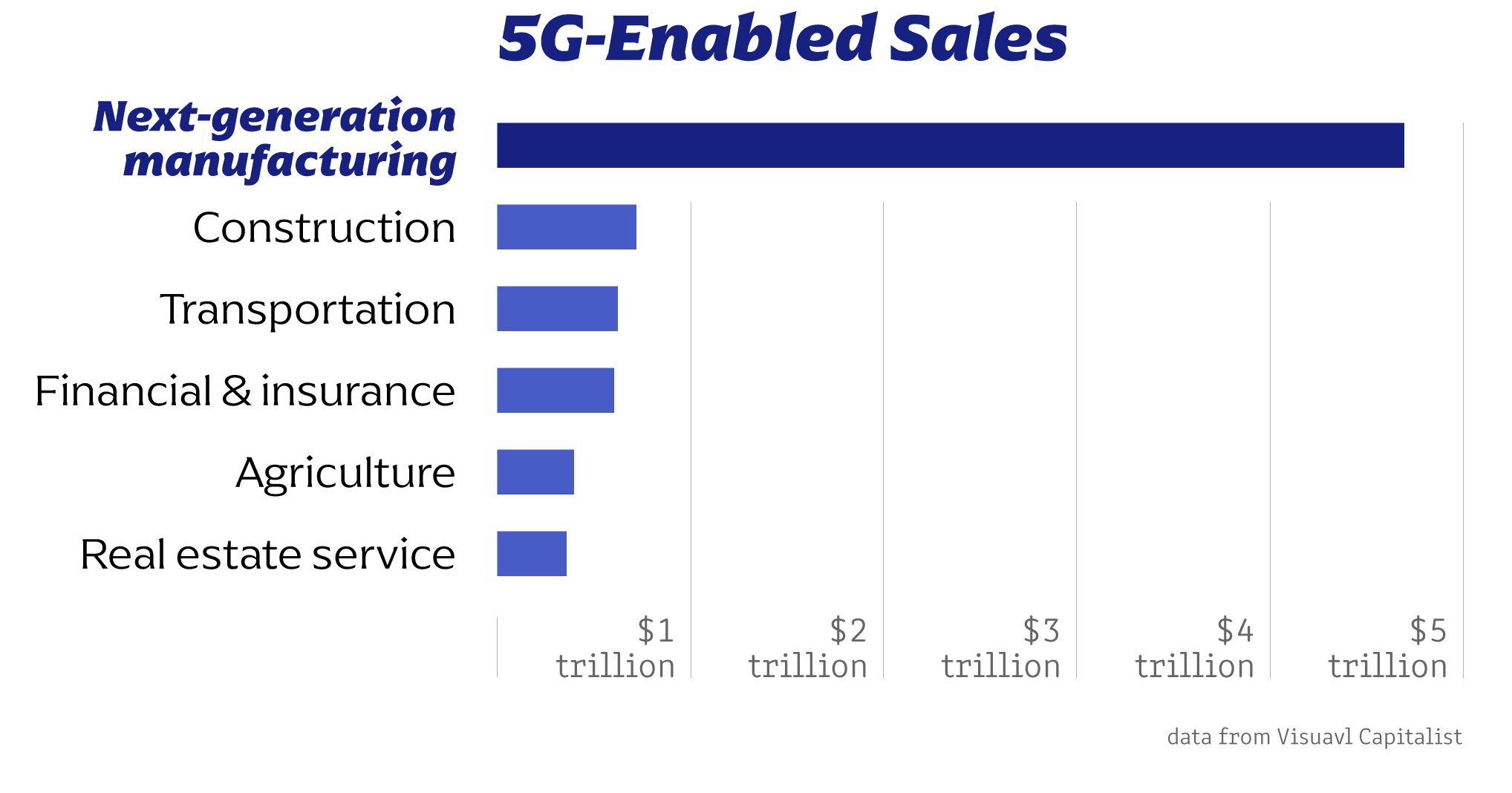

And with 5G projected to generate US$17 TRILLION by 2035 it may just be the biggest single inflection point opportunity of the next decade. The numbers behind 5G’s potential impact are simply astonishing. By the time it reaches maturity, it’s estimated that 5G could enable sales that are:70X the the artificial intelligence market in 2023

