To complete your order, it is necessary to enable JavaScript.

Motley Fool Canada - Order Now!

Already a member? Login

Dividend Investor Canada

Join TODAY

If you’d like to discover how investors like you managed to earn 17X higher returns than “regular” stock investing — with 44% less volatility…

All while being able to collect a steady stream of incredibly tax efficient “bonus income cheques” every few months in amounts like $120… $280… and even $945…

Then we’d like to invite you to be among a select group of Canadian investors who will get to “test drive” a historic investment solution that we believe could help you make this the first of many profitable years to come.

Dear fellow investor,

I don’t know about you, but if there’s one thing I find incredibly frustrating — and occasionally even downright discouraging — about trying to grow rich by investing in stocks, it’s this…

If you ask 100 of the most successful investors on the planet what the single biggest key to becoming a stock market millionaire is, you’ll likely get 100 different answers.

Some will tell you to focus all your attention on valuation. Others believe it’s all about management… revenue growth… return on equity… book value… or competitive advantages.

Still others say that timing… allocation… risk-management… or even technical analysis is the secret.

You name it, and someone out there believes they’ve found the one true path to life-changing profits. Frankly, it’s almost enough to make you want to swear off investing all together…

And it’s precisely why a closed-door conversation I was recently a part of here at The Motley Fool stopped me dead in my tracks and made me completely rethink how I invest my hard-earned money.

More importantly, it’s also why I asked to be the one who reached out to you today with this special invitation.

The simple (and proven!) method that supercharged returns – and actually reduced risk…

You see, as a longtime follower and employee of The Motley Fool, I’ve always believed that buying and holding great companies for the long term is my best bet for turning the cash I have into the wealth and security I’ve always wanted for myself and my family.

(And given that you’re reading this right now, I think it’s probably safe to assume you believe the same thing!)

But it wasn’t until the conversation I just mentioned that I realized there was one crucial aspect missing from many of the companies I personally own — and just how much of an impact this could have on my wealth over time.

Here are a few of my top holdings. Can you spot the one thing all of these stocks are missing?

AbCellera Biologics

Data Communications Management

VerticalScope Holdings

Katipult Technology

KITS Eye Care

Lightspeed Commerce

Nova Cannabis

Don't beat yourself up if you haven't spotted it yet... but suffice it to say that many of the stocks you own probably lack this crucial return-boosting, volatility-reducing quality as well…

But don’t worry!

Because over the next few minutes, I’m not only going to lay out exactly what this vital — yet often overlooked — characteristic is… and why it could prove so incredibly important to your (and my) future financial success…

But also show you a quick, easy, and cost-effective way to begin harnessing the awesome power of this often overlooked wealth-boosting mechanism in your own portfolio…

And in the process potentially set yourself up to enjoy gains 17X — or even 65X — higher than “regular” stock investing… all while experiencing less volatility and receiving steady cash payouts along the way!

First, I need to get back to the jaw-dropping statistic that made me completely rethink how I invest my money…

Like I said, it happened during a recent closed-door meeting here at The Motley Fool global headquarters.

My colleagues were deep into a discussion about how we could better serve the needs and wants of Canadian investors like you, when someone mentioned a study they had recently come across from RBC Capital Markets.

We pulled it up online to have a look for ourselves, and as soon as we did the room fell silent…

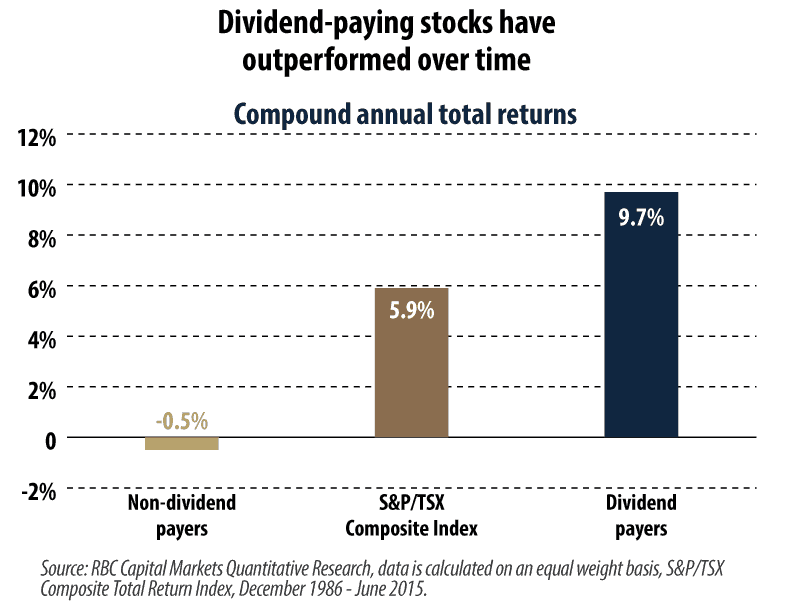

That’s because we discovered that between 1986 and 2015, non-dividend-paying stocks in the S&P/TSX Composite index returned hard-working investors like you and me an average compound return of -0.5% per year.

Yes, you read that right…

Over a nearly 30-year period, those stocks that didn’t pay a dividend, on average, ended up losing money year after year after year.

As an investor you might find that rather disheartening (I know I certainly did at first!).

But hold that thought, because there’s a major silver lining…

Namely that while those non-dividend-paying stocks ended up costing investors like you and me money over that time period, their dividend-paying counterparts would have earned us an average compound return of 9.7% per year…

If you take the time to put pencil to paper and do the math, you’ll see that…

That amounts to an 17X higher return on your money! Yet incredibly, it’s only part of the story…

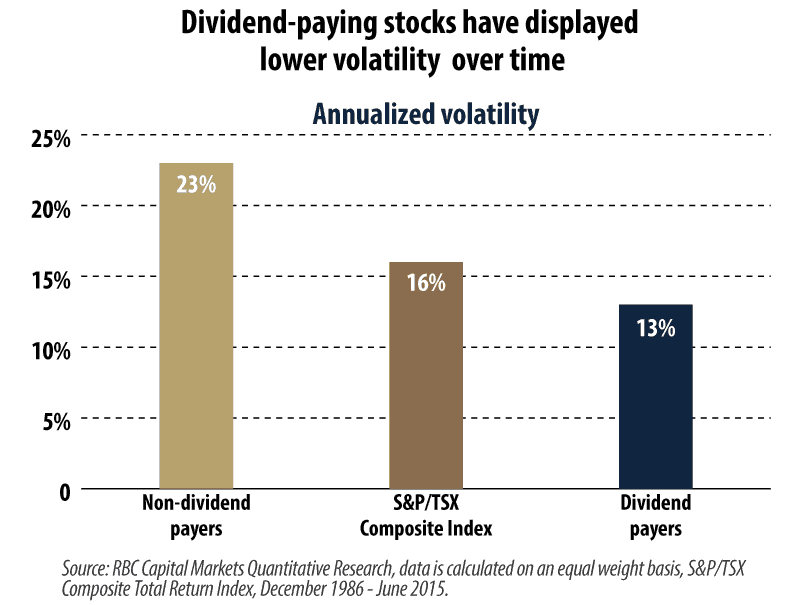

Because not only did dividend payers outperform by a margin of 17-to-1, but they did so with 44% less volatility than non-dividend payers!

You better believe that got my attention! And it even inspired me to do a little further research on my own.

Believe it or not, what I discovered ended up shocking me even more.