18X the sales from ALL e-commerce last year

If you need to do a double take… Neither of those numbers is a typo! Now, you might be thinking that 5G has been around for a while – so what happens in 2024? Well, it may surprise you to hear that by the end of 2022 only 13% of consumers had a 5G phone, and a lot of enterprises also still operate on previous generation networks! But that’s about to change. With major network expansions and new applications set to launch, 2024 marks the year 5G shifts from potential to powerful reality. One CEO even believes the real growth of 5G “will be driven by enterprises” and… Another chief executive says 5G will “change the way companies work and the way people live.” You see, 5G technology is up to 26,000 times faster than 3G. And up to 100 times faster than 4G – or LTE – the wireless technology that came before it. And all these 100X to 1,000X improvements have far-reaching implications, because I believe they’re a game changer for literally dozens of powerful industries. Essentially, all the areas of the economy that have struggled to embrace the FULL benefits of the digital world. Technologies like:Artificial intelligence for advanced robotics that could propel American manufacturing forward…

The Internet of Things for smart grids across utilities and the energy sector…

Self-driving cars that could take the automobile industry into the 21st century…

And remote medical work that could allow doctors to even operate across time zones…

All have the potential to bring MASSIVE industries across the economy fully into the digital age… But – nearly across the board – these breakthrough technologies require significant advancements in constant connectivity that’s faster, with higher bandwidth and lower latency than today’s networks. And this is where the 100X to 1,000X improvements of 5G networks could be an absolute game changer!

That’s why I’m going to give you a FREE copy of “Inflection Point Opportunities 2024” when you join Next-Gen Supercycle with today’s Early Bird offer!

Next-Gen Supercycle is a portfolio service that’s been built from the ground up for investors who are looking for our top guidance at this pivotal moment. Because frankly, most of the 5G investing guidance you’ll find across the Internet… Well, I think it flat out stinks! In fact, I’ll save you a trip to Google! Because if you search “best 5G stocks,” you’re going to find names like Verizon, Nokia, and AT&T over and over again. Now, these are fine companies… NO disrespect intended. But they’re already very large. And I believe their upside is limited…and buying them would be – frankly – a potential “waste” of such a rare opportunity! Instead, The Motley Fool is proud to offer you this invitation to join a portfolio designed to capture our highest-conviction 5G opportunities. In total, we reviewed research on more than 900 companies Motley Fool analysts have placed ratings on – and narrowed it down to a list of our top 43 stock ideas that could see significant potential upside during 5G’s most explosive growth period! Next-Gen Supercycle comes with exclusive reports on each company’s opportunity in this fast-growing industry that could reach an estimated US$17 trillion in global economic impacts! The moment you accept this invitation to join Next-Gen Supercycle, you’ll have access to our “core” of 5G pure plays such as…A tiny billion-dollar leader in the self-driving car space: This (for now) little-known technology company builds AI-powered assistants with an eye to autonomous vehicles. While you may be familiar with companies in this space like Google, this tiny “pure play” is worth only about 1/575 as much!

In addition, Next-Gen Supercycle contains our No. 1 play for that estimated US$275 billion American infrastructure buildout… And some of our highest-conviction 5G “arms dealers” – or stocks we believe benefit from the growth of 5G no matter if Verizon, AT&T… Or any other company ultimately comes out on top!Next-Gen Supercycle is built to be your one-stop resource for this pivotal time!

The team inside Next-Gen Supercycle is simply laser focused on all the potential impacts of 5G’s growth and is aiming to build a “one-stop shop” for this important megatrend. As I showed earlier, it’s projected that 5G could impact US$17 trillion in global impacts and potentially re-shape more than a dozen powerful industries. With The Motley Fool’s long track record of building wealth across the entirety of transformative digital trends, we’ve designed Next-Gen Supercycle to capture what we’ve pinpointed as the full spectrum of opportunities in 5G’s economy-wide “digital transformation.” So as part of our complete game plan inside Next-Gen Supercycle, members will also receive recommendations of stocks our team believes are leaders in markets 5G could transform! From healthcare to an explosion of digital payments to plays on the creation of data… You’ll have access to a portfolio that provides targeted exposure to the economy-wide impacts of this megatrend! And the moment you accept today’s Invitation, you’ll discover allocation guidance, portfolio rankings, research reports, and digital content that are exclusive to Next-Gen Supercycle! Plus, Next-Gen Supercycle comes with continuing commentary and dispatches from our team. So whenever the most important news is happening in this fast-moving industry, you can have the peace of mind to know you’re receiving only the best intel from our expert team! Speaking of our expert team… With his expertise in diving deep into trends like digital payments, streaming, and augmented reality and now 5G, Next-Gen Supercycle is led by Jason Moser, one of The Motley Fool’s foremost technology experts. Which may bring up another question in your mind: “What kind of returns are we targeting?” Lead Advisor Jason Moser and his team are aiming to build a diversified portfolio – containing stocks of different potential risk and upside – that they believe can potentially achieve 6X to 7X growth across the next decade! This level of returns would very likely be far in advance of the market if achieved, but we’re confident investing in the right opportunities in 5G at early time frames in its potential growth could deliver compelling returns!Plus, when you accept today’s Next-Gen “Inflection Point” Bundle offer, you’ll also unlock unlimited access to The Motley Fool’s Market Pass!

And that’s because at The Motley Fool, we firmly believe that investing in just one sector – even a projected US$17 TRILLION growth sector! – is not the right approach. And even as excited as we are about the 10 top stocks in our exclusive new “Inflection Point Opportunities: Ten Top Stocks to Buy Now” report… We want to ensure all of our members are building a diversified portfolio of AT LEAST 25 stocks for the long run. For that reason, today’s Early Bird offer ALSO includes unlimited access to Market Pass, giving you access to:Motley Fool Canada Stock Advisor – The “jack of all trades” investing service that’s beating the market by nearly 2-to-1. [A $299 value]

Motley Fool Hidden Gems Canada – The “small-cap specialist” that’s focused on finding under-the-radar, tiny stocks with great value. [A $499 value]

Motley Fool Rule Breakers Canada – The “hyper growth hunter” focused on uncovering great companies early in their evolution [A $499 value]

Motley Fool Dividend Investor Canada – The “passive income playbook” for investors looking for high-yield passive income opportunities right here in Canada. [A $349 value]

Everlasting Stocks – The “Tom Gardner portfolio” which issues timely recommendations based entirely on the personal investing approach of our CEO and founder Tom Gardner. [BONUS]

This not only gives you immediate access to over 375 active stock picks, but you can expect a total of nine NEW recommendations each month. And of course… All that’s in addition to our Next-Gen Supercycle portfolio, targeting the biggest opportunities for the economy-wide 5G inflection point. The best part?Thanks to today’s Early Bird offer, this Next-Gen “Inflection Point” Bundle deal costs a whole lot less than you might think…

Especially when you consider the extensive research you’ve just witnessed on recent market events and historical inflection points! Now, normally a report like “Inflection Point Opportunities: 10 Top Stocks to Buy Now” would cost $1,000 alone. But as I mentioned, we’re including it for FREE with today’s offer. And it gets better. You see, while Next-Gen SuperCycle has a list price of $1,999… And Market Pass has a normal list price of $999 (not to mention the total value of included services is over $1,646)… Everything you get today adds up to over $3,998 in total value – but you won’t pay anywhere near that today. In fact, we wanted to kick off the new year with an extra sweet deal. Which means you can get access to all of the above for only $1,398 today. That’s more than $2,600 in savings! And who knows…Your personal savings might be even larger – because YOU may already have credits available for this upgrade offer!

Members are often surprised at how many credits they have. So, at the very least it’s worth clicking the button below to see your personal offer. Plus, to sweeten the deal just a little bit more…We’re also including two additional VIP reports, including:

“3 Top Underrated Security Stocks Ready to Dominate”

[A $300 value]

“Hidden Gems: 3 Top Small Caps Picked by Motley Fool CEO Tom Gardner”

[A $300 value]

That said, I must note that since so much of the value of this offer is delivered immediately when you join, we simply cannot offer refunds on this offer.