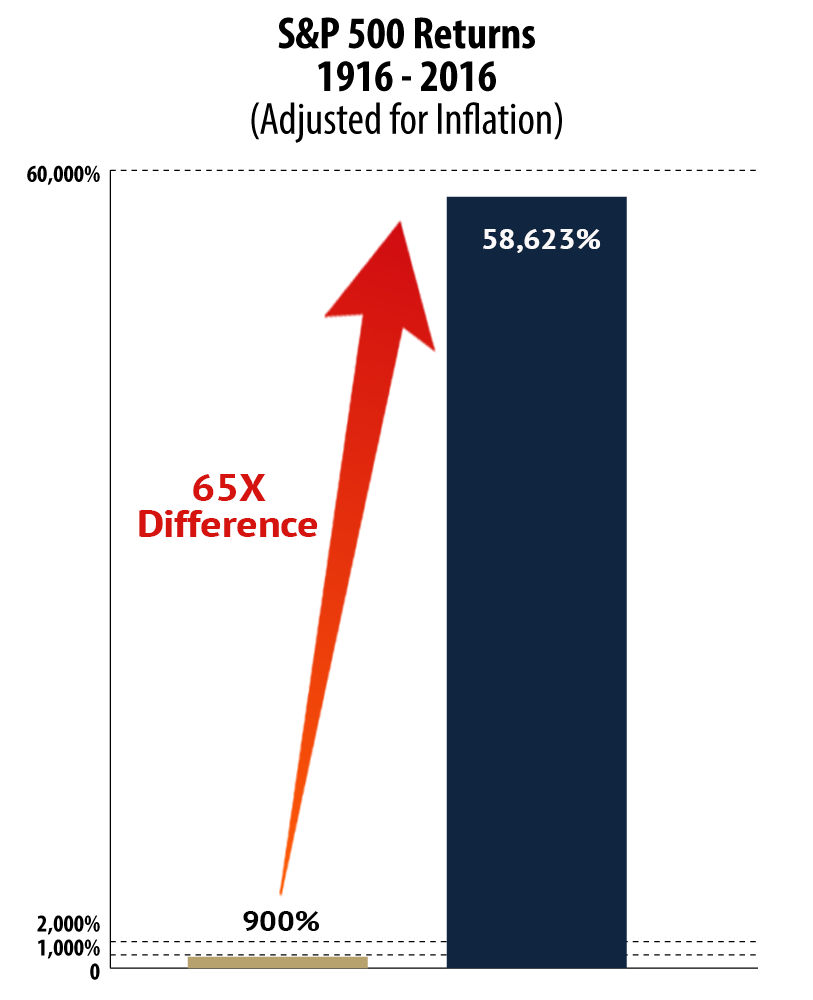

You see, using data from legendary Yale economist and Nobel laureate Robert Schiller, I calculated that over the past century, the S&P 500 index in the U.S. is only up about 900% once you factor in inflation.

For a long-term-focused investor like me, I found that number to be downright disappointing — and I’ll bet you will, too.

But then I ran a few more calculations and discovered this…

Were you to have simply reinvested your dividends over that time period, your return would have skyrocketed to an amazing 58,623%!

That’s a 65X difference!

Data as of 01/09/17

I don’t know about you, but that’s all the proof I need of just how important dividends are to successful long-term investing…

Not to mention how essential they may be to helping investors like you and me reach even our loftiest financial goals.

I mean, just imagine…

What would you do if you knew you could boost your investment returns by 17X — or even 65X?

Would you build your dream vacation home in cottage country? Or finally get that new luxury car you’ve had your eye on for so long?

Perhaps you’d treat your family to a long vacation somewhere exotic like Tanzania or Thailand? Or spend your winters sailing around the Caribbean on your own boat?

Or, heck, maybe even just retire a few years early, so you could kick back and do nothing at all for a change?

They’re all exciting ideas, to be sure. And I hear my friends and colleagues talking about them all the time.

As for me, I’d probably just rest a little easier knowing that my wife and son would be well taken care of should anything ever happen to me.

Frankly, it’s also why I wanted to be the one who reached out to you with this special invitation today.

On that note, please allow me to properly introduce myself…

My name is Jared George.

And like you, I’m a hard-working investor who’s always on the lookout for ways to grow the cash I have into the wealth I want…

Mostly just so that I can help set my family up for a lifetime of comfort and security… but, if I’m being honest, also so that I can make some of my own lifelong dreams come true, too (like owning my own boutique cafe one day!).

Which is why I jumped at the chance to come work at a company like The Motley Fool — where I could not only earn money, but also discover the very best ways to put that money to work for me.

And I have to say, after taking the time to really dig and do some research on the wealth-building power of dividends, I’ve begun to completely rethink how I’m going to invest my money going forward.

My guess is after reading this, you may want to, too!

Of course, what I’ve shown you so far have all just been historical returns, and when it comes to investing there are simply no guarantees.

Plus, let’s face it…

Finding great companies that can both grow the underlying value of your investment and pay a steady — and possibly even increasing — dividend over time is no easy task.

Especially not if you have a family and full-time job, like I do — and I imagine you may as well.

Worse, if you’re not careful you could wind up buying a dividend payer that looks rock solid one day… and sinks like a stone the next!

I’ve seen it happen time and time again with my own eyes.

Investors get lured into buying a “flavour-of-the-week” stock sporting an eye-popping yield — and they do so without really putting in all the time and effort it takes to properly vet a stock.

Then, before they know it, not only are they not getting anywhere near the dividend payouts they signed up for (or any payouts at all!), but they also wake up one day to discover that the underlying stock has completely tanked as well.

Take these now infamous U.S. dividend payers for instance…

Annaly Capital Management (NYSE: NLY) – In the summer of 2011, this once ultra-popular mortgage REIT traded at well over $60 per share share and, for a brief time, yielded an incredible 25%. But then rising interest rates became a major concern. And before long, both the company’s share price and its dividend payout had both been more than cut in half! (Data as of 01/16/17)

DryShips (Nasdaq: DRYS) – In November of 2008, this dry-goods bulk shipper was yielding as much as 18% and its shares were trading above $23 per share. But then a massive global recession and subsequent market meltdown hit, resulting in DryShips ultimately having to suspend its dividend altogether and causing its shares to sink over 90%. (Data as of 01/16/17)

Transocean (Nasdaq: RIG) – In 2014, shares of this deep-water drilling specialist traded as high as $48 per share and, at one point, yielded as much as 15%. But investors who weren’t paying close enough attention to why that yield was so high or didn’t fully appreciate the impact sinking oil prices would have on the company were forced to sit by and watch shares fall all the way under $10 per share and the dividend disappear entirely. (Data as of 01/16/17)

And then, of course, there’s the case of the well-known Canadian company, Bombardier (TSX: BBD.B)…

As you may well know, this plane and train manufacturer paid a steady dividend for over seven years — and often yielded north of 3% — before mounting struggles and the sudden departure of its CEO forced it to cancel its dividend altogether in 2015…

Not to mention, caused its shares to promptly nosedive — and then continue to languish for years to come!

Granted, even the best investors out there occasionally have some losers in their portfolios.

But you and I both know that if you really want to reach your loftiest financial goals, you simply must avoid dividend disasters like these at all costs.

And with so many uncertainties looming on the horizon today about everything from rising interest rates… to the health of the global economy… to the geopolitical landscape…

It may seem harder than ever to navigate the complicated world of successful dividend investing.

Which is why in just a moment, I’ll give you the chance to claim a copy of a brand-new special report we just put together called “5 Warning Signs of a Dangerous Dividend.” (This report is a $29 value, but I’ll show you how to claim a free copy just ahead.)

It’s also why I wasn’t particularly surprised when — in that very same meeting I mentioned earlier — it was announced that…

A whopping 98.9% of Motley Fool Canada readers and premium members like you said they wanted more guidance on which dividend stocks to buy and when…

Of course, whenever we have data that so strongly suggests our members are seeking new and different services, we do our very best to help them out…

Ever since we walked out of that eye-opening meeting everyone here at Motley Fool Canada has been working tirelessly to develop a dividend-focused premium investment service that can help lead anyone from a timid beginner to a seasoned pro to what we believe to be the absolute best dividend-paying stocks the Canadian markets have to offer — with a minimum amount of time and effort required on your part…

We call this unique new solution:

The first thing you should know is that Dividend Investor Canada is headed up by an all-star team of highly experienced Foolish investors, including Motley Fool Canada’s Chief Investment Adviser, Iain Butler, and our newest addition to the investing team Nate Parmelee (more on these two exceptional investors and what they can do for you just ahead)…

You also likely know that, as is the case with all of our premium offerings here at Motley Fool Canada, Dividend Investor Canada is fully backed by a 30-day, 100% membership-fee-back guarantee…

Motley Fool Canada's 30-Day, 100% Membership-Fee-Back Guarantee

- Join Dividend Investor and get started investing today...

- And then take up to a full month to decide whether or not Dividend Investor Canada is a good fit for you…

And if, for any reason, you determine it’s not, we’ll promptly and courteously refund 100% of your membership fee.

No hassle. No runaround. No need to feel like you’re being rushed into a hasty decision.

You have my personal promise on that.