If a group of short-term traders was able to gain access, they could quickly trade on these timely recommendations and then cancel without paying their fair share. They could push up prices of the stocks and do a huge disservice to investors who are committed to this strategy for the long run.

However, here’s the good news for you…

Today’s Early Bird offer is backed by Ironclad 30-Day Satisfaction Guarantee.

Remember, this Early Bird offer expires promptly at MIDNIGHT on Friday, January 12th.

So, when you’re ready to join, simply click the button directly below to lock in the lowest price now: With that all said, I leave the decision to you.I just have one final word of warning…

Once the clock strikes midnight on Friday this “Early Bird” offer will expire. And your chance to secure a copy of “Inflection Point Opportunities 2024: Ten Top Stocks to Buy Now” with today’s exclusive bundle offer could soon be gone forever. I don’t want you to miss this Early Bird opportunity, of course. But more importantly – I don’t want you to spend your days looking back with regret at what might have been. Because, while we can’t hop in a time machine and actually invest before all the previous inflection points we’ve accurately predicted… From where I sit, this “Inflection Point” bundle IS potentially the next best thing. Remember… Amazon’s AWS inflection point resulted in a 200X return for investors who followed The Motley Fool’s buy alert:

Chart refers to U.S. market.

Apple’s iPhone inflection point was good for a 40X return:

Chart refers to U.S. market.

Netflix’s streaming inflection point generated a 174X return for investors who followed along:

Chart refers to U.S. market.

And Netflix’s original programming inflection point was still good for another 15X return!

Chart refers to U.S. market.

Or how about Salesforce’s cloud inflection point – another 38X return inflection point the Motley Fool accurately predicted:

Chart refers to U.S. market.

Or Tesla’s Model S inflection point? That one resulted in a 122X return for investors who followed that recommendation:

Chart refers to U.S. market.

And of course… Nvidia’s AI inflection point – which propelled The Motley Fool’s initial recommendation to a mind-boggling 303X return today:

Chart refers to U.S. market.

Even a single US$20,000 investment in any one of those stocks would be worth anywhere from three quarters of a million to SIX MILLION US dollars today. That’s transformative. Full stop. Of course, if you prefer to do your own research and try to pinpoint the NEXT inflection point opportunities yourself… Be my guest. That’s totally fine and we sincerely wish you the best of luck. If you prefer an EASIER option that’s based on a more than two-decade track record of identifying some of the biggest inflection point winners in the history of the stock market… Then I want to simply remind you: Your “Early Bird” invitation to secure your copy of our special “Inflection Point” Bundle… Including your complimentary copy of “Inflection Point Opportunities 2024: Ten Top Stocks to Buy Now”… And lock in the LOWEST price before it expires promptly on Friday at midnight. To avoid missing out, click the button directly below now!To taking advantage of EVERY opportunity in 2024,

Michael Douglass

Director of Premium Content

The Motley Fool

Michael Douglass

Director of Premium Content

The Motley Fool

Returns as of 12/20/2023 unless otherwise noted. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Alicia Alfiere has positions in Apple. Buck Hartzell has positions in Apple. Jason Moser has positions in Amazon and Apple. Sanmeet Deo has positions in Amazon, Netflix, and Tesla. Seth Jayson has positions in Amazon, Apple, Meta Platforms, Nvidia, and Salesforce. Tom Gardner has positions in Meta Platforms, Netflix, Salesforce, and Tesla. The Motley Fool has positions in Amazon, Apple, Meta Platforms, Netflix, Nvidia, Salesforce, and Tesla. Yasser El-Shimy has positions in Amazon and Nvidia. The Motley Fool has positions in Amazon, Apple, Meta Platforms, Netflix, Nvidia, Salesforce, and Tesla. The Motley Fool has a disclosure policy.

Next-Gen “Inflection Point” Bundle includes U.S. and Canadian stocks. All billing is in CAD. You will be billed according to your choice below and then $1,999 for each year thereafter.

This product is non-refundable.

Having trouble ordering or have any questions for us? Just send them to membersupport@fool.ca, and we’ll get back to you ASAP!

By submitting your order, you are agreeing to our Subscription Terms of Service and Privacy Policy.