But here are a few important — and exciting — things you don’t know about Dividend Investor Canada…

Like that you won’t even have to wait a single day after joining us to begin loading your portfolio up with what our team believes to be the very best and most promising dividend stocks the market has to offer…

That’s because the instant you accept this invitation, you’ll get immediate access to the 50+ stocks the Dividend Investor Canada team has recommended so far.

Which actually brings up an important point…

While the Dividend Investor Canada team has plenty of experience investing both inside and outside Canada, the stocks they officially recommend for this service will ONLY be Canadian-based dividend payers.

Why is that?

Well, the simple answer is…

We’re not only seeking to lead you to investments with higher returns and lower volatility — but also those that may be the most tax-efficient for you…

But the more thorough answer is that as US-based corporate dividends flow across the border into our non-RRSP Canadian investment accounts, Uncle Sam steps in and takes a 15% slice.

And once this rather significant withholding tax is considered, you’ll see why the team has chosen to focus primarily on Canadian-based dividend-payers for their official scorecard, like these high-performers they've already recommended...

Summit Industrial Income REIT, sold for a 384% total return since we rec'd it on January 18, 2017

AltaGas, sold for a 103% profit just 10 months after we rec'd it on February 21, 2019 (while paying a 2.9% yield)

And rest assured that even though the team will only officially be recommending Canadian-based stocks like these, they’ll still always be looking to keep you informed about the very best dividend opportunities that come across their radar — be it foreign or domestic.

These may simply come in the form of weekly updates… special one-off bonus reports (which, of course, you’ll be given priority access to completely free of charge)… or even as part of our exclusive monthly “Dividend Examiner” feature — which the team will provide you with each fourth Thursday of the month.

Of course, this is just one of the many valuable members-only perks you’ll enjoy when you join us today. But I think it’s one of the most interesting and useful…

That’s because the team will provide you with an in-depth — yet easy-to-follow — breakdown of one specific dividend stock, where they’ll closely and thoroughly examine both its current dividend-paying ability and its future dividend growth potential.

(You can think of this as the investment world equivalent of an expert “scouting report” on your favourite NHL superstar… or up-and-coming junior prospect).

Occasionally “Dividend Examiner” will focus on a stock that the team has already added to the scorecard… but other times it may focus on well-known and widely-held dividend payers they think could be in real trouble.

Given the fortune destroying “dividend disasters” I outlined above I’m sure you can see why I think this could prove particularly valuable!

Either way, it’s one members-only perk you’ll never want to miss! And it actually brings us to another of Dividend Investor Canada’s most intriguing — and most unique — features…

Why our “Wild Cards” could be so incredibly helpful…

Legendary investor and self-made multi-billionaire Warren Buffett once said that there were only two “rules” to successful investing…

"Rule No. 1: Never Lose Money."

"Rule No. 2: Never Forget Rule No. 1."

Yet many investors spend so much time focusing on which stocks to buy that there’s no time left over to focus on which stocks to avoid…

And that can have some truly devastating consequences as we discussed earlier.

Which is precisely why from time to time, as part of their quarterly “Wild Card” feature, the team will be identifying dividend stocks they think you shouldn’t buy — and giving you their full rationale behind what makes these the kind of dividend payers you may want to avoid at all costs.

Personally, I can’t wait to see which stocks they select — and if I might hold them in my portfolio!

And when the team isn’t pointing out a ‘stock to avoid’ at all costs, they might be using their “Wild Card” to recommend anything from their favourite U.S.-based dividend payer… to their favourite small-cap dividend payer… to their favourite thinly traded dividend payer…

You’ll just have to go ahead and join us to find out!

And given that you’ve read this far I can only assume you’re giving it some real thought…

In which case I’d remind you that when you join us today you’re entitled to free access to all of our special reports like "5 TSX Stocks to Soar in 2024 and Beyond", “5 Warning Signs of a Dangerous Dividend”, “How to Find Great Dividend Stocks” and “Tax Facts: Dividend Tax Considerations Every Canadian Should Know” – an $186 value!

Plus, you’ll be fully protected by our 30-day, 100% membership-fee-back guarantee. With that in mind, I’d urge you to simply…

Or feel free to stick with me as I dive a little deeper into everything Dividend Investor Canada has to offer you. Starting with…

An all-star team of long time Foolish investors with one goal in mind: to make you money!

If you’re a member of either of our Stock Advisor Canada or Hidden Gems Canada premium services — or just a regular follower of Motley Fool Canada in general — then you’re no doubt already very familiar with the team behind Dividend Investor Canada.

But we’re so thrilled — and proud — to have them leading this valuable new service that we believe they deserve a proper introduction just the same. So here goes…

Iain Butler, Advisor

Iain serves as Chief Investment Adviser for the Motley Fool Canada and is the lead Adviser for our flagship Stock Advisor Canada service.

Before joining the Fool, Iain was a “buy-side” analyst and through this experience is well-versed in the idiosyncratic ways of the Canadian market. His investing interests are centred on scouring the market for interesting businesses that trade at reasonable prices and offer an appealing risk/reward relationship.

Since joining the Fool in 2012, Iain has dedicated himself to spreading our Foolish investment philosophies throughout his home country — and now he looks forward to helping lead our Dividend Investor Canada members to the best (and most Foolish) dividend-paying opportunities the market has to offer.

Nate Parmelee, Co-Advisor

Nate started with The Motley Fool in 2004 and has worked on some of the company's top-tier premium products through the years.

Nate has worked on various global investing teams and brings an unparalleled level of expertise to our group of dividend investors.

Jim Gillies, Co-Advisor

Jim is a Fool and investing veteran with over two decades of experience with a focus on deep value stocks, small-caps, and finding big returns in unlikely places.

Nick Sciple, Co-Advisor

Nick is the newest addition to our Canadian investing team and brings a breadth of experience in the U.S. markets, energy, and dividend investing.

Just take a look at some of the feedback we’ve received from real members of Motley Fool Canada and our Lead Advisor, Iain Butler and Foolish team…

“Canadians need independent investment advice from a trusted source, and Motley Fool is just the channel.”

-Marc V.

“Thank you for the very helpful hints in your website in the past several weeks. I’ve made some stock purchases which so far have been very successful.”

-Alexis Y., Markham, ON

“I’ve been quite delighted with the advent of Fool Canada (espece d’idiots canadiens) and find the articles clear, concise, and useful.”

-W. Young, Ottawa, ON

As you can see, we really couldn’t have put together a more capable — or hard-working — team of Foolish investors.

And we’d like nothing more than to give you the chance to start putting them to work for you…

So you’ll always know precisely which dividend stocks to buy (and avoid!) and when — and can arm yourself with an entire arsenal of unique and valuable tools that are designed to help you potentially make this your most profitable year yet.

Here’s just a small sampling of what you’re entitled to when you join us as a Member today:

Monthly Recommendations: Easy-to-follow monthly recommendations on the one dividend-paying Canadian stock the team thinks you should buy above all others, complete with in-depth research write-ups outlining all the need-to-know details…

Regular Updates: Regular updates on the stocks the team has recommended… so you’ll always be the first to know about important developments affecting the companies we've recommended…

"Watch list" and Best Buys Now: Full access to both Dividend Investor Canada’s official “Watch List” and “Best Buys Now” list — so you’ll always be clued into which dividend stocks the team is considering recommending next and which of their current recommendations they are most excited about right now…

Bonus Reports: Complimentary copies of all special reports and research write-ups the team puts together — including our three brand-new “5 Warning Signs of a Dangerous Dividend”, “Tax Facts: Dividend Tax Considerations Every Canadian Should Know”, and “How to Find Great Dividend Stocks” reports (a combined $87 value — yours FREE)…

“Dividend Examiner” & “Wild Card Recommendations”: A treasure trove of members-only bonus features, content, and perks — including “Dividend Examiner”… “Wild Card Recommendations”… and the official Dividend Investor Canada podcast…

Commentary and Guidance: Team commentary and general guidance on topics that affect you most — including everything from macro-economic concerns… to proper diversification… to education on dividend-related tax issues.

To your wealth,

Jared George

Jared George

Membership Team

Motley Fool Canada

Financial data as of May 1, 2024, unless otherwise noted. Jared George has owned shares of all disclosed stocks.

You will be billed according to your choice below and then $199 for each year thereafter.

Having trouble ordering or have any questions for us? Just send them to [email protected], and we’ll get back to you ASAP!